Bank of America Merrill Lynch said that the US CPI and core CPI are expected to rise 0.2% and 0.3% month-on-month in October. This is unlikely to cause a major change in inflation expectations, nor will it threaten the Federal Reserve's inflation target. Bank of America Merrill Lynch also emphasized not to confront market trends; the post-election momentum usually continues until the next few weeks.

As the dust settles on the US election and the Federal Reserve's November interest rate cut, the market focus quickly turned to the heavy inflation data to be released this week, particularly the US Consumer Price Index (CPI).

On Wednesday at 21:30 Beijing time, the US Bureau of Labor Statistics will release the October CPI data. The market generally expects:

The CPI rose 2.6% year on year in October, up 0.2 percentage points from 2.4% in the previous month, and remained the same as the previous value of 0.2% month on month;

Core CPI maintained year-on-year and month-on-month increases of 3.3% and 0.3%, respectively.

Bank of America Merrill Lynch said that the US CPI and core CPI are expected to rise 0.2% and 0.3% month-on-month in October, but this increase is unlikely to have a significant impact on interest rates.

The agency's analyst Ohsung Kwon and others said in a report released last week that despite accelerated upward pressure on prices during the economic recovery period, this will not lead to a major change in inflation expectations, nor will it threaten the Federal Reserve's inflation target.

Bets to slow down interest rate cuts increase

The Federal Reserve cut interest rates by 25 basis points after the FOMC meeting last week, as expected by the market. Powell said at a press conference after the meeting that the fight against inflation is not over yet, core inflation is still high to a certain extent, the job market continues to cool down very slowly, and the Federal Reserve will continue to cut interest rates, but if inflation cools down and the economy is strong, interest rates can be cut more slowly. The US election will have no impact on monetary policy in the short term. The impact of future fiscal policy will be taken into account. The US deficit and fiscal policy are economic resistance.

Although the Federal Reserve has not hinted that it will suspend action in the future, Wall Street's bets on slowing down interest rate cuts seem to be heating up quietly. Goldman Sachs currently anticipates that the Federal Reserve will cut interest rates by 25 basis points each at the December and January and March meetings, and then cut interest rates by 25 basis points in June and September next year, respectively. Goldman Sachs previously predicted that interest rates would be cut by 25 basis points each for May and June.

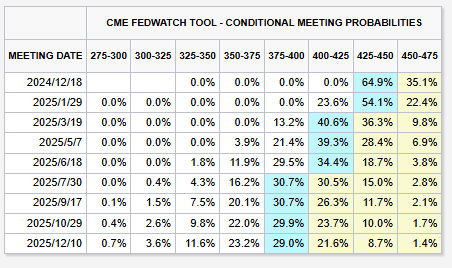

Currently, the CME tool shows that the possibility that the Fed will cut interest rates in December is 65%, and the possibility of continuing to cut interest rates in January next year is 23.6%.

Bank of America Merrill Lynch pointed out that although the election results are “fixed,” policy uncertainty is still high. The Federal Reserve cut interest rates by 25 basis points as scheduled at the November interest rate meeting. Their communication indicates that it is possible to cut interest rates in December. This indicates that the Federal Reserve may be alert to the current state of the economy and is prepared to adopt further easing policies to support economic growth.

Don't fight against market trends, especially in the short term

Bank of America Merrill Lynch also emphasized not to confront market trends, especially the short-term upward trend after the US election.

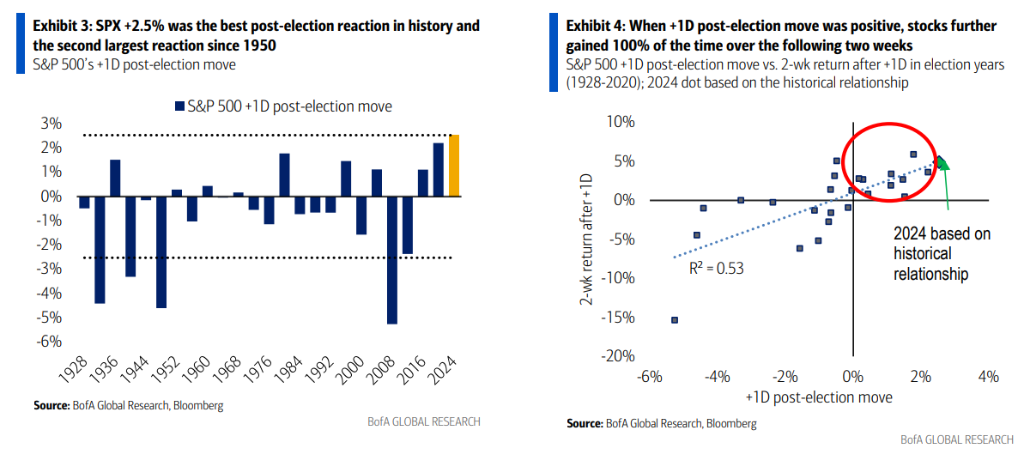

The report notes that the post-election momentum usually continues into the next few weeks. When the stock market achieved a high increase on the first day after the election, taking history as a guide, in the past election cycle, the stock market was 100% positive for the next two weeks. Interest rates have also largely returned to pre-election levels, which at least so far has allayed the main concerns about stocks.

After this round of elections, the S&P 500 index rose 2.5% on the first day after the results came out, the best performance since 1928.

10月CPI同比上涨2.6%,较前月的2.4%上升0.2个百分点,环比0.2%持平前值;

10月CPI同比上涨2.6%,较前月的2.4%上升0.2个百分点,环比0.2%持平前值;