Improved Revenues Required Before Ardelyx, Inc. (NASDAQ:ARDX) Shares Find Their Feet

Improved Revenues Required Before Ardelyx, Inc. (NASDAQ:ARDX) Shares Find Their Feet

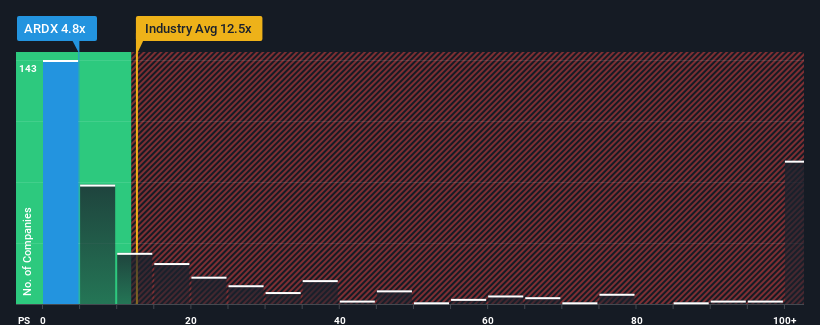

You may think that with a price-to-sales (or "P/S") ratio of 4.8x Ardelyx, Inc. (NASDAQ:ARDX) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in the United States have P/S ratios greater than 12.5x and even P/S above 65x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Ardelyx's P/S Mean For Shareholders?

Recent times haven't been great for Ardelyx as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Ardelyx's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Ardelyx?

In order to justify its P/S ratio, Ardelyx would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 88% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Taking a look back first, we see that the company grew revenue by an impressive 88% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 38% per annum as estimated by the ten analysts watching the company. With the industry predicted to deliver 114% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Ardelyx's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Ardelyx's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Ardelyx maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 2 warning signs we've spotted with Ardelyx.

If you're unsure about the strength of Ardelyx's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.