Judging from the performance, the company achieved double-digit growth in revenue and net profit in fiscal year 2023, making it a “small but beautiful” local SaaS service provider in Hong Kong.

Recently, Huicheng Technology (WCT.US), an enterprise software solution service provider from Hong Kong, successfully entered the NASDAQ market. The company has a long way to go public. It secretly submitted a prospectus with the SEC (US Securities and Exchange Commission) as early as September 2023, and it took more than a year to go public successfully.

In this IPO, Huicheng Technology plans to sell 2 million shares at 4 US dollars each, including 1.1 million new shares and 0.9 million old shares, raising a total of 8 million US dollars. After listing, the company's stock price continued to rise for many days. As of November 11, it closed at $8.98, up 124% from the issue price a month earlier.

According to the prospectus, Huicheng Technology's pre-IPO investors include Ocean Serene (4.5% of the total issued share capital), Paramount Fortune (holding 3.5%), and Prestige Leader (holding 3%).

According to the prospectus, Huicheng Technology's pre-IPO investors include Ocean Serene (4.5% of the total issued share capital), Paramount Fortune (holding 3.5%), and Prestige Leader (holding 3%).

Judging from the performance, the company achieved double-digit growth in revenue and net profit in fiscal year 2023, making it a “small but beautiful” local SaaS service provider in Hong Kong. However, it is worth noting that in the US stock market, there is no shortage of Chinese securities that are also on the SaaS circuit. Currently, Huicheng Technology's price-earnings ratio (TTM) has reached 203.67, far exceeding the valuation of similar individual stocks.

What are the highlights of Huicheng Technology's fundamentals? This also needs to be explored in its prospectus.

Strong growth in subscription services, impressive overall performance

According to public information, Huicheng Technology is from Hong Kong and is a high-end supplier focusing on enterprise software solution services. The company's core business covers the design and implementation of customized software solutions, the construction and operation of cloud-based SaaS platforms, and personalized customization and in-depth development of white label software. With its deep technical strength and industry experience, Huicheng Technology is committed to providing efficient, secure and customizable software service solutions to customers around the world.

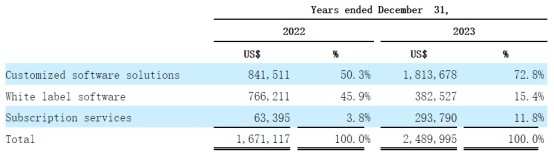

Judging from the revenue structure, the company's business can be divided into three segments: one is the sale of software solutions tailored to customer needs, which has won wide recognition in the market; the second is the development and licensing of white label software to help partners quickly enter the market and expand their business scale by providing branded and customizable software products; and third, subscription services based on SaaS platforms. This model not only provides customers with a convenient way to use the software, but also ensures a stable source of revenue for the company.

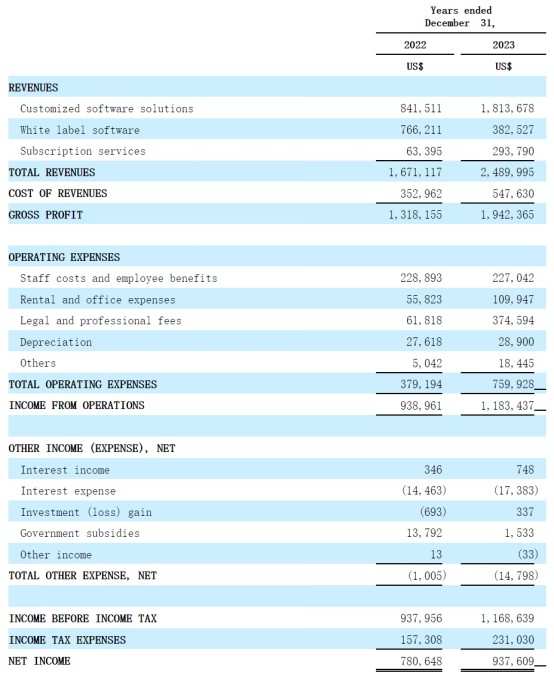

According to financial data, in the 2023 fiscal year ending December 31, the company's revenue was about 2.49 million US dollars, up 49% year on year from 1.67 million US dollars in the same period last year; net profit was 0.9376 million US dollars, up 20% year on year from 0.7806 million US dollars in the same period last year. The company said that this increase was mainly due to a 115.5% increase in revenue from custom software solutions and a 363.4% increase in subscription service revenue, partially offset by a 50.1% decrease in white label software sales revenue.

In fiscal year 2022 and fiscal year 2023, revenue from custom software solutions accounted for about 50.3% and 72.8% of total revenue, respectively, and the number of customer orders received throughout the year increased from 18 in 2022 to 46 in 2023; the share of white label software revenue fell to 15.4% from 45.9% in 2022, and subscription service revenue increased from 3.8% to 11.8%, and the average contract amount for the latter increased from approximately $2,756 to $8,999 in the same period last year.

The Zhitong Finance App learned that in fiscal year 2023, revenue costs, mainly including amortization of intangible assets, subcontract costs, IT personnel costs, and server rent, were 0.5476 million US dollars, an increase of 55.2% over the previous year, slightly exceeding the revenue increase, mainly due to the increase in intangible asset amortization of ERP systems purchased from third parties and their maintenance costs.

For fiscal year 2022 and fiscal year 2023, gross margins were 78.9% and 78.0% of operating income, respectively. As of December 31, 2023, the company's net cash from operating activities was $0.7972 million.

Due to the small size of the business, the company's performance is largely dependent on a few large customers. In FY2022, two customers accounted for 45.9% and 12.2% of the company's total revenue, and the three customers accounted for 69.9%, 14.6%, and 11.3% of total accounts receivable, respectively; in FY2023, one customer still accounted for 11.8% of total accounts receivable.

According to the prospectus, Huicheng Technology's customized software business customers are mainly small and medium-sized enterprises from different vertical service fields, such as retailers, e-commerce, catering, food and beverage, marketing agencies, real estate agencies, educational institutions, insurance institutions or logistics.

As of the publication date of the prospectus, the company has delivered 64 websites and web-based application projects and 61 mobile application development projects, including billing, business management, virtual office, instant messaging, teleconferencing and VoIP, reservation and ticketing, e-commerce, and business intelligence.

Focus on SME customers, and SaaS cloud platforms seize market share at low prices

Looking at the company's fundamentals, cloud services may become one of the biggest highlights of Huicheng Technology. In fiscal year 2023, the revenue share of the company's cloud subscription services grew rapidly from 3.8% to 11.8%, making it the fastest growing segment in revenue.

According to the prospectus, Huicheng Technology launched MR.CLOUD, a proprietary cloud-based SaaS ERP software platform in 2020, which aims to provide SME customers with easy-to-use, affordable, comprehensive and user-friendly ERP software solutions. Mr.Cloud has the characteristics of multiple modules, multiple tenants, and expandable, and supports operation on the web, iOS, and Android terminals.

The Zhitong Finance App learned that compared with leading companies in the industry such as Oracle, MR. CLOUD has a clear price advantage. For example, Oracle's cloud ERP platform costs about HK$1 million, SAP SE's SAP ERP costs about HK$3 million to HK$4 million, while Huicheng Technology's ERP products cost less than HK$0.1 million, and provide a 14-day trial period.

MR.CLOUD integrates ten major modules including human resource management, project management, email marketing automation, financial accounting management, quotation and invoice management, inventory management, group communication, customer relationship management (CRM), sales management, and document management. Currently, the company's R&D work is mainly focused on the expansion and improvement of the Mr. Cloud platform, and it is expected to contribute more performance growth in the future.

Although the growth rate of China's enterprise-level SaaS industry has declined in recent years, the overall market size is still growing steadily. According to statistics from the Chinese Academy of Information and Communications Technology, the size of China's SaaS market reached 58.1 billion yuan in 2023, with a growth rate of about 23.1%.

With the adoption of technologies such as machine learning and artificial intelligence, technological change is providing new growth opportunities for many participants in the SaaS market. At the same time, the industry is also facing many challenges such as high customer acquisition costs, lack of general evaluation standards, and data security and privacy issues.

The growth ceiling is limited or may become a hidden concern for future development

As a SaaS and PaaS service provider that mainly provides services to small and medium-sized enterprises, Huicheng Technology's business is not only driven by the rapid development of e-commerce and online payments, but also benefits from the paperless demand brought about by SMEs to automation and digital transformation and environmental sustainability policies.

As Hong Kong's economic environment continues to pick up, Huicheng Technology's performance is also showing an upward trend. According to the data, in the first half of 2024, the total number of newly established local companies in Hong Kong was 0.0667 million; by the end of June, the total number of local Hong Kong companies registered under the Companies Ordinance reached 1.4409 million, a record high.

With its unique geographical advantages, open market environment and superior business policies, Hong Kong will continue to attract a large influx of enterprises and international capital. However, the business is limited to Hong Kong, and Huicheng Technology's future growth ceiling is not very high, and it may be a cause for market investors to worry.

In response, the company stated in its prospectus that it plans to expand its business in Singapore and Australia in the future through strategic acquisitions and partnerships, and plans to eventually expand its business and customer base to the US, but it has not yet determined or participated in any substantive discussions on any potential goals.

On the other hand, the company is expanding IT businesses related to online marketing, including search engine optimization (SEO), email marketing, social media marketing, and content marketing. To this end, the company has developed functional modules such as mobile membership, shopping websites, and POS payments.

As can be seen, thanks to the rapid development of the cloud service business, Huicheng Technology has achieved impressive results, but due to its small business scale, the company will still face considerable uncertainty in the future. At the same time, the Sass circuit where the company is located is currently not as popular for financing as before, which also weakens the company's potential room for valuation growth.

招股书显示,惠程科技的IPO前投资者包括Ocean Serene(占已发行股本总额的4.5%)、Paramount Fortune(持股3.5%)和Prestige Leader(持股3%)。

招股书显示,惠程科技的IPO前投资者包括Ocean Serene(占已发行股本总额的4.5%)、Paramount Fortune(持股3.5%)和Prestige Leader(持股3%)。