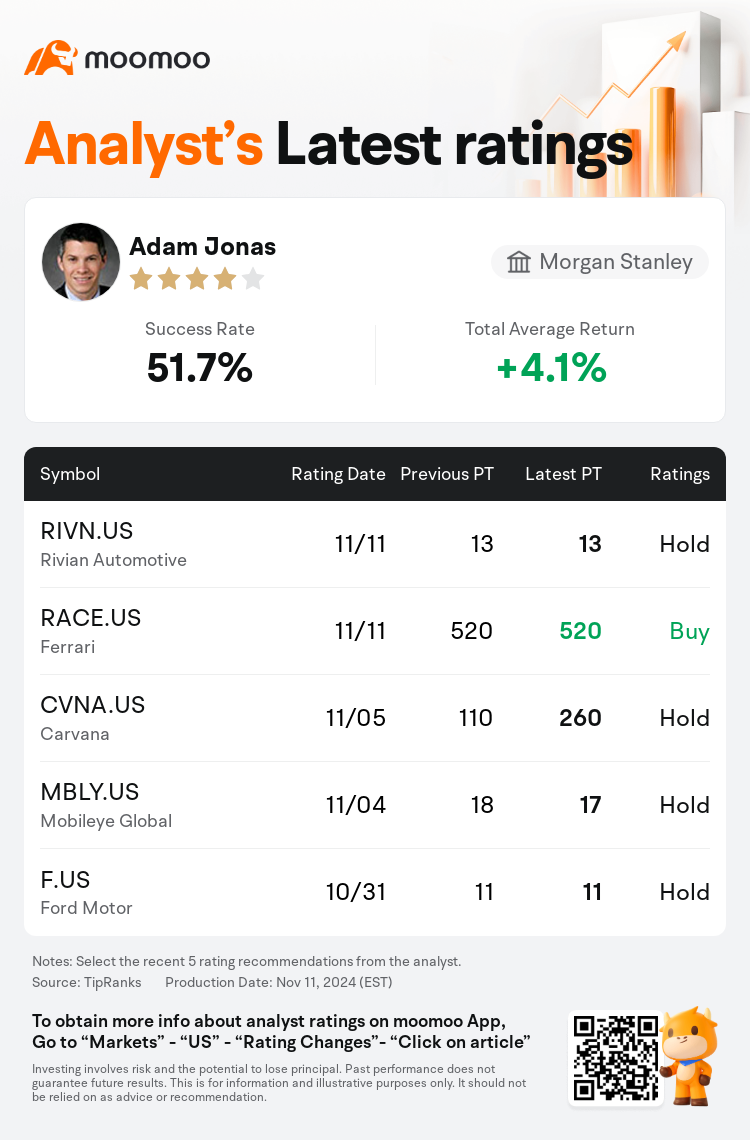

Morgan Stanley analyst Adam Jonas maintains $Rivian Automotive (RIVN.US)$ with a hold rating, and maintains the target price at $13.

According to TipRanks data, the analyst has a success rate of 51.7% and a total average return of 4.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Rivian Automotive (RIVN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Rivian Automotive (RIVN.US)$'s main analysts recently are as follows:

Despite ongoing near-term challenges, it's noted that Rivian Automotive is steadily advancing towards achieving important goals. These objectives include reaching a positive gross profit by the fourth quarter, sustaining that profitability by 2025, and the successful introduction of the pivotal R2 model. It's been assessed that Rivian possesses ample liquidity to support its operations leading up to the R2 launch, indicating that the company's overall trajectory remains unchanged.

Rivian Automotive's wider than expected Q3 loss has been noted, yet the anticipation of $275M in regulatory credits anticipated entirely in Q4 bolsters confidence that the company will reach its gross profit positive target. However, there is concern regarding the potential impact on R1 consumer demand if the $7,500 IRA lease credit is altered.

The third-quarter results for Rivian Automotive fell short of estimates across several major indicators, with the expectation for full-year adjusted EBITDA also being revised downwards. This updated forecast is primarily due to the company's earlier reduction in production expectations, which is likely to restrict the spreading out of fixed costs.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

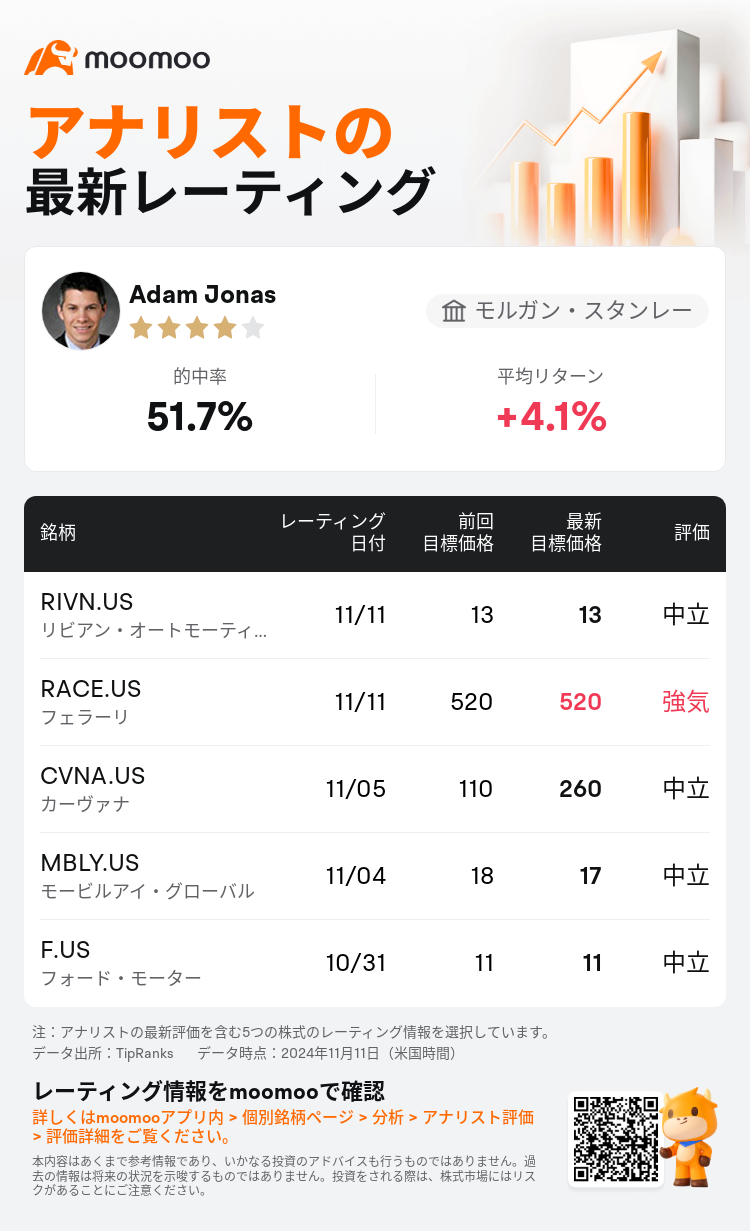

モルガン・スタンレーのアナリストAdam Jonasは$リビアン・オートモーティブ・インク (RIVN.US)$のレーティングを中立に据え置き、目標株価を13ドルに据え置いた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は51.7%、平均リターンは4.1%である。

また、$リビアン・オートモーティブ・インク (RIVN.US)$の最近の主なアナリストの観点は以下の通りである:

また、$リビアン・オートモーティブ・インク (RIVN.US)$の最近の主なアナリストの観点は以下の通りである:

短期的な課題が続いているにもかかわらず、リビアン・オートモーティブは重要な目標の達成に向けて着実に進んでいることは注目に値します。これらの目標には、第4四半期までにプラスの売上総利益を達成すること、2025年までにその収益性を維持すること、そして重要なR2モデルの導入を成功させることが含まれます。リビアンには、R2の立ち上げに至るまでの事業を支える十分な流動性があると評価されており、会社全体の軌跡は変わっていないことがわかります。

Rivian Automotiveの第3四半期の損失が予想を上回ったことは注目されていますが、第4四半期に完全に2億7500万ドルの規制クレジットが見込まれるため、同社が売上総利益のプラス目標を達成するという確信が高まります。ただし、7,500ドルのIRAリースクレジットが変更された場合、R1の消費者需要に及ぼす潜在的な影響が懸念されます。

リビアン・オートモーティブの第3四半期の結果は、いくつかの主要な指標で見積もりを下回りました。通年の調整後EBITDAの予想も下方修正されました。この最新の予測は、主に同社が以前に生産予想を引き下げたことによるもので、固定費の分散が制限される可能性があります。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$リビアン・オートモーティブ・インク (RIVN.US)$の最近の主なアナリストの観点は以下の通りである:

また、$リビアン・オートモーティブ・インク (RIVN.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of