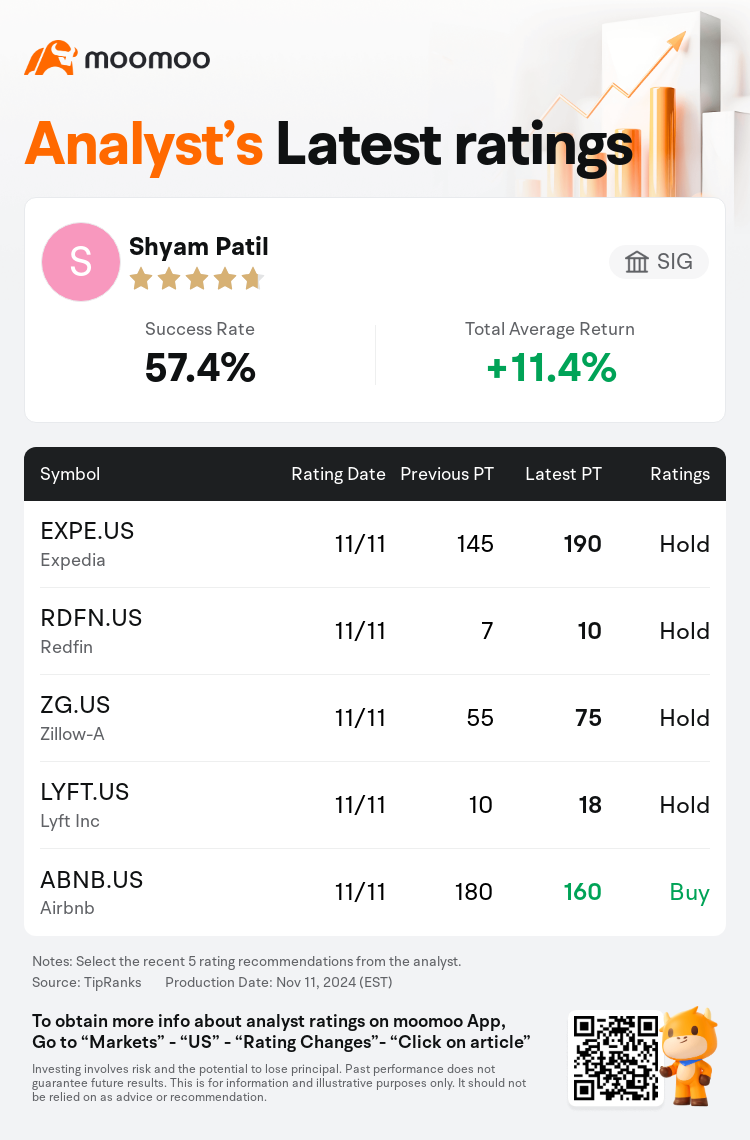

SIG analyst Shyam Patil maintains $Expedia (EXPE.US)$ with a hold rating, and adjusts the target price from $145 to $190.

According to TipRanks data, the analyst has a success rate of 57.4% and a total average return of 11.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Expedia (EXPE.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Expedia (EXPE.US)$'s main analysts recently are as follows:

Expedia's third-quarter outcomes and projections for the fourth quarter were robust, propelled by the strong performance of Brand Expedia and enhancements in Vrbo, as observed by an analyst.

Expedia's Q3 performance exceeded expectations in terms of nights and bookings, and the forecast for Q4 remains positive despite potential setbacks from adverse weather conditions. Additionally, Vrbo showed a turnaround, achieving positive results for the entire quarter.

Post Q3 earnings, it's noted that Expedia's Hotels.com brand continues to face challenges, and a significant positive shift may be challenging due to increasing competition. It's also observed that rising costs associated with Vrbo and Hotels.com might balance out the favorable trends in Gross Bookings projected for 2025 and the years that follow.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

サスケハナ(SIG)のアナリストShyam Patilは$エクスペディア・グループ (EXPE.US)$のレーティングを中立に据え置き、目標株価を145ドルから190ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は57.4%、平均リターンは11.4%である。

また、$エクスペディア・グループ (EXPE.US)$の最近の主なアナリストの観点は以下の通りである:

また、$エクスペディア・グループ (EXPE.US)$の最近の主なアナリストの観点は以下の通りである:

アナリストによると、エクスペディアの第3四半期の業績と第4四半期の予測は堅調でした。これは、ブランドエクスペディアの好調な業績とVrboの機能強化に後押しされました。

エクスペディアの第3四半期の業績は、宿泊数と予約数で予想を上回り、悪天候による後退の可能性があるにもかかわらず、第4四半期の予測は引き続き好調です。さらに、Vrboは好転し、四半期全体で好業績を達成しました。

第3四半期の収益以降、エクスペディアのHotels.comブランドは引き続き課題に直面しており、競争の激化により、大きなプラスの変化は難しい可能性があることが指摘されています。また、VrboとHotels.comに関連するコストの上昇が、2025年とその後の数年間に予測される総予約数の好調な傾向のバランスを取る可能性があることもわかりました。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$エクスペディア・グループ (EXPE.US)$の最近の主なアナリストの観点は以下の通りである:

また、$エクスペディア・グループ (EXPE.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of