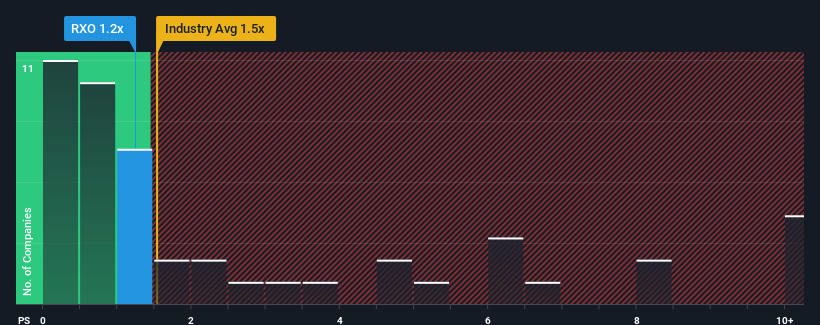

It's not a stretch to say that RXO, Inc.'s (NYSE:RXO) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the Transportation industry in the United States, where the median P/S ratio is around 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has RXO Performed Recently?

While the industry has experienced revenue growth lately, RXO's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think RXO's future stacks up against the industry? In that case, our free report is a great place to start.How Is RXO's Revenue Growth Trending?

RXO's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 66% as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.8%, which is noticeably less attractive.

In light of this, it's curious that RXO's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From RXO's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that RXO currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for RXO you should be aware of.

If these risks are making you reconsider your opinion on RXO, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.