Financial giants have made a conspicuous bullish move on Visa. Our analysis of options history for Visa (NYSE:V) revealed 36 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $193,024, and 32 were calls, valued at $2,087,431.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $230.0 and $355.0 for Visa, spanning the last three months.

Volume & Open Interest Trends

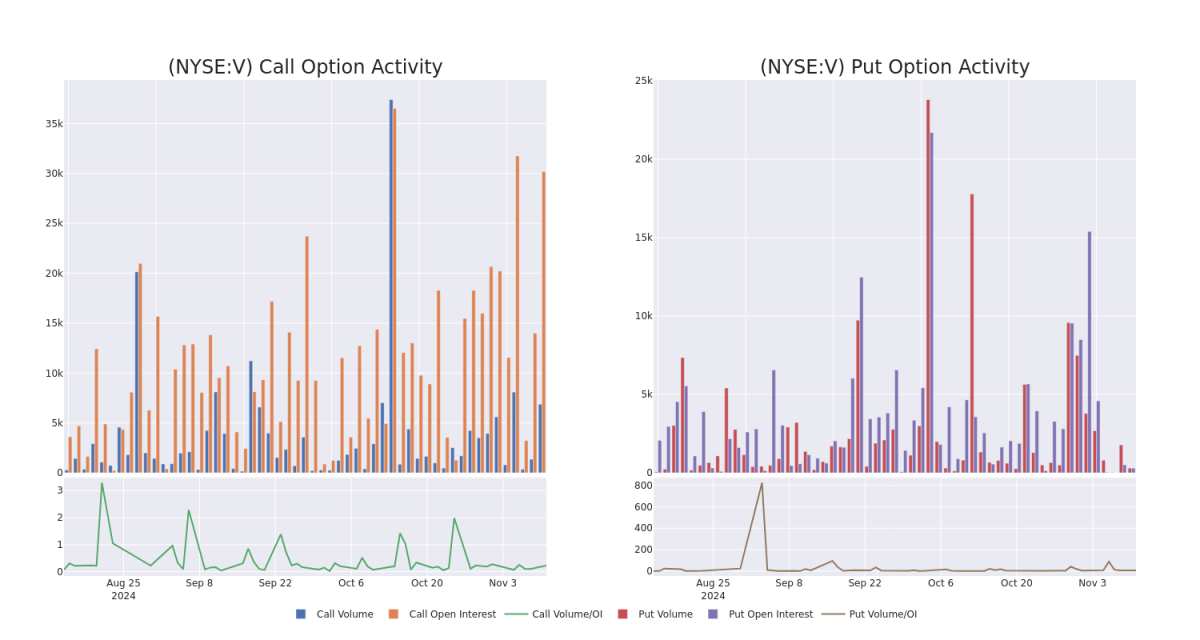

In today's trading context, the average open interest for options of Visa stands at 1451.52, with a total volume reaching 7,175.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $230.0 to $355.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Visa stands at 1451.52, with a total volume reaching 7,175.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Visa, situated within the strike price corridor from $230.0 to $355.0, throughout the last 30 days.

Visa Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | CALL | TRADE | BULLISH | 12/20/24 | $3.55 | $3.45 | $3.52 | $320.00 | $598.4K | 1.4K | 1.7K |

| V | CALL | SWEEP | BEARISH | 12/20/24 | $8.25 | $8.1 | $8.1 | $310.00 | $126.3K | 1.9K | 193 |

| V | CALL | TRADE | BEARISH | 03/21/25 | $11.25 | $10.6 | $10.6 | $320.00 | $106.0K | 368 | 100 |

| V | CALL | TRADE | BULLISH | 12/20/24 | $10.55 | $9.05 | $10.05 | $305.00 | $100.5K | 1.8K | 100 |

| V | CALL | TRADE | BEARISH | 11/15/24 | $7.65 | $7.6 | $7.6 | $305.00 | $67.6K | 2.4K | 166 |

About Visa

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Visa's Current Market Status

- Currently trading with a volume of 2,135,630, the V's price is up by 0.78%, now at $310.27.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 73 days.

What Analysts Are Saying About Visa

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $326.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Macquarie persists with their Outperform rating on Visa, maintaining a target price of $335. * In a cautious move, an analyst from Oppenheimer downgraded its rating to Outperform, setting a price target of $321. * An analyst from TD Cowen persists with their Buy rating on Visa, maintaining a target price of $325. * An analyst from Jefferies persists with their Buy rating on Visa, maintaining a target price of $330. * An analyst from BMO Capital has decided to maintain their Outperform rating on Visa, which currently sits at a price target of $320.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.