Despite an already strong run, Gansu Golden Solar Co., Ltd (SZSE:300093) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 35%.

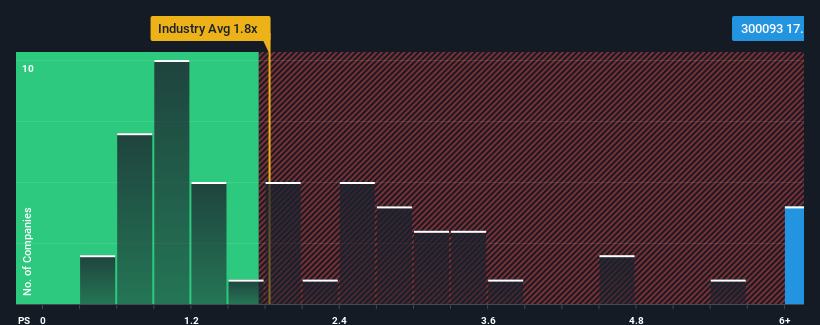

After such a large jump in price, when almost half of the companies in China's Building industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider Gansu Golden Solar as a stock not worth researching with its 17.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Gansu Golden Solar's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Gansu Golden Solar over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Gansu Golden Solar, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Gansu Golden Solar's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Gansu Golden Solar's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's top line. As a result, revenue from three years ago have also fallen 37% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 22% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Gansu Golden Solar's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Shares in Gansu Golden Solar have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Gansu Golden Solar revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Gansu Golden Solar you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.