Despite an already strong run, Zhejiang Tianzhen Technology Co., Ltd. (SZSE:301356) shares have been powering on, with a gain of 26% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.9% in the last twelve months.

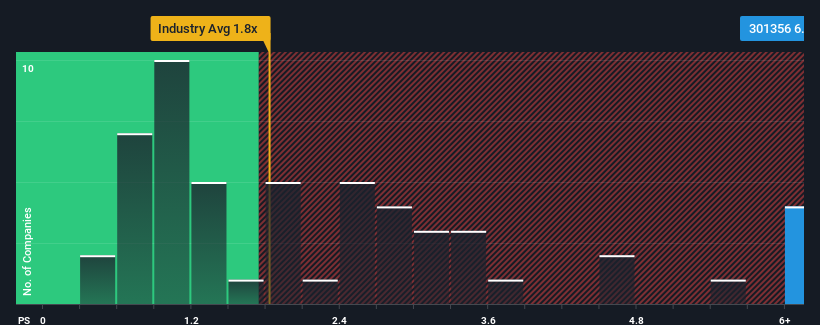

Following the firm bounce in price, you could be forgiven for thinking Zhejiang Tianzhen Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.8x, considering almost half the companies in China's Building industry have P/S ratios below 1.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Zhejiang Tianzhen Technology Has Been Performing

While the industry has experienced revenue growth lately, Zhejiang Tianzhen Technology's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Zhejiang Tianzhen Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Zhejiang Tianzhen Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Zhejiang Tianzhen Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. This means it has also seen a slide in revenue over the longer-term as revenue is down 82% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 230% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 22%, the company is positioned for a stronger revenue result.

With this information, we can see why Zhejiang Tianzhen Technology is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Zhejiang Tianzhen Technology's P/S

Zhejiang Tianzhen Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Zhejiang Tianzhen Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Building industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Zhejiang Tianzhen Technology with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Zhejiang Tianzhen Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.