United Faith Auto-Engineering Co.,Ltd. (SZSE:301112) shareholders have had their patience rewarded with a 28% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.9% over the last year.

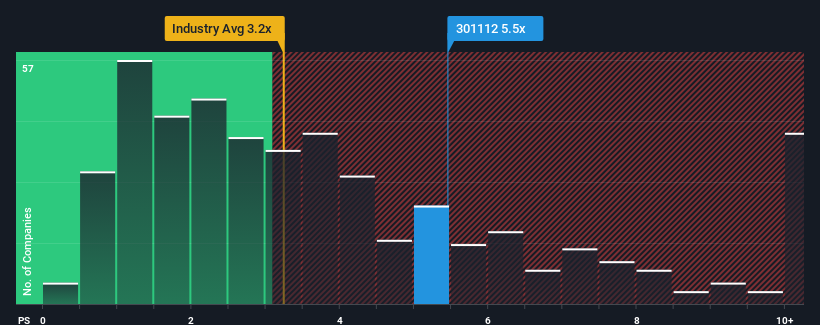

After such a large jump in price, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 3.2x, you may consider United Faith Auto-EngineeringLtd as a stock to avoid entirely with its 5.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does United Faith Auto-EngineeringLtd's P/S Mean For Shareholders?

United Faith Auto-EngineeringLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on United Faith Auto-EngineeringLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For United Faith Auto-EngineeringLtd?

In order to justify its P/S ratio, United Faith Auto-EngineeringLtd would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, United Faith Auto-EngineeringLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 3.8% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that United Faith Auto-EngineeringLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On United Faith Auto-EngineeringLtd's P/S

United Faith Auto-EngineeringLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of United Faith Auto-EngineeringLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

It is also worth noting that we have found 3 warning signs for United Faith Auto-EngineeringLtd (1 makes us a bit uncomfortable!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.