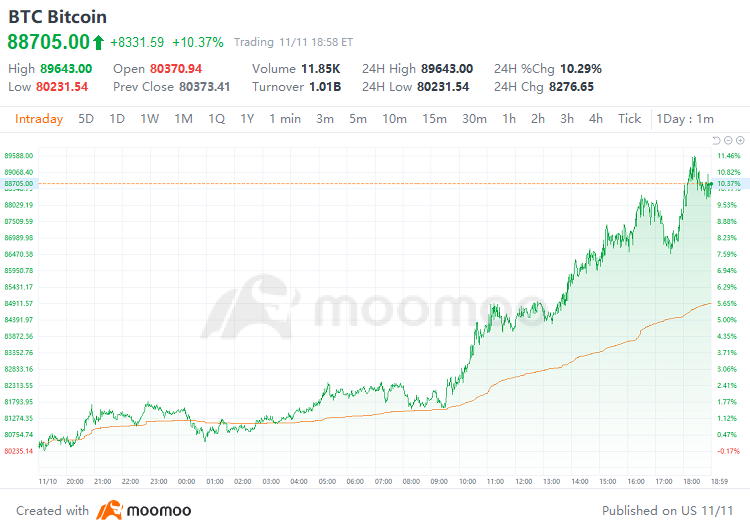

During Monday’s US trading hours, the crypto market continued to rally, fueled by Donald Trump’s recent electoral victory. $Bitcoin (BTC.CC)$ began its ascent over the weekend and gained further traction throughout the week, breaking several significant psychological thresholds and briefly topping $89,000.

All major cryptocurrencies saw a uniform surge. $Ethereum (ETH.CC)$ boasted a 7-day cumulative increase of approximately 40%, markedly outperforming Bitcoin’s 31%.

Supported by endorsements from Elon Musk, $Dogecoin (DOGE.CC)$ ’s value doubled within a week.

As optimism grows following Trump's election, Bitcoin futures premiums have surged. Data from derivatives exchange Deribit shows that wagers exceeding $2.8 billion were placed on Bitcoin surpassing the $90,000 mark.

As optimism grows following Trump's election, Bitcoin futures premiums have surged. Data from derivatives exchange Deribit shows that wagers exceeding $2.8 billion were placed on Bitcoin surpassing the $90,000 mark.

On the same day, prominent Bitcoin stakeholder $MicroStrategy (MSTR.US)$ announced a substantial acquisition of approximately 0.0272 million bitcoins for around $2.03 billion, marking its largest purchase since December 2020.

In their third-quarter report on October 30, MicroStrategy introduced their "21/21 plan," aiming to secure $42 billion through $21 billion in equity and $210 billion in debt over the next three years to further invest in Bitcoin.

During regular trading hours on Monday, $iShares Bitcoin Trust (IBIT.US)$ surpassed $Gold Trust Ishares (IAU.US)$ in managed assets. Although IBIT's current management scale is still about $30 billion shy of the world’s largest gold ETF, $SPDR Gold ETF (GLD.US)$, its overtaking of IAU marks a significant milestone.

According to FactSet, IBIT received approximately $1 billion in inflows last week alone, accumulating a total of $27 billion since its January launch. The recent spike in Bitcoin’s price is expected to push the ETF's asset management scale above $30 billion.

By last Friday, IBIT managed assets worth $34.3 billion, slightly ahead of IAU’s nearly $33 billion.

Bitcoin has the highest correlation with global liquidity, making this undoubtedly a significant trend. With zero-commission trading, are you sure you don't want to give it a try?