CASTECH Inc. (SZSE:002222) shares have continued their recent momentum with a 46% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 30%.

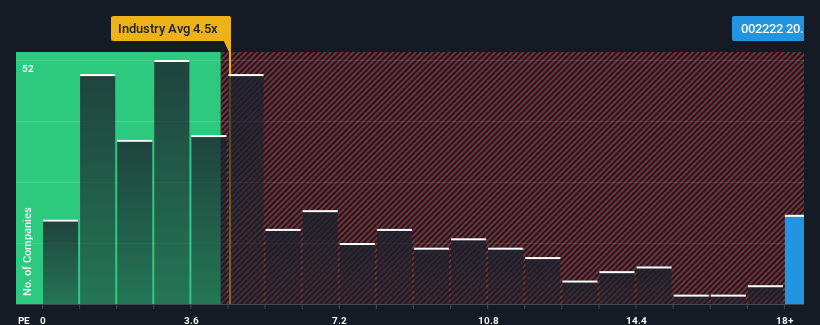

Since its price has surged higher, CASTECH may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 20.9x, since almost half of all companies in the Electronic industry in China have P/S ratios under 4.5x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does CASTECH's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, CASTECH has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think CASTECH's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For CASTECH?

In order to justify its P/S ratio, CASTECH would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, CASTECH would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. Revenue has also lifted 27% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 27%, which is not materially different.

In light of this, it's curious that CASTECH's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From CASTECH's P/S?

CASTECH's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given CASTECH's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for CASTECH with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.