① The J-35A, the second domestically produced stealth fighter, was officially unveiled at the Zhuhai Air Show this afternoon; ② Recently, the stock price of China Airlines Shenfei once reached a record high; ③ China Airlines Shenfei's partial relocation and construction project has progressed.

Financial Services Association, November 12 (Reporters Liang Xiangcai and Hu Haoqiong) The J-35A, the second domestically produced stealth fighter, the J-35A, was finally officially unveiled at the 15th China International Aerospace Expo (hereinafter referred to as the Zhuhai Air Show) held today with a burst of loud “Dragon Yin”.

According to an earlier announcement by China Airlines Shen Fei (600760.SZ), the J-35A is jointly developed and produced by Shenyang Aircraft Design Research Institute, a subsidiary of the Aviation Industry Group, and Shenyang Aircraft Industry (Group) Co., Ltd. (hereinafter referred to as Shenfei Company). Relevant experts from the China Aviation Industry Group have publicly stated that the J-35 series is “one aircraft with multiple models, air and sea twins.”

Currently, out of several fixed capital raising projects where Shen Fei plans to invest nearly 10 billion yuan, some progress has already been made in planning the “Shen Fei Company Partial Relocation and Construction Project” with the largest investment amount in a long time.

Currently, out of several fixed capital raising projects where Shen Fei plans to invest nearly 10 billion yuan, some progress has already been made in planning the “Shen Fei Company Partial Relocation and Construction Project” with the largest investment amount in a long time.

The opening of the 15th China Airlines Exhibition Photo source: Photo taken by a reporter from the Financial Federation

J-35A officially unveils “multiple models in one”, and there are more expectations

At 11:9 on November 12, at the 15th China International Aerospace Expo in Zhuhai City, Guangdong Province, a J-35A was officially displayed on flight with a wave of “dragon singing” moving to the ground.

An J-35A is being displayed in flight. Image source: Photo taken by a Financial Services Association reporter

Bao Ming, a military commentator, a master of military logistics, and a doctor of combat command, told the Financial Federation reporter: “The J-35A's debut is significant. Coupled with the J-20, it shows that only China and the US can simultaneously produce a moderately heavy fourth-generation fully stealth air superiority fighter, fully demonstrating the advanced R&D capabilities and production level of the Chinese aviation industry.” The J-35A fully complies with the standards of 4th generation (also classified as 5th generation) aircraft.

Bao Ming further stated, “The J-35 is likely to develop a series of models in the future. At the Air Show Hall 1, at the China Aviation Industry booth, I saw the new J-35 series model aircraft. One of them has a thick undercarriage and foldable wings, which indicates that it is likely to become a carrier-based aircraft and fighter for other purposes in the future.”

Wang Yongqing, chief expert of the China Aviation Industry Group's Shenyang Institute, recently publicly stated that the J-35 series is “one aircraft with multiple models, air and sea twins”. “The reuse of many technologies has greatly improved the maturity of key technologies. The maturity of technology is high, the maturity of the system is high, and the reliability of the equipment will also be greatly improved. Today, we saw the J-35A, which shows that we are still progressing in an orderly manner”.

It is worth noting that in the aviation industry exhibition hall, another 1:5 two-seater J-20 model appeared on the booth. At the center of the booth, the J-35A and J-20S models appeared in the same frame.

In response, Bao Ming told the Financial Federation reporter: This shows that the J-20 not only has a basic model, but now also has a two-seater model, which means that the J-20 may be used as a network node in the air combat system in the future to perform command and control functions, so that the J-20's excellent information-based air combat functions will be fully exploited.

According to information, the J-20S is a new-generation medium range, heavy duty, two-seat, multi-purpose stealth fighter independently developed by the China Aviation Industry Group. It has excellent medium- and long-range air combat capability and accurate strike capability against the ground and sea, has outstanding situation perception, electronic interference, and tactical command and control capabilities, and has man/drone cooperative combat capabilities.

The stock price recently reached a new high, and Shen Fei supports the “backbone” of performance

On the eve of the opening of the Zhuhai Airlines launch, following early “spoilers” of information related to the J-35A, the secondary market reacted strongly: from November 4 to 11, it had 3 ups and downs, with an increase of about 35% during the period. In the November 11 market, the stock price of China Airlines Shen Fei once reached a record high. However, with the opening of today's aviation launch, the stock price of China Airlines Shen Fei has begun to fall.

After the market on November 6, China Airlines Shen Fei stated in an announcement of abnormal stock trading fluctuations that the J-35A is a new-generation medium stealth multi-purpose fighter independently developed by China. The product is jointly developed and produced by the Shenyang Aircraft Design Research Institute, a subsidiary of the Aviation Industry Group, and Shenyang Aircraft Industry (Group) Co., Ltd.

According to reports, Shen Fei is the main contributor to the performance of China Airlines Shen Fei. For the whole of 2023, Shenfei's revenue was 45.337 billion yuan, accounting for about 98% of the company's overall revenue; net profit for the same period was 2.96 billion yuan, accounting for 98.43%.

According to the 2023 financial report of China Airlines Shen Fei, Shen Fei Company, Yangzhou Academy, and Ji Airlines are the three major controlling shareholders of China Airlines Shenfei. Among them, Shen Fei is 100% owned by China Airlines Shen Fei. Its main business is fighter aircraft (covering special aircraft), drones, civil aircraft parts, and aircraft maintenance.

Financial reports show that in January-September of this year, China Airlines Shen Fei achieved operating income of 25.298 billion yuan, a year-on-year decrease of 26.95%; net profit to mother was 1.818 billion yuan, a year-on-year decrease of 23.12%. In response, the company explained that it was mainly affected by the progress of contract signing, and the stated demand for related products was not signed as scheduled.

On November 6, Ji Ruidong, Party Secretary and Chairman of China Airlines Shen Fei, said at the performance briefing that the company's order was signed according to aviation defense equipment models and procurement plans determined by specific users based on strategic national defense requirements.

Looking further, as of the end of the third quarter, the company's cash flow statement showed 16.817 billion yuan of cash received from sales of goods and provision of labor services, an increase of 62.94% over the previous year. On the balance sheet for the same period, contract liabilities were 5.814 billion yuan, up 25.17% year on year; inventory for the same period was 11.489 billion yuan, up 21.72% year on year, the highest since the company entered the capital market.

In terms of civil aviation products, the company's products are mainly manufactured for civil aircraft parts. The company actively participates in the development of domestic civil aircraft, and the airframe structural components produced are used in projects such as C919 and ARJ21.

The fixed increase investment project with a total investment of over 10 billion dollars has progressed

Currently, the fixed increase investment project being promoted by China Airlines Shen Fei has attracted investors' attention.

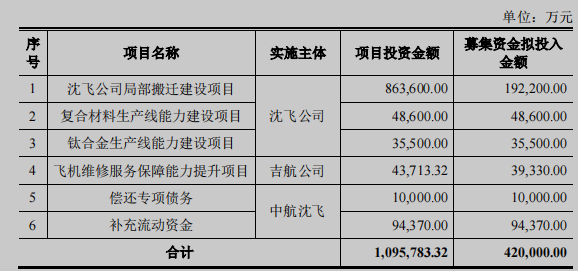

According to the announcement, the company plans to raise an additional 4.2 billion yuan for six major projects. The implementing entity of more than half of the capital is Shenfei. The three corresponding projects are Shenfei's partial relocation and construction project, the composite material production line capacity building project, and the titanium alloy production line capacity building project. The amount of capital raised is 1.922 billion yuan, 0.486 billion yuan, and 0.355 billion yuan, respectively.

Screenshot source: China Airlines Shen Fei Dingzheng Plan Announcement

Among the six major projects the company plans to invest in, the total investment amount for the relocation and construction project is the highest, at 8.636 billion yuan.

According to the company's previous relevant announcement, out of the 8.636 billion yuan investment capital for the above relocation and construction project, it is mainly government relocation compensation funds; the total land use is about 4.2,692 square kilometers, and the project construction period is 60 months. The main construction content is plant and site construction in production areas and flight areas, and additional process equipment. This project does not produce direct economic benefits. After implementation, it will lay a good foundation for future scientific research and production support tasks and bring indirect benefits to the company's business.

In fact, the relocation and construction project has progressed substantially. According to China Airlines Shen Fei's announcement on December 19, 2023, Shenfei Company, a wholly-owned subsidiary of the company implementing this project, has formally signed a “State-owned Construction Land Use Rights Transfer Contract” with the Shenyang Municipal Natural Resources Bureau. The parcel area is about 1.8885 square kilometers, and the sale price is about 0.629 billion yuan.

China Airlines Shen Fei has been planning the relocation and construction project for a long time. As early as July 2019, the Aviation Industry Group, the controlling shareholder of the company, signed the “Framework Agreement on the Partial Relocation Cooperation of Shenyang Aircraft Industry (Group) Co., Ltd.” The Aviation Industry Group, Shenfei Company, the People's Government of Liaoning Province, and the Shenyang Municipal People's Government will jointly promote Shenfei's partial relocation and construction project.

目前,沈飞公司拟投资近百亿元的几大定增募投项目中,筹划已久投资额最大的“沈飞公司局部搬迁建设项目”已有部分进展。

目前,沈飞公司拟投资近百亿元的几大定增募投项目中,筹划已久投资额最大的“沈飞公司局部搬迁建设项目”已有部分进展。