Morgan Stanley said that the market is looking forward to Tesla's potential in autonomous driving, energy and AI, and the company's stock price is expected to hit $500 next year. Musk has emerged from a political “outsider” to a potential key figure in policy making, or to some extent, accelerate Tesla's development.

The dust has settled on the US election, and as Musk's “bond” with Trump deepens, Tesla's prospects are being re-examined by investors. Morgan Stanley even gave Tesla a bullish forecast price of $500.

On November 11, Morgan Stanley's latest research report showed that the market is looking forward to Tesla's long-term potential in autonomous driving, renewable energy, and artificial intelligence. Under the bullish market scenario, the company's stock price may rise to 500 US dollars in the next 12 months.

Recently, Musk and Trump have helped Twitter's share price soar by about 40% to a two-year high, exceeding Morgan Stanley's target price of 310 US dollars. Tesla's current share price of $350 makes the company's valuation multiple (EV/EBITDA) 16 times. The bank's research report predicts that if the stock price reaches 400 US dollars, the valuation multiplier will rise 19 times, while at 500 US dollars it will be close to 24 times.

Recently, Musk and Trump have helped Twitter's share price soar by about 40% to a two-year high, exceeding Morgan Stanley's target price of 310 US dollars. Tesla's current share price of $350 makes the company's valuation multiple (EV/EBITDA) 16 times. The bank's research report predicts that if the stock price reaches 400 US dollars, the valuation multiplier will rise 19 times, while at 500 US dollars it will be close to 24 times.

As Musk's political influence grows, Tesla is likely to play a more important role in the future of new energy, autonomous driving, and robotics in the US. The research report points out that although the relationship between Musk and the Trump administration is difficult to quantify its influence on Tesla, Musk's rise from a political “outsider” to a potential key figure in policy making may accelerate Tesla's development to a certain extent.

Energy, automotive, mobility and other businesses jointly boost the $500 target

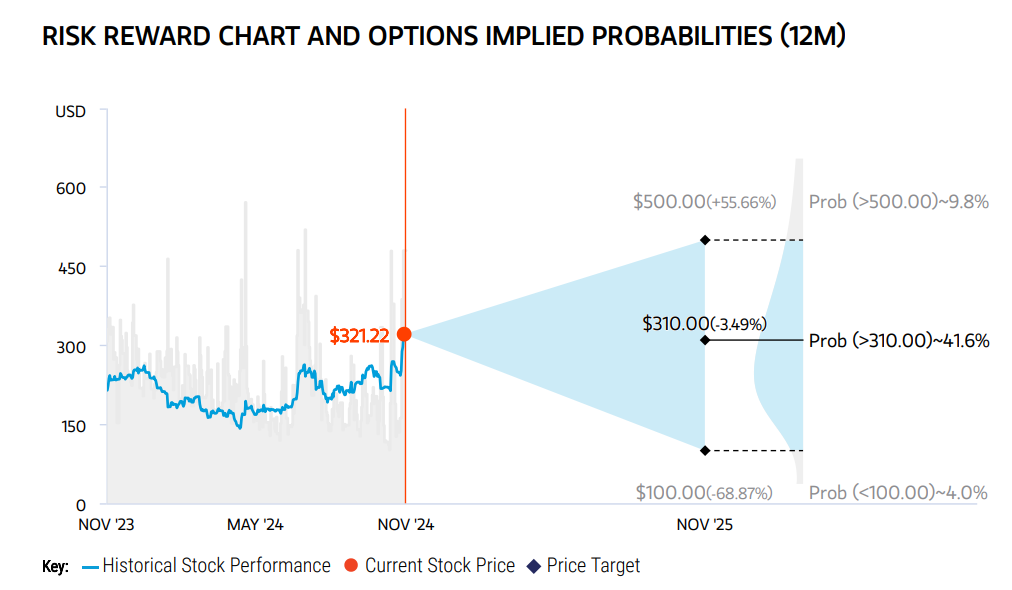

Morgan Stanley said that in the next 12 months, under the bull market scenario, Tesla's stock price is expected to hit 500 US dollars; under the basic scenario, Tesla's stock price may be around the 310 level; under the bear market scenario, Tesla's stock price may fall to 100 US dollars.

The bank's research report mentioned the main drivers and key assumptions of Tesla's $500 bull market target, including the automotive business contributing $90 per share and the energy business contributing $85 per share:

- Automobile business: Tesla is expected to sell 8 million vehicles by 2030, at a compound annual growth rate of 28%, contributing $90 per share.

- Energy business: Tesla's energy storage system (ESS) is expected to deploy 400 GWh by 2030, with a compound annual growth rate of 54%, contributing 85 US dollars/share.

- Internet services: Includes recurring revenue such as software, charging, and fully automated driving (FSD), contributing $146 per share.

- Mobile/shared mobility services: It is expected to have a fleet of 1 million vehicles by 2030, contributing $118 per share.

- Third-party batteries and power systems: It is expected to supply 3.4 million non-Tesla electric vehicles with batteries and power systems by 2030, contributing $61 per share.

- Humanoid robot business: Expected to contribute $0 per share by 2030. The business is expected to contribute approximately $100 per share by 2040.

Investors had little interest in Tesla's energy business a few quarters ago, but that changed in 2023. Tesla's energy storage system deployment increased 125% in one year and is expected to double again this year. Musk's previous statement that Tesla's energy business will be more valuable than the automobile business is also being verified. According to Morgan Stanley, the gross margin of Tesla's energy business (solar+energy storage) is almost double that of the automobile business.

In the field of autonomous driving, Musk's autonomous driving technology and “cybercab” (Cybercab) program are still facing regulatory challenges.

Research reports show that it is unclear whether Tesla can obtain approval for unsupervised fully automated driving within the next two years, but advances in software technology may still drive up the stock price. Although the relationship between Tesla and the Trump administration will be potentially beneficial, the market still disputes the path and timing of the monetization of Tesla's autonomous driving technology and robotics business.

How is political influence changing Tesla?

The research report points out that although the relationship between Musk and the Trump administration is difficult to quantify its impact on Tesla, what is clear is that Musk's influence is rapidly increasing. If the US moves towards electric vehicles, autonomous driving, robotics, and renewable energy independence in the future, Tesla may play a key role in this process. Some have even compared this transformation to the Manhattan Project, the US Highway Act, or the Apollo Moon landing program.

Morgan Stanley said that Musk's rise from a political “outsider” to a potential key figure in policy making may accelerate Tesla's development beyond the automotive sector to a certain extent.

近期,马斯克站队特朗普已经助推特斯拉股价飙升约40%创两年新高,超过摩根士丹利310美元的目标价。当前特斯拉350美元的股价,使公司估值倍数(EV/EBITDA)达到16倍。该行研报预测,若股价达到400美元,估值倍数将升至19倍,而500美元时将接近24倍。

近期,马斯克站队特朗普已经助推特斯拉股价飙升约40%创两年新高,超过摩根士丹利310美元的目标价。当前特斯拉350美元的股价,使公司估值倍数(EV/EBITDA)达到16倍。该行研报预测,若股价达到400美元,估值倍数将升至19倍,而500美元时将接近24倍。