It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Changzhou Xingyu Automotive Lighting SystemsLtd (SHSE:601799), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Changzhou Xingyu Automotive Lighting SystemsLtd Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Changzhou Xingyu Automotive Lighting SystemsLtd's EPS shot up from CN¥3.40 to CN¥4.54; a result that's bound to keep shareholders happy. That's a fantastic gain of 33%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Changzhou Xingyu Automotive Lighting SystemsLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Changzhou Xingyu Automotive Lighting SystemsLtd maintained stable EBIT margins over the last year, all while growing revenue 29% to CN¥12b. That's encouraging news for the company!

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Changzhou Xingyu Automotive Lighting SystemsLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Changzhou Xingyu Automotive Lighting SystemsLtd maintained stable EBIT margins over the last year, all while growing revenue 29% to CN¥12b. That's encouraging news for the company!

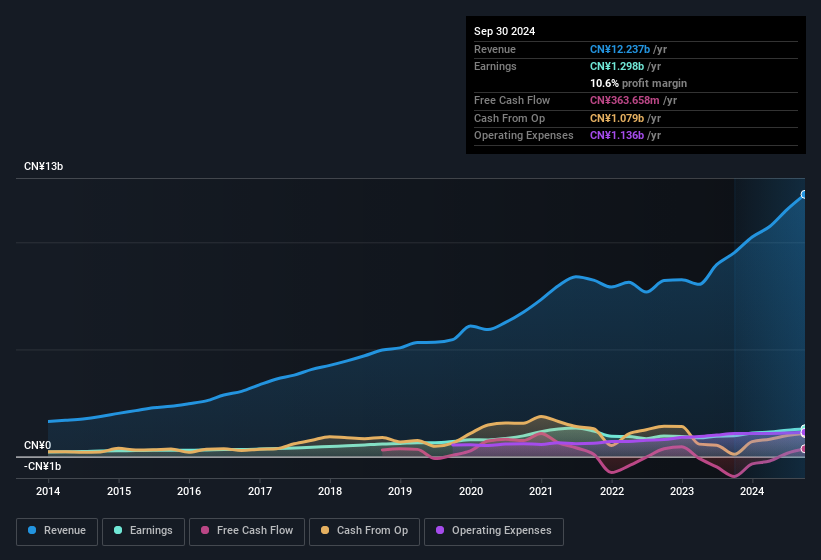

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Changzhou Xingyu Automotive Lighting SystemsLtd's future profits.

Are Changzhou Xingyu Automotive Lighting SystemsLtd Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Changzhou Xingyu Automotive Lighting SystemsLtd insiders own a meaningful share of the business. Actually, with 48% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. at the current share price. This is an incredible endorsement from them.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Changzhou Xingyu Automotive Lighting SystemsLtd with market caps between CN¥29b and CN¥86b is about CN¥1.8m.

Changzhou Xingyu Automotive Lighting SystemsLtd offered total compensation worth CN¥1.1m to its CEO in the year to December 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Changzhou Xingyu Automotive Lighting SystemsLtd Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Changzhou Xingyu Automotive Lighting SystemsLtd's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. The overarching message here is that Changzhou Xingyu Automotive Lighting SystemsLtd has underlying strengths that make it worth a look at. Of course, just because Changzhou Xingyu Automotive Lighting SystemsLtd is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.