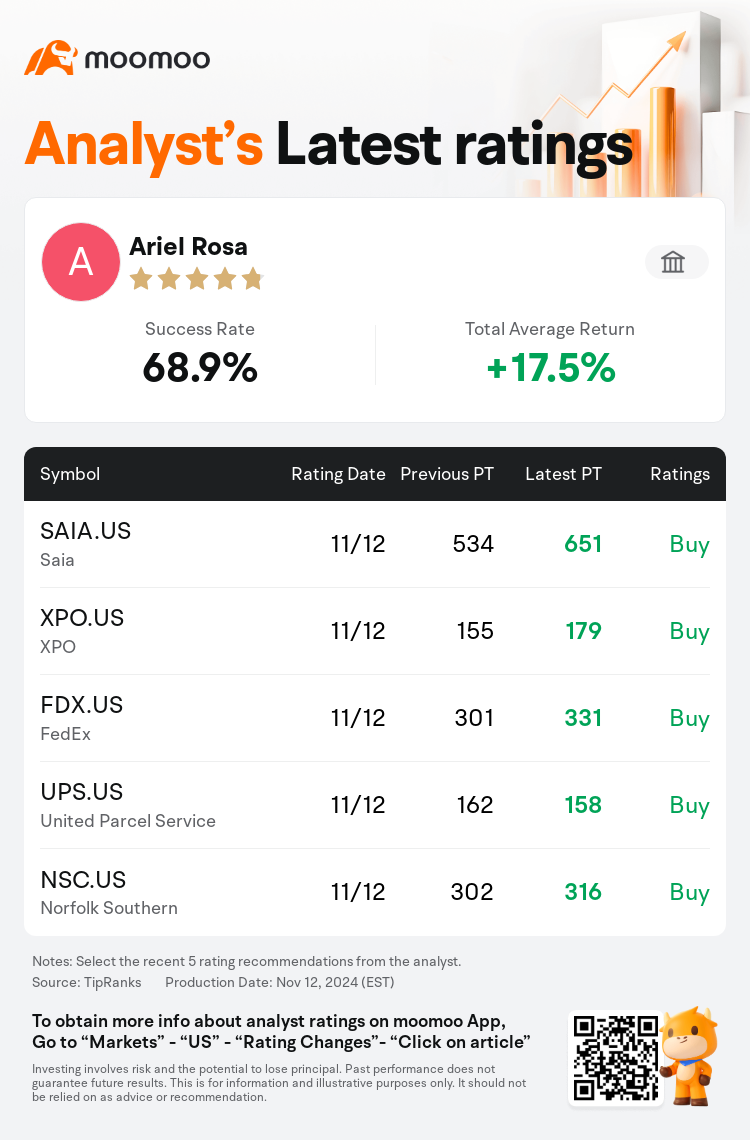

Citi analyst Ariel Rosa maintains $XPO (XPO.US)$ with a buy rating, and adjusts the target price from $155 to $179.

According to TipRanks data, the analyst has a success rate of 68.9% and a total average return of 17.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $XPO (XPO.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $XPO (XPO.US)$'s main analysts recently are as follows:

The firm's analysis indicates a significantly higher potential for earnings growth through 2026, bolstered by market enthusiasm for future prospects that extend past the current downturn. The analysis further implies that the less than truckload sector has considerable volume potential, which is anticipated to be driven by share gains in addition to demand recovery.

Sentiment for North American transport stocks seems to have 'rapidly improved,' despite a mixture of third-quarter earnings and generally cautious fourth-quarter forecasts. There is concern that investors may be pursuing stocks that have already experienced significant increases, with the expectation that companies will need to greatly exceed estimates to justify their current market values. Additionally, there is an increased possibility that earnings for 2025 might not meet expectations.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

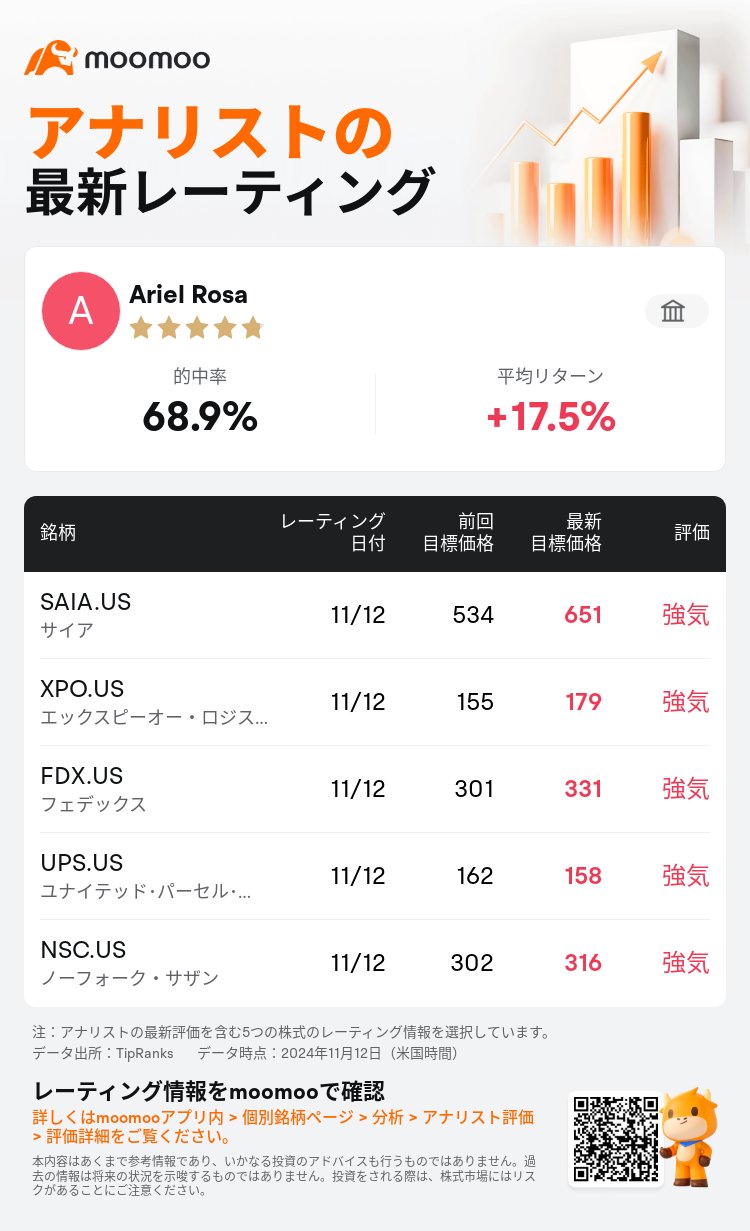

シティグループのアナリストAriel Rosaは$エックスピーオー・ロジスティックス (XPO.US)$のレーティングを強気に据え置き、目標株価を155ドルから179ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は68.9%、平均リターンは17.5%である。

また、$エックスピーオー・ロジスティックス (XPO.US)$の最近の主なアナリストの観点は以下の通りである:

また、$エックスピーオー・ロジスティックス (XPO.US)$の最近の主なアナリストの観点は以下の通りである:

同社の分析によると、現在の景気後退を乗り越えた将来の見通しに対する市場の熱意に支えられて、2026年までの収益成長の可能性は大幅に高まっています。分析はさらに、トラック積載量未満のセクターにはかなりの量の可能性があることを示唆しています。これは、需要の回復に加えて株式の上昇によって牽引されると予想されます。

北米の運輸株に対するセンチメントは、第3四半期の収益と概ね慎重な第4四半期の予測が混在しているにもかかわらず、「急速に改善」したようです。投資家は、企業が現在の市場価値を正当化するために予想を大幅に上回る必要があることを期待して、すでに大幅に上昇している株を追い求めているのではないかという懸念があります。さらに、2025年の収益が期待に応えられない可能性が高まっています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$エックスピーオー・ロジスティックス (XPO.US)$の最近の主なアナリストの観点は以下の通りである:

また、$エックスピーオー・ロジスティックス (XPO.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of