During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

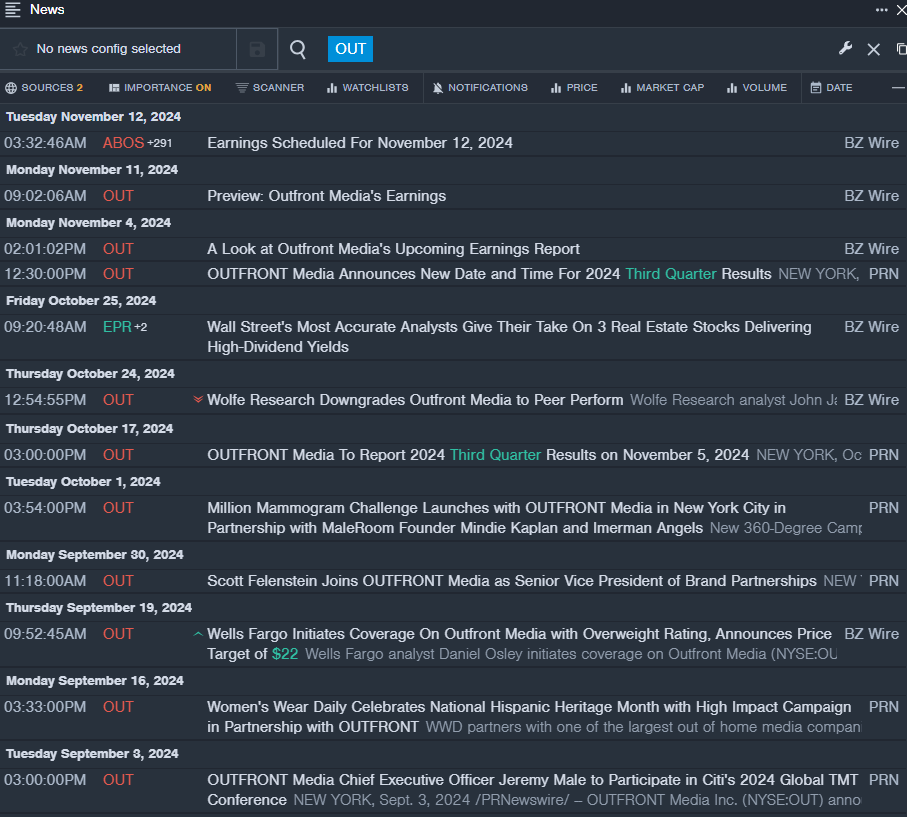

OUTFRONT Media Inc. (NYSE:OUT)

- Dividend Yield: 6.65%

- Barrington Research analyst James Goss maintained an Outperform rating and raised the price target from $17 to $18 on Aug. 13. This analyst has an accuracy rate of 66%.

- TD Cowen analyst Lance Vitanza initiated coverage on the stock with a Hold rating and a price target of $16 on July 16. This analyst has an accuracy rate of 80%.

- Recent News: On Sept. 30, Scott Felenstein joined OUTFRONT Media as Senior Vice President of Brand Partnerships.

- Benzinga Pro's real-time newsfeed alerted to latest OUT news

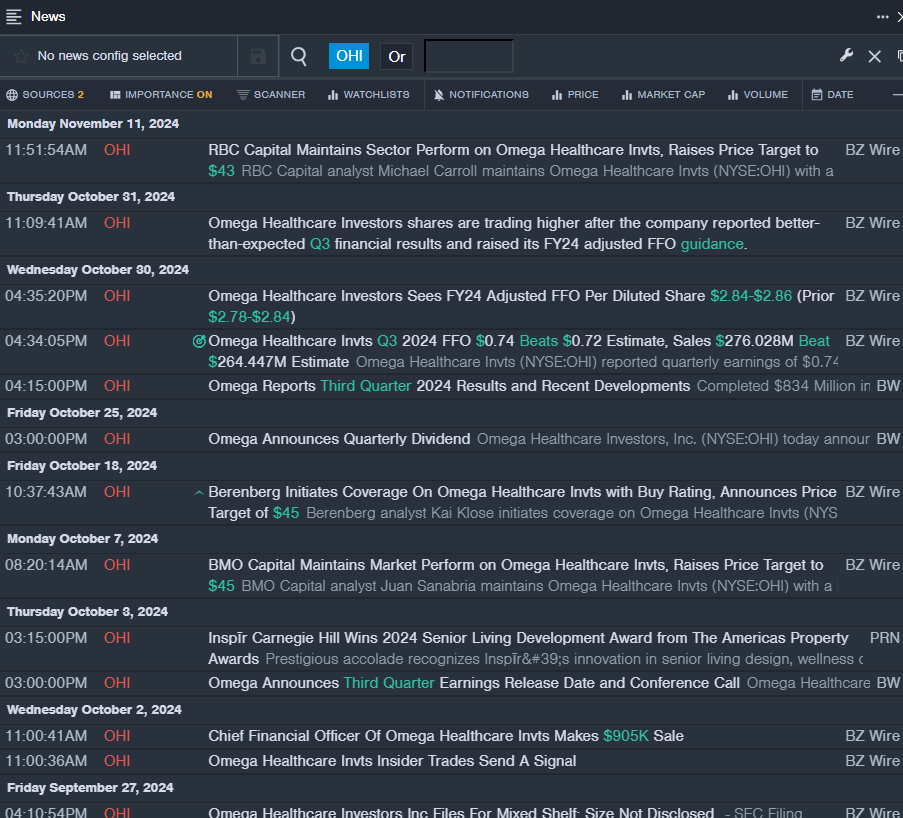

Omega Healthcare Investors, Inc. (NYSE:OHI)

- Dividend Yield: 6.47%

- RBC Capital analyst Michael Carroll maintained a Sector Perform rating and raised the price target from $39 to $43 on Nov. 11. This analyst has an accuracy rate of 61%.

- Wells Fargo analyst Connor Siversky assumed coverage on the stock with an Overweight rating and raised the price target from $40 to $43 on Oct. 1. This analyst has an accuracy rate of 66%.

- Recent News: On Oct. 30, Omega Healthcare Investors reported better-than-expected third-quarter financial results.

- Benzinga Pro's real-time newsfeed alerted to latest OHI news.

RLJ Lodging Trust (NYSE:RLJ)

- Dividend Yield: 6.12%

- Truist Securities analyst Gregory Miller maintained a Buy rating and cut the price target from $14 to $11 on Oct. 28. This analyst has an accuracy rate of 68%.

- Wolfe Research analyst Keegan Carl downgraded the stock from Outperform to Peer Perform on Sept. 26. This analyst has an accuracy rate of 67%.

- Recent News: On Nov. 6, RLJ Lodging posted better-than-expected quarterly sales.

- Benzinga Pro's charting tool helped identify the trend in RLJ stock.

Read More:

Read More:

- Jim Cramer: This Tech Stock Can 'Go To 160,' Recommends Buying Domino's Pizza