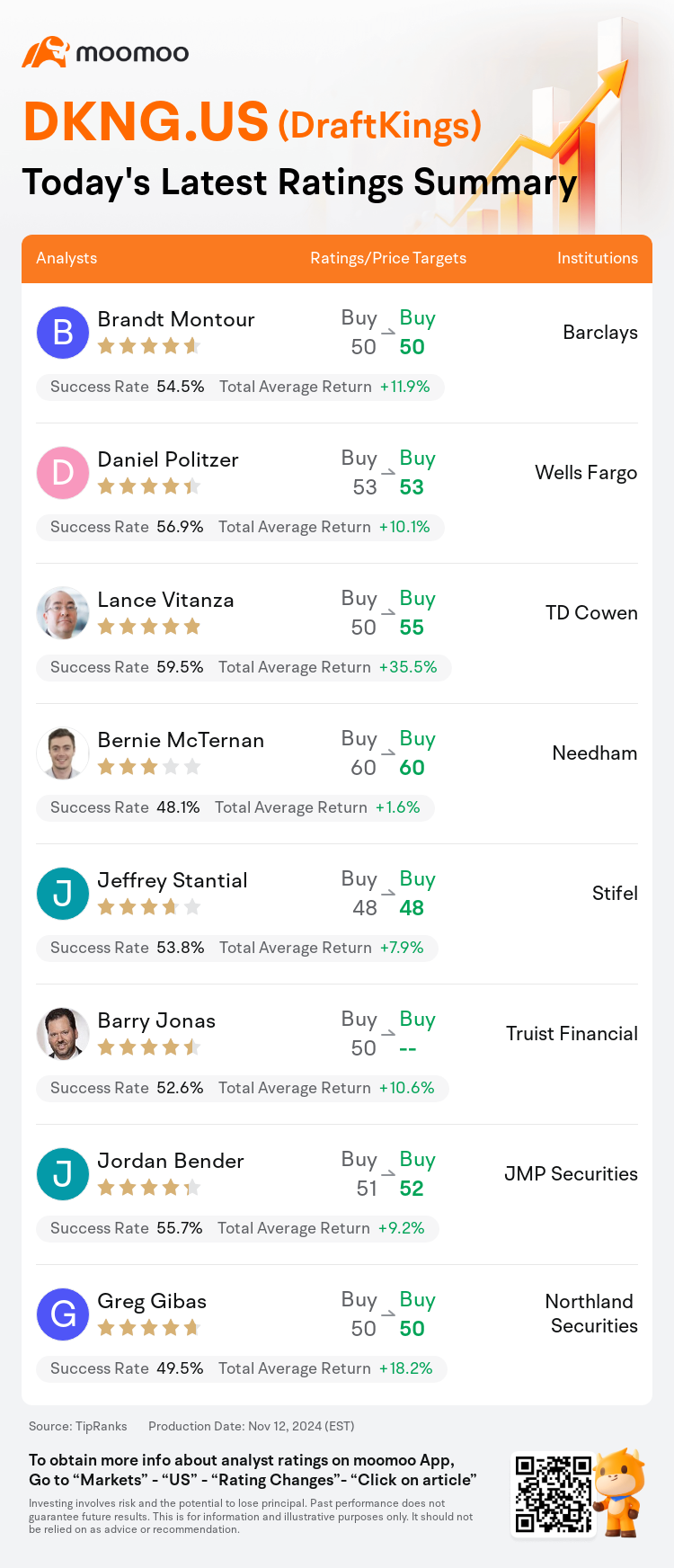

On Nov 12, major Wall Street analysts update their ratings for $DraftKings (DKNG.US)$, with price targets ranging from $48 to $60.

Barclays analyst Brandt Montour maintains with a buy rating, and maintains the target price at $50.

Wells Fargo analyst Daniel Politzer maintains with a buy rating, and maintains the target price at $53.

TD Cowen analyst Lance Vitanza maintains with a buy rating, and adjusts the target price from $50 to $55.

TD Cowen analyst Lance Vitanza maintains with a buy rating, and adjusts the target price from $50 to $55.

Needham analyst Bernie McTernan maintains with a buy rating, and maintains the target price at $60.

Stifel analyst Jeffrey Stantial maintains with a buy rating, and maintains the target price at $48.

Furthermore, according to the comprehensive report, the opinions of $DraftKings (DKNG.US)$'s main analysts recently are as follows:

The company's guidance for Q4 and the year 2025 is seen as conservative. Additionally, the underlying structural hold tailwinds are still present.

DraftKings announced third-quarter revenues that were slightly less than the general market expectations, in conjunction with adjusted EBITDA that surpassed the consensus. The company has moderated its 2024 forecast due to outcomes in the early fourth quarter that were favorable to customers, yet it has maintained its 2025 adjusted EBTDA forecast. Additionally, management has indicated that there are multiple factors which could positively influence the company's projections for 2025.

The firm acknowledges improvements in the company's disclosures but expresses concerns regarding the clarity of its guidance. It suggests that the current stock valuation reflects an expectation of near-flawless performance by the year 2025.

Revenue growth was described as robust despite being slightly below forecasts, with a substantial year-over-year rise in active customers and a reduction in Customer Acquisition Cost, contributing to an improved EBITDA margin.

DraftKings' narrower losses in Q3 were a result of robust player acquisition and retention, expansion into new jurisdictions, and the integration of Jackpocket. It's believed that DraftKings stands out as one of the most attractive opportunities among high-growth entities.

Here are the latest investment ratings and price targets for $DraftKings (DKNG.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

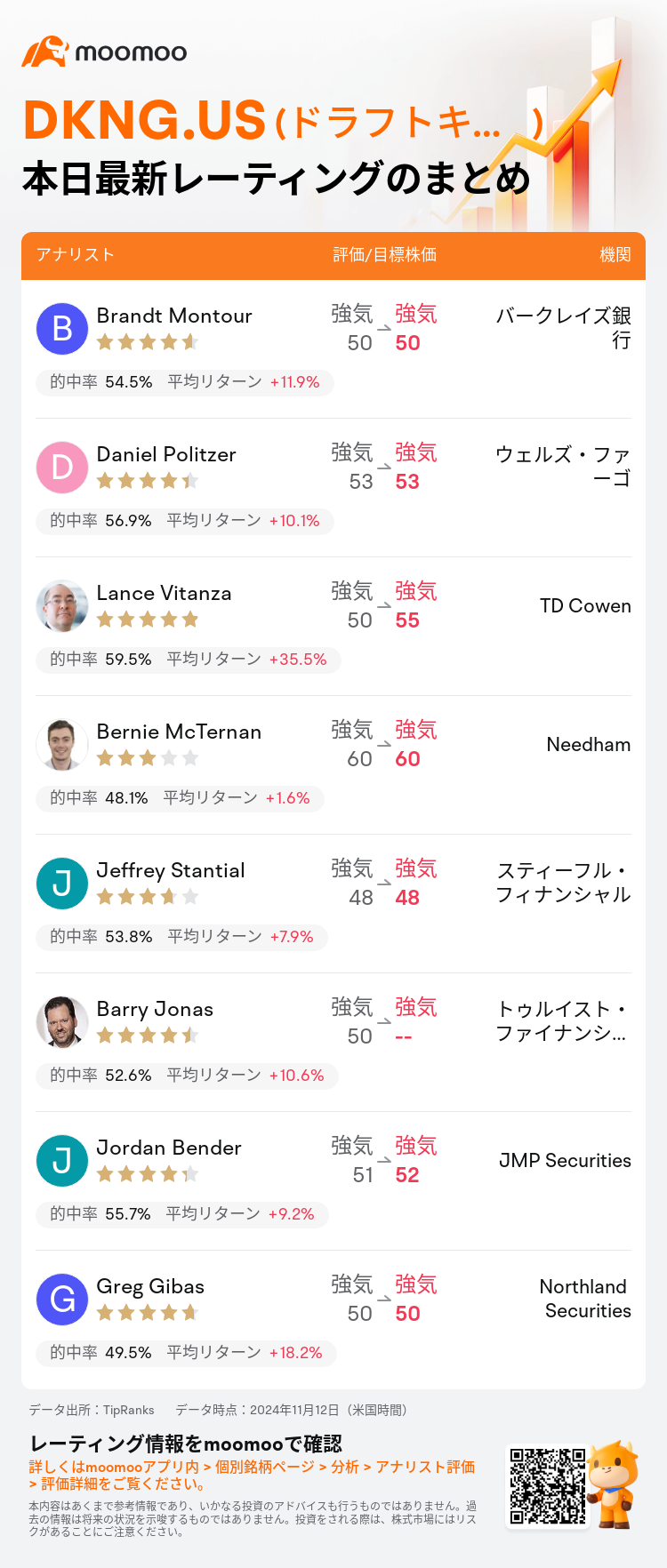

11月12日(米国時間)、ウォール街主要機関のアナリストが$ドラフトキングス (DKNG.US)$のレーティングを更新し、目標株価は48ドルから60ドル。

バークレイズ銀行のアナリストBrandt Montourはレーティングを強気に据え置き、目標株価を50ドルに据え置いた。

ウェルズ・ファーゴのアナリストDaniel Politzerはレーティングを強気に据え置き、目標株価を53ドルに据え置いた。

TD CowenのアナリストLance Vitanzaはレーティングを強気に据え置き、目標株価を50ドルから55ドルに引き上げた。

TD CowenのアナリストLance Vitanzaはレーティングを強気に据え置き、目標株価を50ドルから55ドルに引き上げた。

NeedhamのアナリストBernie McTernanはレーティングを強気に据え置き、目標株価を60ドルに据え置いた。

スティーフル・フィナンシャルのアナリストJeffrey Stantialはレーティングを強気に据え置き、目標株価を48ドルに据え置いた。

また、$ドラフトキングス (DKNG.US)$の最近の主なアナリストの観点は以下の通りである:

第4四半期および2025年の会社のガイダンスは慎重とされています。さらに、基盤となる構造的な中立風はまだ存在しています。

ドラフトキングスは、一般的な市場の期待よりもわずかに低い第三四半期の売上高を発表し、調整後のEBITDAは合意を上回りました。早期の第四半期の結果が顧客にとって好都合であったため、会社は2024年の予測を調整しましたが、2025年の調整後EBTDAの予測は維持しています。さらに、経営陣は2025年の会社の予測にポジティブな影響を与える複数の要因があることを示しています。

企業は、企業の開示の改善を認めつつ、ガイダンスの明確さについて懸念を表明しています。現在の株式評価が2025年までのほぼ完璧なパフォーマンスを期待していると指摘しています。

売上高成長は、予測よりもわずかに低いものの、活発な顧客数と顧客獲得コストの削減が大幅な年次増に貢献し、改善されたEBITDAマージンをもたらしました。

第3四半期のドラフトキングスの狭まった損失は、堅調なプレイヤーの獲得と定着、新しい管轄区への拡大、Jackpocketの統合の結果でした。ドラフトキングスは、高成長企業の中で最も魅力的な機会の1つとして際立っていると考えられています。

以下の表は今日8名アナリストの$ドラフトキングス (DKNG.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

TD CowenのアナリストLance Vitanzaはレーティングを強気に据え置き、目標株価を50ドルから55ドルに引き上げた。

TD CowenのアナリストLance Vitanzaはレーティングを強気に据え置き、目標株価を50ドルから55ドルに引き上げた。

TD Cowen analyst Lance Vitanza maintains with a buy rating, and adjusts the target price from $50 to $55.

TD Cowen analyst Lance Vitanza maintains with a buy rating, and adjusts the target price from $50 to $55.