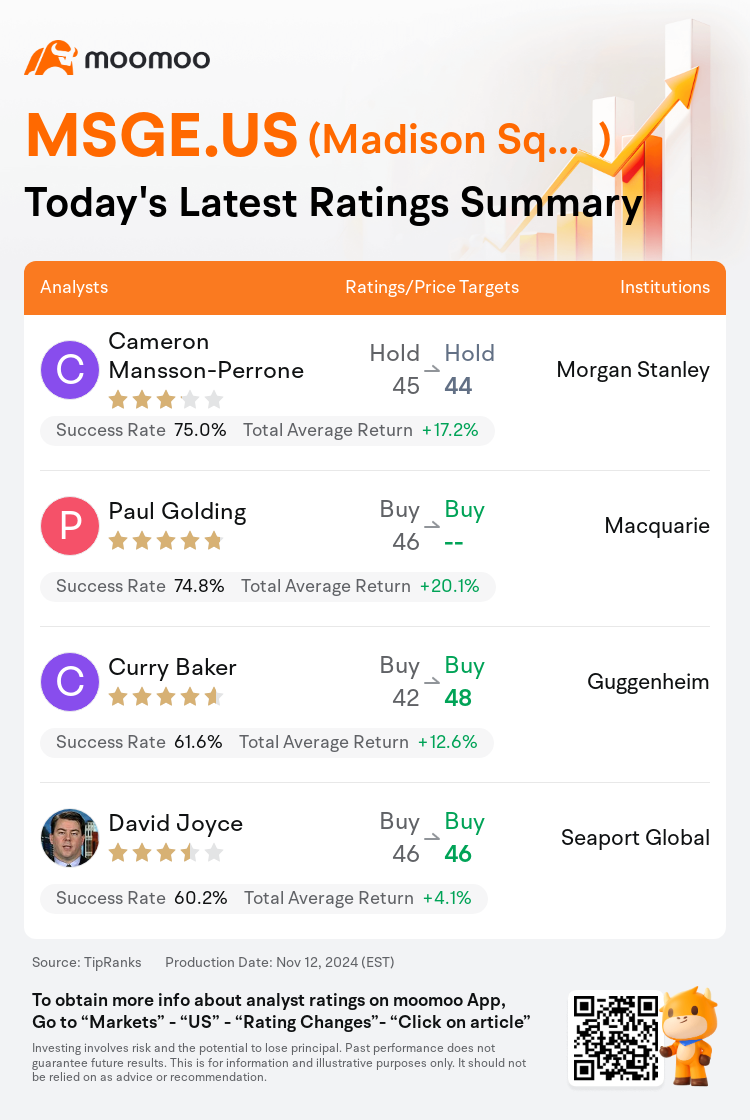

On Nov 12, major Wall Street analysts update their ratings for $Madison Square Garden Entertainment (MSGE.US)$, with price targets ranging from $44 to $48.

Morgan Stanley analyst Cameron Mansson-Perrone maintains with a hold rating, and adjusts the target price from $45 to $44.

Macquarie analyst Paul Golding maintains with a buy rating.

Guggenheim analyst Curry Baker maintains with a buy rating, and adjusts the target price from $42 to $48.

Guggenheim analyst Curry Baker maintains with a buy rating, and adjusts the target price from $42 to $48.

Seaport Global analyst David Joyce maintains with a buy rating, and maintains the target price at $46.

Furthermore, according to the comprehensive report, the opinions of $Madison Square Garden Entertainment (MSGE.US)$'s main analysts recently are as follows:

Consumer health remains 'solid' and shares should benefit if the second half concert calendar firms up. However, estimates have been lowered after the company revised its FY25 guidance downwards, attributing the change to slower concert bookings and the additional costs related to internalizing sponsorship sales.

MSG Entertainment's Q1 revenue fell short in the concert segment due to challenging comparisons, yet the quarter's earnings surpassed expectations due to improved operating expenses. It was observed that recent cancellations have occurred either due to subdued interest in certain shows or acts, or as a result of artist injuries or illnesses.

Here are the latest investment ratings and price targets for $Madison Square Garden Entertainment (MSGE.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

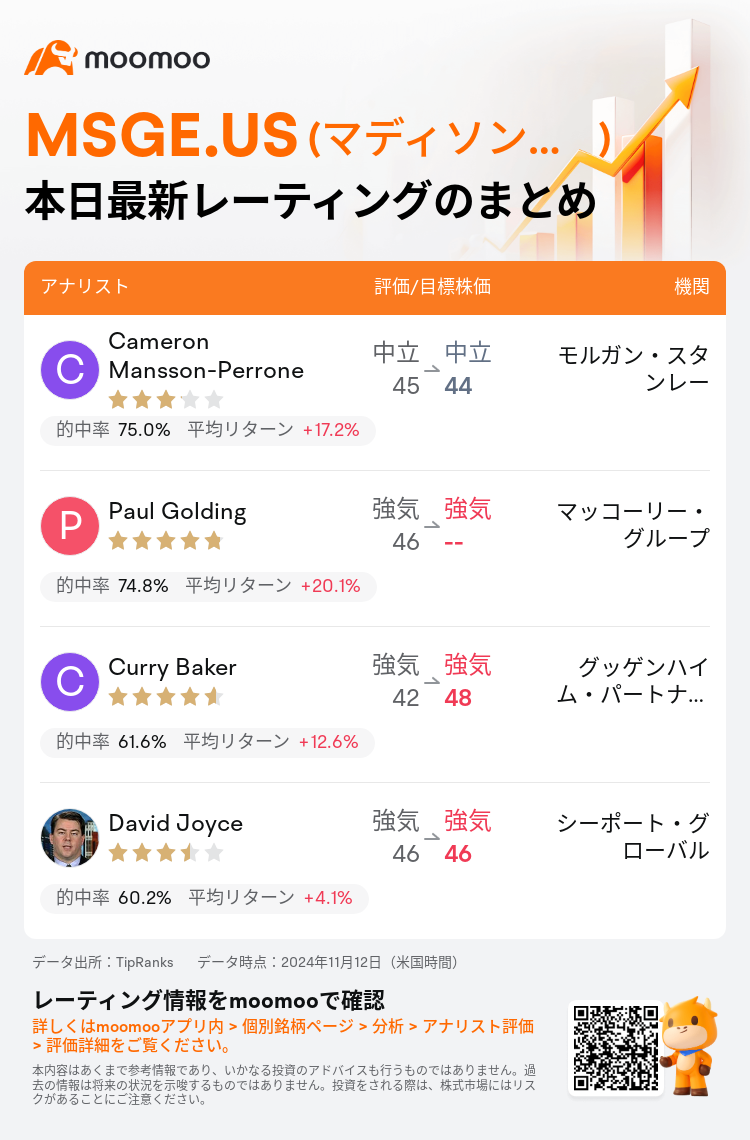

11月12日(米国時間)、ウォール街主要機関のアナリストが$マディソン・スクエア・ガーデン・エンタート (MSGE.US)$のレーティングを更新し、目標株価は44ドルから48ドル。

モルガン・スタンレーのアナリストCameron Mansson-Perroneはレーティングを中立に据え置き、目標株価を45ドルから44ドルに引き下げた。

マッコーリー・グループのアナリストPaul Goldingはレーティングを強気に据え置き。

グッゲンハイム・パートナーズのアナリストCurry Bakerはレーティングを強気に据え置き、目標株価を42ドルから48ドルに引き上げた。

グッゲンハイム・パートナーズのアナリストCurry Bakerはレーティングを強気に据え置き、目標株価を42ドルから48ドルに引き上げた。

シーポート・グローバルのアナリストDavid Joyceはレーティングを強気に据え置き、目標株価を46ドルに据え置いた。

また、$マディソン・スクエア・ガーデン・エンタート (MSGE.US)$の最近の主なアナリストの観点は以下の通りである:

消費関連の健康状態は引き続き「安定的」であり、後半のコンサートカレンダーが安定すれば株価に恩恵があります。ただし、同社が2025会計年度の見通しを下方修正した後、見積もりを引き下げたことが報告され、この変更はコンサートの予約が遅れたことやスポンサーセールスの内部化に伴う追加費用が原因とされています。

MSGエンターテイメントの第1四半期売上高はコンサート部門で不調であり、厳しい比較のため期待を下回りましたが、営業費用が改善されたため、四半期の収益は期待を上回りました。最近のキャンセルは、特定のショーまたはアクトへの興味の低下、アーティストの負傷や病気によるものであるか、あるいはその結果であることが観察されました。

以下の表は今日4名アナリストの$マディソン・スクエア・ガーデン・エンタート (MSGE.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

グッゲンハイム・パートナーズのアナリストCurry Bakerはレーティングを強気に据え置き、目標株価を42ドルから48ドルに引き上げた。

グッゲンハイム・パートナーズのアナリストCurry Bakerはレーティングを強気に据え置き、目標株価を42ドルから48ドルに引き上げた。

Guggenheim analyst Curry Baker maintains with a buy rating, and adjusts the target price from $42 to $48.

Guggenheim analyst Curry Baker maintains with a buy rating, and adjusts the target price from $42 to $48.