Downgrade: Here's How Analysts See Olaplex Holdings, Inc. (NASDAQ:OLPX) Performing In The Near Term

Downgrade: Here's How Analysts See Olaplex Holdings, Inc. (NASDAQ:OLPX) Performing In The Near Term

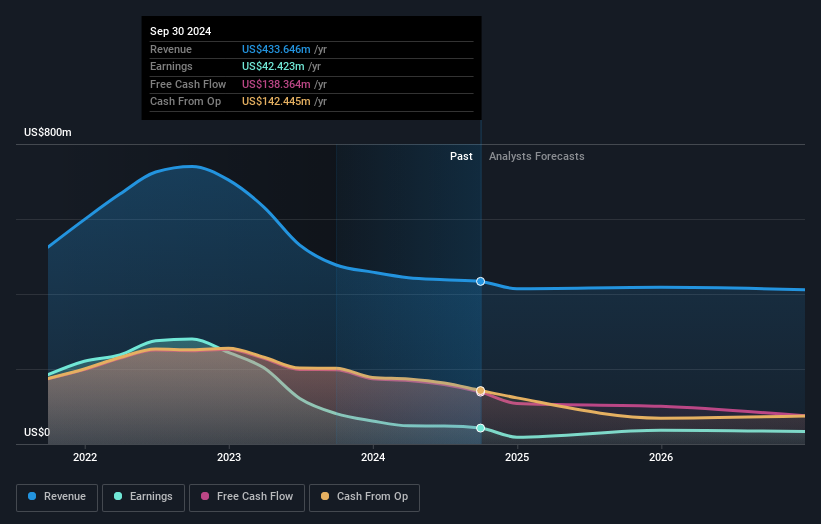

One thing we could say about the analysts on Olaplex Holdings, Inc. (NASDAQ:OLPX) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

關於Olaplex Holdings,Inc.(納斯達克:OLPX)的分析師,我們可以說一件事情-他們並不樂觀,剛剛對該機構的近期(法定)預測進行了重大的負面修訂。營業收入和每股收益(EPS)預測都被下調,分析師們看到地平線上的灰雲。

Following the latest downgrade, the current consensus, from the ten analysts covering Olaplex Holdings, is for revenues of US$418m in 2025, which would reflect a noticeable 3.7% reduction in Olaplex Holdings' sales over the past 12 months. Statutory earnings per share are anticipated to crater 25% to US$0.048 in the same period. Previously, the analysts had been modelling revenues of US$475m and earnings per share (EPS) of US$0.099 in 2025. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a large cut to earnings per share numbers as well.

在最新的下調之後,涵蓋Olaplex Holdings的十位分析師的當前共識是,2025年營業額爲41800萬美元,這將反映出Olaplex Holdings過去12個月銷售額明顯減少了3.7%。法定每股收益預計在同一時期將大幅下滑25%,至0.048美元。此前,分析師們曾在2025年對營業額和每股收益(EPS)進行了美元47500萬和0.099美元的建模。看起來分析師情緒已大幅下滑,營收預測大幅下調,每股收益數字也受到了大幅削減。

It'll come as no surprise then, to learn that the analysts have cut their price target 10% to US$2.29.

那麼,毫不奇怪,分析師們把其價格目標下調了10%,至2.29美元。

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 3.0% by the end of 2025. This indicates a significant reduction from annual growth of 7.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 4.9% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Olaplex Holdings is expected to lag the wider industry.

當然,觀察這些預測的另一種方式是將它們放入行業背景中進行對比。這些估計意味着銷售預計將放緩,在2025年底之前預計年化銷售額將下降3.0%。這表明相比於過去五年的年增長7.7%,預計其銷售將出現顯著減少。相比之下,我們的數據顯示,同一行業中其他(有分析師覆蓋的)公司預計未來可預見的未來每年實現4.9%的營收增長。因此,儘管其營收預計會減少,但這片烏雲並沒有銀邊-預計Olaplex Holdings將落後於更廣泛的行業。

The Bottom Line

最重要的事情是分析師增加了它對下一年每股虧損的估計。令人欣慰的是,營收預測未發生重大變化,業務仍有望比整個行業增長更快。共識價格目標穩定在28.50美元,最新估計不足以對價格目標產生影響。

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Olaplex Holdings. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Olaplex Holdings' revenues are expected to grow slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Olaplex Holdings.

新估算中最大的問題是,分析師已經降低了每股收益的預期,表明Olaplex Holdings可能會面臨業務上的風險。不幸的是,分析師也下調了他們對營業收入的預估,而行業數據顯示,Olaplex Holdings的營業收入增長速度預計將慢於整個市場。在分析師情緒發生如此明顯變化之後,如果讀者對Olaplex Holdings感到有些戒心,我們可以理解。

Uncomfortably, our automated valuation tool also suggests that Olaplex Holdings stock could be overvalued following the downgrade. Shareholders could be left disappointed if these estimates play out. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

令人不安的是,我們的自動估值工具也表明,Olaplex Holdings的股票在下調之後可能被高估。如果這些預估結果成真,股東可能會感到失望。歡迎訪問我們的免費平台了解更多關於我們估值方法的信息,了解原因,並審視支撐我們估值的假設。

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

跟蹤管理層是購買還是銷售,是尋找可能達到關鍵點的有趣公司的另一種方法,我們的免費公司列表由內部支持的增長公司組成。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 3.0% by the end of 2025. This indicates a significant reduction from annual growth of 7.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 4.9% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Olaplex Holdings is expected to lag the wider industry.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 3.0% by the end of 2025. This indicates a significant reduction from annual growth of 7.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 4.9% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Olaplex Holdings is expected to lag the wider industry.