After chip stocks were sold off, Citi said it was almost time to buy chip stocks again.

The Zhitong Finance App learned that a research team from Wall Street firm Citi said in a report on Tuesday that after the start of the third quarter earnings season, despite the strong performance of a small number of chip stocks such as TSM.US (TSM.US) and Nvidia (NVDA.US), which have fully benefited from the AI boom, the entire US chip sector experienced a wave of exaggerated sell-offs because demand for non-AI is still sluggish. According to the Citigroup research team now, it is almost time for market capital to buy chip stocks on dips. This also means that chip stocks, one of the core driving forces that have led US stocks into a bull market since 2023, are expected to regain the popularity of global capital after being sold off during the earnings season, and may once again launch a “crazy cow” super market and become the C position in the US stock market.

A team led by Citigroup analyst Christopher Danley wrote in a report to clients: “During the chip company earnings season, consensus expectations fell by about 11%, and the Philadelphia Semiconductor Index fell sharply by nearly 10%. The main reason was that demand for analog chips and microchips was still weak, which in turn caused stocks such as Microchip Technology (MCHP.US), NXP Semiconductors (NXPI.US), and Intel (INTC.US) to drop sharply.”

“However, we think this irrational downward/sharp sell-off is almost over, and people's attention will gradually turn to 2025. We expect overall sales in the global semiconductor market to increase by about 9% year on year in 2025, and we expect to increase 17% year over year in 2024 from last year's relative weakness.” Citi added in the above report.

“However, we think this irrational downward/sharp sell-off is almost over, and people's attention will gradually turn to 2025. We expect overall sales in the global semiconductor market to increase by about 9% year on year in 2025, and we expect to increase 17% year over year in 2024 from last year's relative weakness.” Citi added in the above report.

Citigroup's research team led by Christopher Danley said that the long-term downward trend in demand for chips in industrial terminals, which is currently the weakest in the chip segment, should “disappear soon,” and it is expected that the adjustment of chip inventory in the automotive market, another market that has been weak for a long time, should end in the first half of 2025.

“In contrast, the chip market, which includes segments such as PCs, smartphones, and data center servers, that is, demand in the chip market continues to show 'steady growth'. Investors should now establish stock positions in the chip industry and 'shift to more aggressive allocation exposure' in the first quarter of 2025. Part of the logic is that hyperscale technology companies such as Amazon, Google, and Microsoft collectively spend huge amounts on artificial intelligence.” The Citigroup research team added.

In this research report, the Citigroup research team continued to insist on the investment institution's “buy” ratings for AMD (AMD.US), ADI.US (ADI.US), Broadcom (AVGO.US), Micron Technology (MCHP.US), Texas Instruments (TXN.US), Nvidia (NVDA.US), and Kelley (KLAC.US).

AI chips and memory chips support the semiconductor market's “half of the sky”

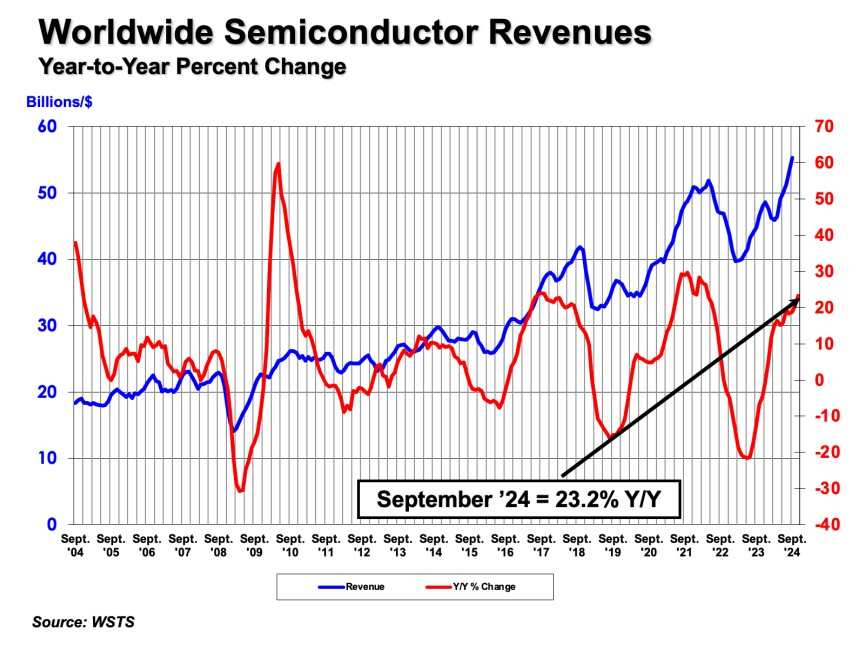

The current demand for AI chips and memory chips for data center servers is very strong, and this will probably be the case for a long time to come. According to the latest statistics recently released by the Semiconductor Industry Association (SIA), driven by strong demand for data center server AI chips such as Nvidia's H100/H200, global semiconductor market sales reached 166 billion US dollars in the third quarter of 2024, up 23.2% year-on-year compared to the third quarter of 2023, and 10.7% month-on-month compared to already strong sales in the second quarter of 2024. Global semiconductor market sales in September 2024 were approximately $55.3 billion in a single month, up 4.1% from the semiconductor market sales of $53.1 billion in August 2024.

As for the semiconductor market demand outlook for 2025, according to Gartner's latest forecast, the global semiconductor market will reach overall sales of approximately $717 billion in 2025, an increase of 14% over 2024. This growth was mainly driven by a recovery in demand for AI-related semiconductors in data centers and consumer electronics products incorporating end-side AI. Gartner predicts that sales in the global semiconductor market may reach 630 billion dollars this year, which means a significant increase of 18.8% over the previous year. Gartner predicts that the memory chip market will perform the strongest in 2025. It is expected to grow by 20.5%, and sales are expected to reach 196.3 billion dollars. Among them, enterprise-grade NAND flash memory and DRAM will be the main driving force.

According to the semiconductor industry outlook data released by the World Semiconductor Trade Statistics Organization (WSTS) in spring, it is expected that the global semiconductor market will show a very strong recovery trend in 2024, and WSTS's forecast for the 2024 global semiconductor market sales volume will rise sharply compared to the forecast report for the end of 2023. For 2024, WSTS predicts a market size of 611 billion dollars, which means a sharp increase of 16% compared to the previous year. This is also a significant upward revision of the forecast for the end of 2023.

Looking ahead to 2025, WSTS predicts that the sales volume of the global semiconductor market is expected to reach 687 billion US dollars, which means that the global semiconductor market is expected to grow by about 12.5% on top of the already strong recovery trend in 2024. WSTS expects this growth to be driven mainly by the memory chip category and the artificial intelligence logic category. The overall scale of these two categories is expected to soar to more than $200 billion in 2025, fueled by the AI boom. Compared with the previous year, WSTS expects the total sales growth rate of the memory chip category dominated by DRAM and NAND to exceed 25% in 2025, and the total sales growth rate of the logic chip category including CPU and GPU is expected to exceed 10%. At the same time, it also expects the growth rate of all other market segments such as discrete devices, optoelectronics, sensors, and analog semiconductors to reach single digits.

WSTS predicts that the analog chip market, which accounts for an important share of the chips required for electric vehicles (EVs) and the industrial side, is still sluggish. The market size is expected to shrink by 2.7% in 2024, but WSTS predicts that the overall size of the analog chip market is expected to expand 6.7% in 2025, which means that the analog chip recovery process may slowly start in 2025 next year. Analog chips play an essential role in various key functional modules and systems of electric vehicles, including power management, battery management, sensor interface, audio and video processing, and motor core control systems.

“然而,我们认为这种非理性地下跌/剧烈抛售几乎结束,人们的注意力逐渐将转向2025年。我们预计2025年全球半导体市场的整体销售额将同比增长约9%,预计2024年有望在去年相对疲软的基础上同比增长17%。”花旗在上述报告中补充表示。

“然而,我们认为这种非理性地下跌/剧烈抛售几乎结束,人们的注意力逐渐将转向2025年。我们预计2025年全球半导体市场的整体销售额将同比增长约9%,预计2024年有望在去年相对疲软的基础上同比增长17%。”花旗在上述报告中补充表示。