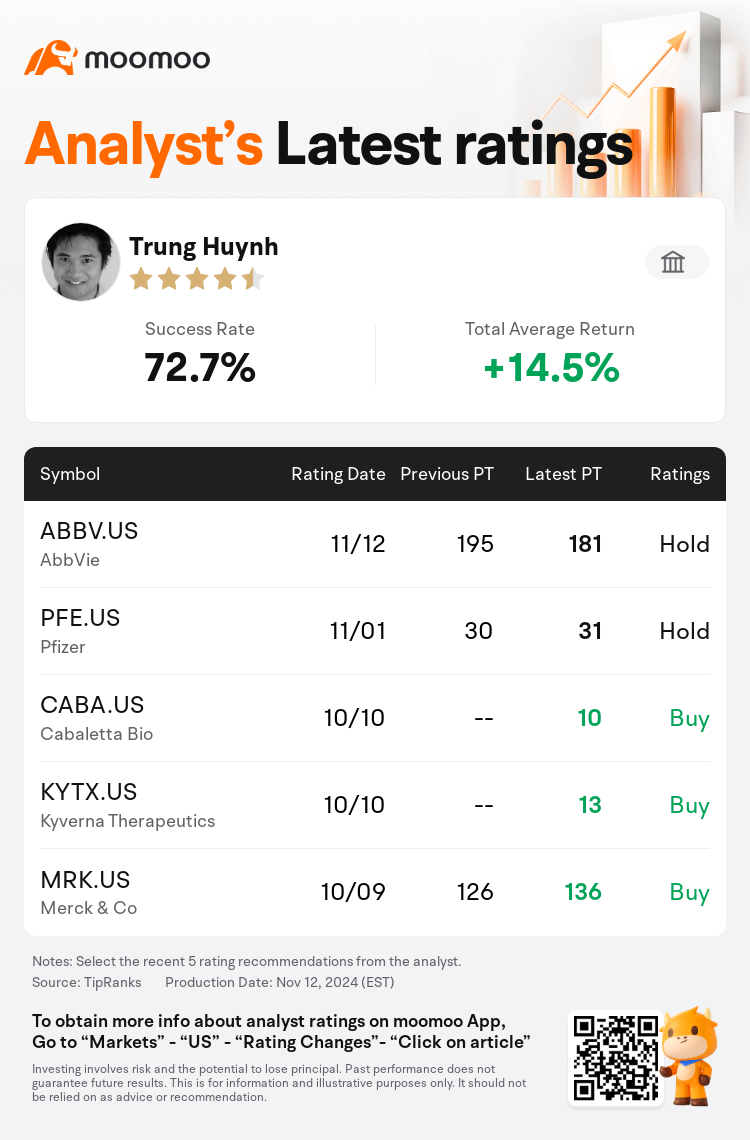

UBS analyst Trung Huynh maintains $AbbVie (ABBV.US)$ with a hold rating, and adjusts the target price from $195 to $181.

According to TipRanks data, the analyst has a success rate of 72.7% and a total average return of 14.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $AbbVie (ABBV.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $AbbVie (ABBV.US)$'s main analysts recently are as follows:

The revision of expectations for AbbVie followed an unexpected update on their Phase 2 study of emraclidine. After removing emraclidine from the projection and adjusting the estimates for Cobenfy for another company, the total anticipated revenue for 2033 has increased by 7%. This alteration, however, is not expected to significantly affect the overall revenue or earnings per share growth trajectory for either company.

The pivotal Phase 2 data for AbbVie's emraclidine did not meet expectations, failing to show a statistically significant change from baseline in the Positive and Negative Symptom Scale total score in studies for schizophrenia. This was a key factor in AbbVie's acquisition of Cerevel, with emraclidine projected to generate substantial sales and compete against Coben. The analyst has since removed emraclidine from their financial model.

The firm acknowledges that the outcomes of the EMPOWER 1 and 2 Emraclidine Phase 2 studies in Schizophrenia, where placebo outperformed both active arms in both trials, have led to the realization that the central value proposition of the significant acquisition is effectively negated.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

瑞士銀行分析師Trung Huynh維持$艾伯維公司 (ABBV.US)$持有評級,並將目標價從195美元下調至181美元。

根據TipRanks數據顯示,該分析師近一年總勝率為72.7%,總平均回報率為14.5%。

此外,綜合報道,$艾伯維公司 (ABBV.US)$近期主要分析師觀點如下:

此外,綜合報道,$艾伯維公司 (ABBV.US)$近期主要分析師觀點如下:

對AbbVie的預期調整是在其對emraclidine的2期研究出人意料地更新之後進行的。在將emraclidine從預測中刪除並調整了另一家公司的Cobenfy的估計值後,2033年的預期總收入增長了7%。但是,預計這種變化不會對兩家公司的整體收入或每股收益的增長軌跡產生重大影響。

AbbVie的emraclidine的關鍵2期數據沒有達到預期,未能顯示精神分裂症研究中陽性和陰性症狀量表總分與基線相比有統計學上的顯著變化。這是艾伯維收購Cerevel的關鍵因素,預計emraclidine將帶來可觀的銷售額並與Coben競爭。此後,該分析師已將emraclidine從其財務模型中刪除。

該公司承認,針對精神分裂症的EMPOWER 1和2 Emraclidine二期研究的結果使人們認識到,此次重大收購的核心價值主張實際上被否定了,安慰劑在這兩項試驗中的表現都超過了兩個活性組。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$艾伯維公司 (ABBV.US)$近期主要分析師觀點如下:

此外,綜合報道,$艾伯維公司 (ABBV.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of