Whales with a lot of money to spend have taken a noticeably bearish stance on MongoDB.

Looking at options history for MongoDB (NASDAQ:MDB) we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $384,622 and 2, calls, for a total amount of $143,050.

From the overall spotted trades, 8 are puts, for a total amount of $384,622 and 2, calls, for a total amount of $143,050.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $210.0 to $300.0 for MongoDB over the recent three months.

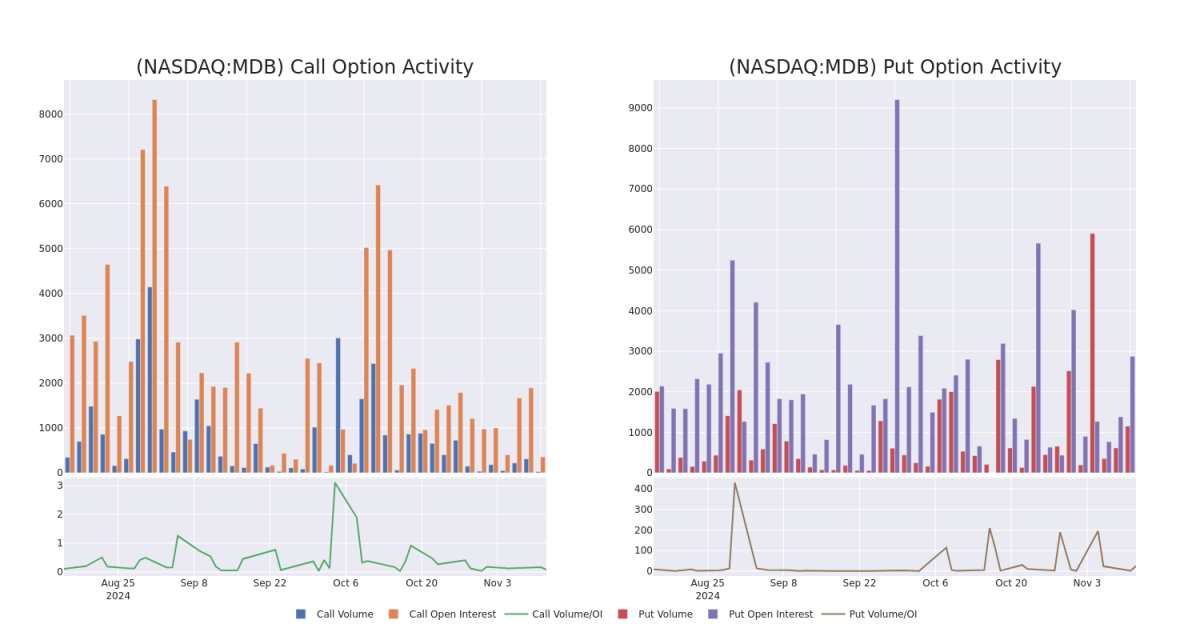

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for MongoDB's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across MongoDB's significant trades, within a strike price range of $210.0 to $300.0, over the past month.

MongoDB 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MDB | CALL | TRADE | BEARISH | 12/20/24 | $48.25 | $46.0 | $46.0 | $260.00 | $115.0K | 341 | 25 |

| MDB | PUT | TRADE | BULLISH | 01/17/25 | $32.7 | $32.35 | $32.35 | $300.00 | $100.2K | 785 | 35 |

| MDB | PUT | SWEEP | BULLISH | 02/21/25 | $21.1 | $21.05 | $21.05 | $270.00 | $71.5K | 32 | 105 |

| MDB | PUT | TRADE | NEUTRAL | 11/15/24 | $1.87 | $1.24 | $1.5 | $280.00 | $45.0K | 1.7K | 303 |

| MDB | PUT | SWEEP | BEARISH | 03/21/25 | $27.2 | $26.5 | $27.2 | $270.00 | $40.8K | 159 | 21 |

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Following our analysis of the options activities associated with MongoDB, we pivot to a closer look at the company's own performance.

Where Is MongoDB Standing Right Now?

- With a trading volume of 610,507, the price of MDB is up by 0.83%, reaching $294.0.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 21 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MongoDB options trades with real-time alerts from Benzinga Pro.