Teyi Pharmaceutical Group Co.,Ltd (SZSE:002728) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

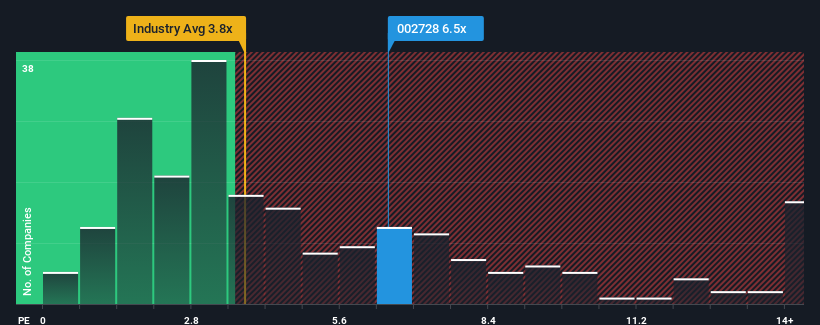

After such a large jump in price, given around half the companies in China's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3.8x, you may consider Teyi Pharmaceutical GroupLtd as a stock to avoid entirely with its 6.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Teyi Pharmaceutical GroupLtd's P/S Mean For Shareholders?

For instance, Teyi Pharmaceutical GroupLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Teyi Pharmaceutical GroupLtd will help you shine a light on its historical performance.How Is Teyi Pharmaceutical GroupLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Teyi Pharmaceutical GroupLtd's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Teyi Pharmaceutical GroupLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.2% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 223% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Teyi Pharmaceutical GroupLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Teyi Pharmaceutical GroupLtd's P/S?

Teyi Pharmaceutical GroupLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Teyi Pharmaceutical GroupLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Teyi Pharmaceutical GroupLtd (of which 1 is a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on Teyi Pharmaceutical GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.