Investors Still Aren't Entirely Convinced By Zhejiang Jiecang Linear Motion Technology Co.,Ltd.'s (SHSE:603583) Earnings Despite 25% Price Jump

Investors Still Aren't Entirely Convinced By Zhejiang Jiecang Linear Motion Technology Co.,Ltd.'s (SHSE:603583) Earnings Despite 25% Price Jump

Zhejiang Jiecang Linear Motion Technology Co.,Ltd. (SHSE:603583) shares have continued their recent momentum with a 25% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 7.9% isn't as attractive.

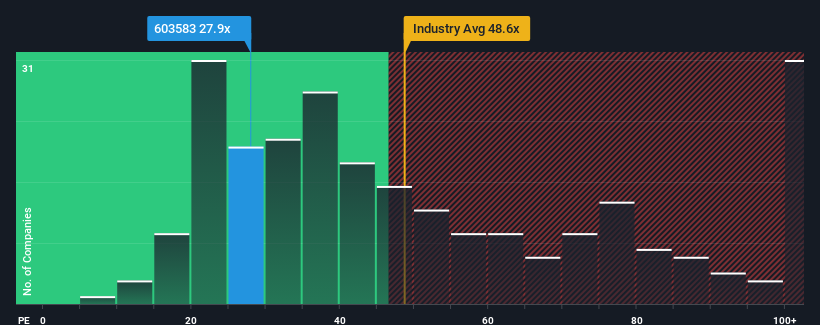

Although its price has surged higher, Zhejiang Jiecang Linear Motion TechnologyLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 27.9x, since almost half of all companies in China have P/E ratios greater than 38x and even P/E's higher than 75x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Zhejiang Jiecang Linear Motion TechnologyLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

Zhejiang Jiecang Linear Motion TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Zhejiang Jiecang Linear Motion TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 37% last year. EPS has also lifted 12% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 47% over the next year. With the market only predicted to deliver 40%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Zhejiang Jiecang Linear Motion TechnologyLtd is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Zhejiang Jiecang Linear Motion TechnologyLtd's P/E?

Despite Zhejiang Jiecang Linear Motion TechnologyLtd's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Zhejiang Jiecang Linear Motion TechnologyLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Zhejiang Jiecang Linear Motion TechnologyLtd that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.