Occidental Petroleum announced financial results for the third quarter.

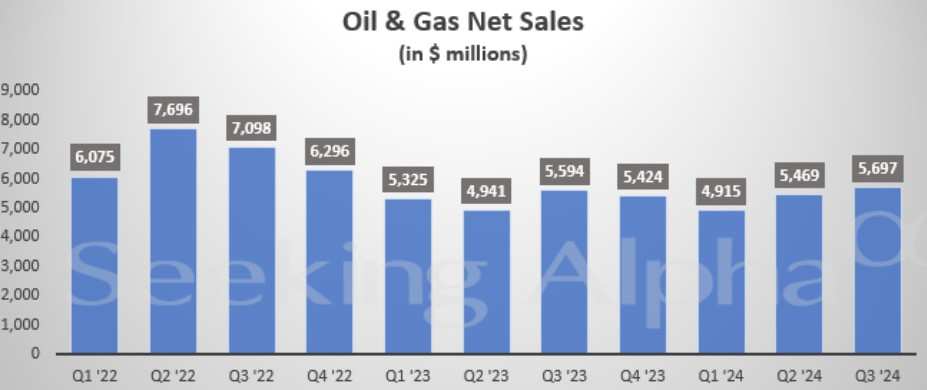

Zhitong Finance learned that the third-quarter profit announced by the US oil and gas company Occidental Petroleum (OXY.US) exceeded Wall Street's expectations, but due to the decline in asset sales and chemical business, the company's total revenue fell 14%. Due to weakening oil and gas prices, the Q3 adjusted profit was 0.977 billion US dollars, or 1 US dollar per share, down from 1.13 billion US dollars and 1.18 US dollars per share in the same period last year. Analysts had anticipated earnings of 74 cents per share, according to data compiled by LSEG. The oil company reported third-quarter revenue up 0.2% year over year to $7.17 billion, slightly higher than the forecast of $7.12 billion.

Occidental Petroleum's quarterly profit includes losses on one-time asset sales and gains from stock sales and derivatives. Occidental Petroleum said its operating profit from oil and gas extraction fell 25% to $1.2 billion due to loss in asset sales. The company lost $0.572 billion in sales. In July of this year, the company sold assets to Permian Resources (PR.US) and an unidentified buyer for a total price of $0.97 billion. Strong operating performance led to operating cash flow of $3.8 billion.

One factor contributing to the year-over-year decline in earnings was that the average price of crude oil fell 6% to $75.33 per barrel, while the average domestic gas price fell 26% to $0.40 per thousand cubic feet. These declines reflect broader market trends affecting global energy prices.

One factor contributing to the year-over-year decline in earnings was that the average price of crude oil fell 6% to $75.33 per barrel, while the average domestic gas price fell 26% to $0.40 per thousand cubic feet. These declines reflect broader market trends affecting global energy prices.

Proceeds from this sale helped reduce the heavy debt burden of buying shale oil and gas producer CrownRock for $12 billion. Long-term debt at the end of the third quarter was $25.46 billion, and $4 billion of debt was reduced through cash and asset sales. Repaying $4 billion of debt meant that Occidental Oil's short-term debt reduction target of nearly 90% was met.

The operating profit of the company's chemicals business fell to $0.304 billion from $0.373 billion a year ago. The midstream business benefited from derivatives and earned $0.49 billion in revenue through the sale of shares of pipeline operator Western Midstream Partners (WES.US).

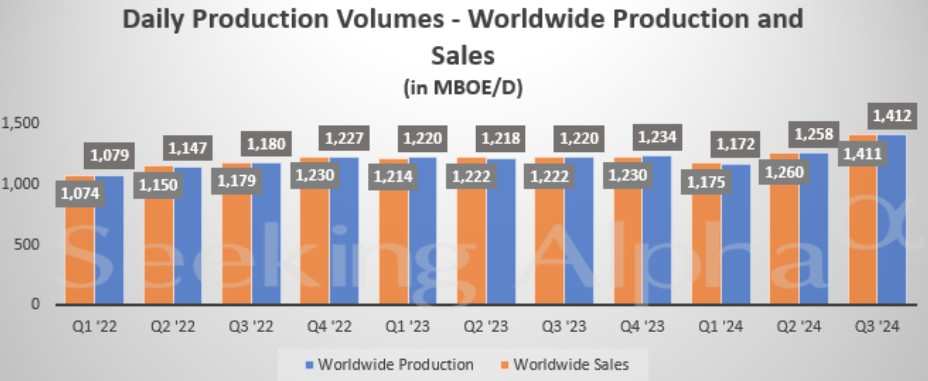

Thanks to the acquisition of CrownRock, Occidental Petroleum increased its oil production by 15.7% to 1.4 million barrels per day. The company said the annual production of the expanded Permian oil field will reach 0.661 million b/d, up from 0.588 million b/d a year ago.

Notably, production in the Permian Basin exceeded expectations of 0.03 million barrels of oil equivalent per day. However, in the Gulf of Mexico, production has dropped significantly due to weather-related disruptions. These differences underscore the importance of geographical diversification.

Rapidly rising production could threaten efforts to contain global warming in the middle of this century. The company's total production is 1.412 million barrels of oil equivalent per day, which is 0.22 million barrels of oil equivalent per day above the guideline midpoint.

Occidental Petroleum has outlined several strategic priorities, highlighting its leadership in sustainability, particularly through carbon management projects. Plans to launch the Stratos direct air capture facility underscore its commitment to environmental initiatives, in line with its long-term renewable energy goals.

Occidental Petroleum remains wary of commodity price fluctuations, which poses a risk to the stability of its earnings. Integrating CrownRock with other assets requires caution. Management is preparing for these challenges and remains cautious but optimistic about capital expenditure and consolidation risks. As a result, Occidental Petroleum intends to maximize its production capacity while increasing the efficiency of its core assets.

导致其收益同比下降的一个因素是,原油平均价格下降了6%,至每桶75.33美元,而国内天然气平均价格下降了26%,至每千立方英尺0.40美元。这些下跌反映了影响全球能源价格的更广泛的市场趋势。

导致其收益同比下降的一个因素是,原油平均价格下降了6%,至每桶75.33美元,而国内天然气平均价格下降了26%,至每千立方英尺0.40美元。这些下跌反映了影响全球能源价格的更广泛的市场趋势。