Traders are increasing their bets on further declines in the usa treasury market, predicting that policies promised by Trump will reignite inflation and keep usa interest rates high.

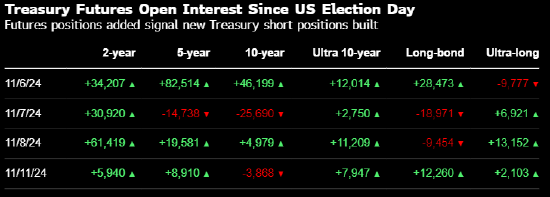

Data released on Tuesday showed that the open contracts on two-year notes rose for the fourth consecutive trading day. This indicates that traders are establishing put positions ahead of the election and before the inflation data is released on Wednesday.

As short-selling bets expand, usa bonds are being sold off, with yields rising over 10 basis points across the board on Tuesday. An indicator of roi for treasury bonds is just 1.4% away from erasing this year's gains.

Citi strategist David Bieber wrote in a report that the market's positioning on the election outcome is correct, but there is generally insufficient short-selling in the treasury market.

Citi strategist David Bieber wrote in a report that the market's positioning on the election outcome is correct, but there is generally insufficient short-selling in the treasury market.

As bond investors and federal reserve observers assess future interest rate trends in the usa, inflation has once again come back into view. Traders expect the likelihood that officials will cut rates by 25 basis points again in December is just slightly above 50%.

Neel Kashkari, president of the Minneapolis Federal Reserve, stated on Tuesday that he will pay attention to the imminent inflation data to determine if another rate cut is appropriate at the December meeting. He said that given the pace of housing inflation is above average, it may take one or two years for inflation to reach the target, although he described the cooling in that area as "encouraging."

Apollo Global Management Co-President Scott Kleinman said the market shouldn't be too complacent about the current inflation and interest rate trajectory in the United States.

花旗策略师David Bieber在报告中写道,这个市场对选举结果的定位是正确的,但在国债市场的空头押注中普遍不足。

花旗策略师David Bieber在报告中写道,这个市场对选举结果的定位是正确的,但在国债市场的空头押注中普遍不足。