2 Reasons to Buy Nvidia Before Nov. 20 and 1 Reason to Wait

2 Reasons to Buy Nvidia Before Nov. 20 and 1 Reason to Wait

Nvidia (NASDAQ: NVDA) has proven to be an excellent investment over the short and long terms. The stock has soared 2,700% in five years and so far this year, is heading for an increase of almost 200%.

英伟达(纳斯达克:NVDA)在短期和长期内都被证明是一项绝佳投资。这支股票在五年内飙升了2700%,而今年迄今为止,已经增长了近200%。

The reason behind this is simple: Nvidia has built an artificial intelligence (AI) empire, serving one of today's highest-growth areas. The current $200 billion AI market is forecast to reach $1 trillion by the end of the decade. As this growth takes place, Nvidia could be one of the biggest winners.

背后的原因很简单:英伟达已经建立了一个人工智能帝国,服务于当今增长最快的领域之一。目前2000亿美元的人工智能市场预计到本十年末将达到1万亿美元。随着这一增长的发生,英伟达可能成为最大的赢家之一。

The tech company's dominance in AI chips and related products and services has helped it report triple-digit revenue growth in recent times, and at rock-solid levels of gross margin. If you haven't gotten in on Nvidia yet, though, you may be wondering whether now — ahead of the upcoming earnings report — would make a good time to invest in this hot stock. Below are two reasons to buy Nvidia before the Nov. 20 report — and one reason to wait.

科技公司在人工智能芯片及相关产品和服务领域的主导地位帮助其最近实现了三位数的营业收入增长,毛利率也保持在坚实水平。然而,如果你还没有参与英伟达股票,也许你会想知道现在 — 在即将到来的财报前 — 是不是一个好时机投资这只热门股票。以下是在11月20日发布财报前买入英伟达的两个理由 — 以及一个理由去观望。

Reason to buy: Potential update on Blackwell

买入原因:可能会有关于Blackwell的更新

Nvidia is heading for a big moment, and the company probably will give us an update during the fiscal 2025 third-quarter earnings report next week. The tech powerhouse is launching its new Blackwell architecture and best-performing chip ever during the fourth quarter. It aims to ramp up production and generate billions of dollars in revenue during this time period, Nvidia said during its last earnings report back in August.

英伟达即将迎来重要时刻,公司可能会在下周的2025财年第三季度财报中向我们提供更新。这家技术巨头将在第四季度推出其新的Blackwell架构和有史以来性能最佳的芯片。英伟达表示,公司旨在加大生产力,并在此期间创造数十亿美元的营业收入,这是该公司在8月份上次发布财报时所表示的。

The tech giant also said at the time that demand for Blackwell surpassed supply, and this is expected to continue into next year. This tells us that customers are flocking to Nvidia for the new platform — and are even willing to wait for it.

科技巨头当时还表示,对Blackwell的需求超过供应,预计这种情况将持续到明年。这告诉我们,顾客们正在涌向英伟达新平台 — 甚至愿意等待。

The company has offered updates about the Blackwell launch during past earnings reports this year, so as we approach the key moment, it's likely we'll learn more about this major new release. Considering the forecast for billions in revenue as of the very first quarter of commercialization, there's reason to be optimistic about Blackwell as a new growth driver for Nvidia.

公司今年在过去的财报中提供了Blackwell发布的更新,因此在我们接近关键时刻时,我们很可能会了解更多关于这个重要的新发布的信息。考虑到商业化初期就有数十亿美元营业收入的预测,有理由对Blackwell作为英伟达新的增长动力持乐观态度。

If this top AI player offers us confirmation of these points — and potentially additional positive details — the stock could soar after Nov. 20.

如果这位顶尖的人工智能公司确认这些观点,并有可能提供额外的积极细节,股票在11月20日后可能会飙升。

Reason to buy: Reasonable valuation in the world of growth stocks

买入原因:在成长股领域有合理的估值

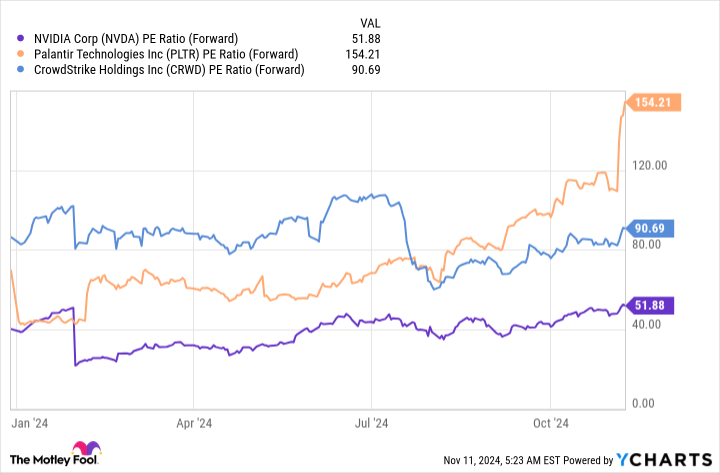

Nvidia isn't the cheapest stock on the block, trading at more than 50x forward earnings estimates today. But it's important to put this into perspective. For a growth stock involved in AI, it's not the most expensive stock, either. Software company Palantir Technologies and cybersecurity giant CrowdStrike both trade at much higher levels by the same measure, for example.

英伟达并非是股市中最便宜的股票,今天以超过50倍的市场前瞻盈利预期交易。但重要的是要从长远来看这个问题。对于一家涉及人工智能的成长股,它也不是最昂贵的股票。例如,软件公司Palantir Technologies和网络安全巨头crowdstrike以同样的衡量标准交易的水平要高得多。

NVDA Price-to-Earnings Ratio (Forward) data by YCharts.

英伟达 市盈率 (前瞻)数据由YCharts提供。

Nvidia actually looks reasonably priced at today's level when considering both its track record and potential for earnings growth in the years to come. As mentioned, revenue has soared and a gross margin level of more than 70% shows solid profitability on sales. Moving forward, growth in the AI market, Nvidia's position as a leader, and the company's focus on innovation to stay ahead should keep earnings marching higher.

英伟达在考虑到其过往业绩和未来盈利增长潜力时,实际上看起来是合理定价的。如前所述,收入飙升,超过70%的毛利率显示销售利润稳健。展望未来,人工智能市场的增长,英伟达作为领导者的地位,以及公司致力于创新保持领先的重点应该会继续推动盈利增长。

Potential good news from Nvidia on Nov. 20 could push the stock higher, lifting its valuation, too. All of this makes Nvidia look like a great long-term growth stock to get into at today's price.

英伟达在11月20日有望传来利好消息,可能会推动股价上涨,也会提升其估值。所有这些都使英伟达看起来像是一个很好的长期增长股,在当今价格入场。

Reason to wait: Long-term investing means you don't have to time the market

等待的理由:长期投资意味着您无需时机市场。

Nvidia makes a great buy today because it's reasonably priced, considering its prospects, and may get a boost from any positive news on Blackwell during the upcoming earnings report. However, long-term investors don't have to rush into a particular stock to benefit from a potential short-term move.

英伟达今天是一个很好的买入机会,因为其价格合理,考虑到其前景,并且可能会受益于即将到来的财报中有关Blackwell的任何积极消息。然而,长期投资者无需匆忙加入特定股票,以从潜在的短期行动中受益。

This is because share performance over a period of a few days or weeks won't have much impact on returns if a stock is held for five years or longer. This is great news because you don't have to worry about timing the market and feeling disappointed if you miss out on one particular period of gains. If the company is solid and has bright long-term prospects, positive share-price performance will happen over time.

这是因为股票在持有五年或更长时间后,几天或几周的股票表现并不会对回报产生太大影响。这是一个好消息,因为您不必担心入市时间和如果错过某个特定增长期而感到失望。如果公司稳固,有光明的长期前景,股价表现积极的情况将会在时间内发生。

All of this means that there are some good reasons to buy Nvidia right now, ahead of the earnings report. However, if you'd rather wait — or need to wait to free up cash to invest — don't worry. An investment after the report or even further down the road still may score a big win for your portfolio over the long haul.

所有这一切意味着现在有一些很好的理由来买入英伟达,提前财报。然而,如果您宁愿等待,或需要等待释放现金以投资,请不要担心。在财报之后或甚至之后,依然可能为您的投资组合长期以来赢得大胜。

Nvidia is heading for a big moment, and the company probably will give us an update during the fiscal 2025 third-quarter earnings report next week. The tech powerhouse is launching its new Blackwell architecture and best-performing chip ever during the fourth quarter. It aims to ramp up production and generate billions of dollars in revenue during this time period, Nvidia said during its last earnings report back in August.

Nvidia is heading for a big moment, and the company probably will give us an update during the fiscal 2025 third-quarter earnings report next week. The tech powerhouse is launching its new Blackwell architecture and best-performing chip ever during the fourth quarter. It aims to ramp up production and generate billions of dollars in revenue during this time period, Nvidia said during its last earnings report back in August.