LanzaTech Global, Inc. (NASDAQ:LNZA) shares have retraced a considerable 33% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 67% share price decline.

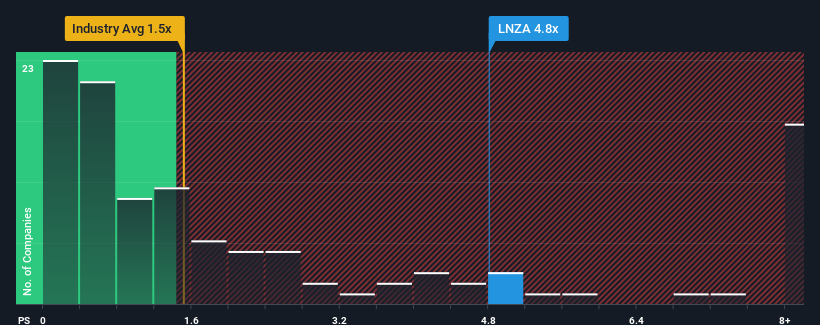

Even after such a large drop in price, given around half the companies in the United States' Commercial Services industry have price-to-sales ratios (or "P/S") below 1.5x, you may still consider LanzaTech Global as a stock to avoid entirely with its 4.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does LanzaTech Global's P/S Mean For Shareholders?

Recent revenue growth for LanzaTech Global has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on LanzaTech Global will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like LanzaTech Global's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like LanzaTech Global's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. The latest three year period has also seen an excellent 128% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 103% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 8.7% growth forecast for the broader industry.

In light of this, it's understandable that LanzaTech Global's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate LanzaTech Global's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of LanzaTech Global's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for LanzaTech Global that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.