Top 4 Consumer Stocks That May Explode In November

Top 4 Consumer Stocks That May Explode In November

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費不可或缺板塊中最被低估的公司股票出現了買入機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

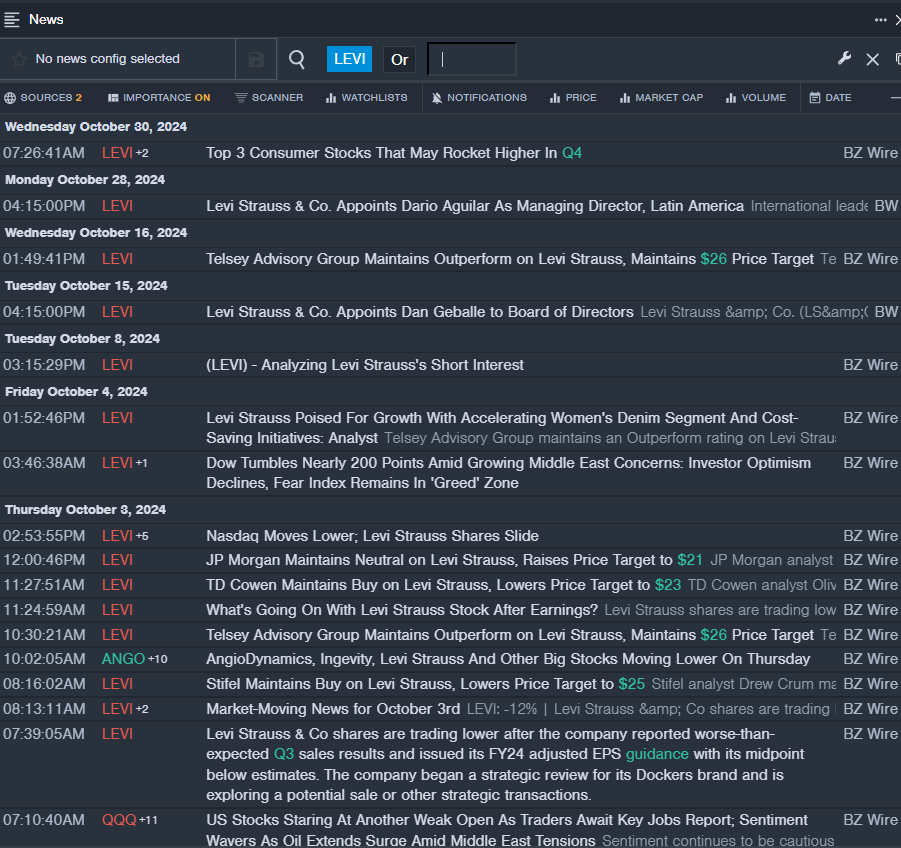

Levi Strauss & Co (NASDAQ:LEVI)

李維斯公司 (納斯達克:LEVI)

- On Oct. 28, Levi Strauss named Dario Aguilar as Managing Director, Latin America. The company's stock fell around 11% over the past month and has a 52-week low of $13.94.

- RSI Value: 29.52

- LEVI Price Action: Shares of Levi fell 0.7% to close at $16.86 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest LEVI news.

- 在10月28日,李維斯任命達里奧·阿吉拉爾爲拉丁美洲董事。公司股票在過去一個月下跌了約11%,並且52周低點爲$13.94。

- 相對強弱指數(RSI)值:29.52

- LEVI價格走勢:李維斯股票在週二下跌0.7%,收於$16.86。

- Benzinga Pro的實時新聞提醒最新LEVI資訊。

Crocs Inc (NASDAQ:CROX)

卡駱馳公司(納斯達克:CROX)

- On Oct. 29, Crocs reported third-quarter financial results and lowered its revenue guidance related to the HEYDUDE Brand. The company reported adjusted earnings per share of $3.60 (+11%), beating the street view of $3.10. Quarterly revenues of $1.062 billion (+2%) beat the analyst consensus of $1.05 billion. The company's stock fell around 27% over the past month and has a 52-week low of $77.16.

- RSI Value: 25.13

- CROX Price Action: Shares of Crocs fell 0.9% to close at $101.98 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in CROX stock.

- 在10月29日,卡駱馳發佈了第三季度財務結果,並下調了與HEYDUDE品牌相關的營業收入指引。公司報告的調整後每股收益爲$3.60(+11%),超過華爾街預期的$3.10。季度營業收入爲$10.62億(+2%),超過分析師共識的$10.5億。該公司的股票在過去一個月下跌了約27%,並且有着$77.16的52周低點。

- RSI值:25.13

- CROX價格走勢:卡駱馳的股票在週二下跌了0.9%,收於$101.98。

- Benzinga Pro的圖表工具幫助識別了CROX股票的趨勢。

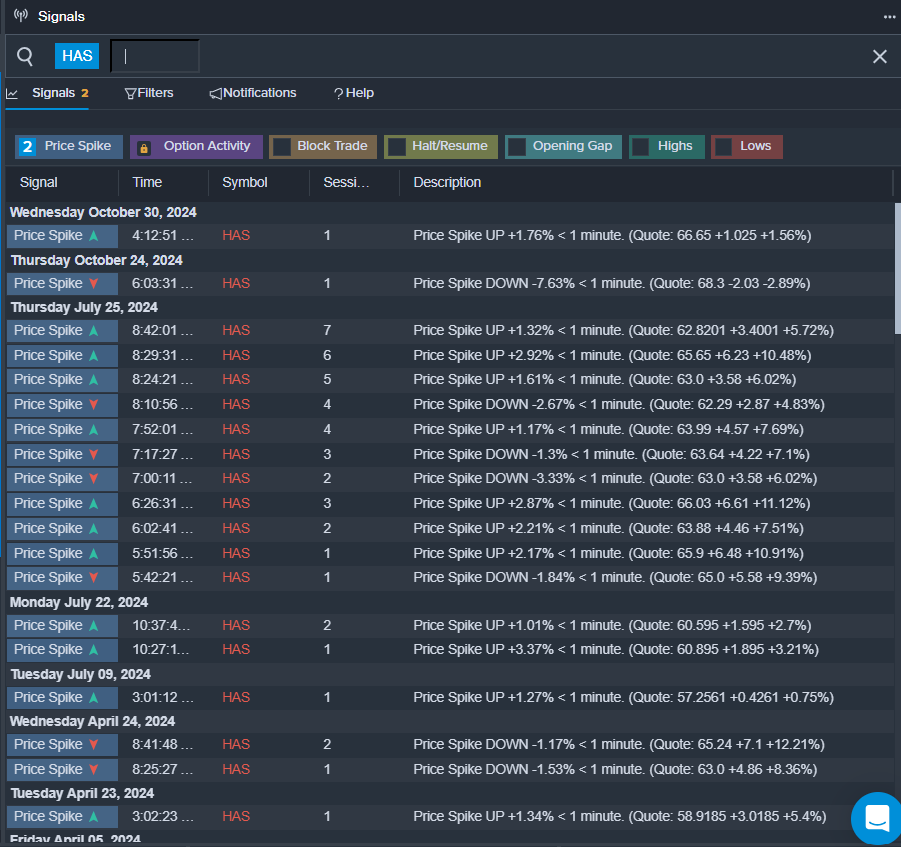

Hasbro Inc (NASDAQ:HAS)

孩之寶公司(納斯達克:HAS)

- On Oct. 24, Hasbro reported a third-quarter sales decline of 15% year-on-year to $1.281 billion, marginally missing the analyst consensus estimate of $1.295 billion. "We continue to execute our turnaround efforts and are poised to finish the year with improved profitability, cash flow and operational rigor," said Gina Goetter, Hasbro's Chief Financial Officer. The company's stock fell around 11% over the past month and has a 52-week low of $42.70.

- RSI Value: 29.26

- HAS Price Action: Shares of Hasbro fell 1.1% to close at $63.42 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in HAS shares.

- 10月24日,孩之寶報告第三季度銷售額同比下降15%,至12.81億,略微低於分析師一致預期的12.95億。"我們繼續推進我們的轉型工作,預計將在年末實現盈利能力、現金流和運營效率的改善,"孩之寶的首席財務官吉娜·戈特說。該公司的股票在過去一個月下跌了約11%,並且52周低點爲42.70美元。

- RSI值:29.26

- HAS價格表現:孩之寶的股票在週二下跌了1.1%,收於63.42美元。

- Benzinga Pro的信號功能提醒了HAS股票潛在的突破。

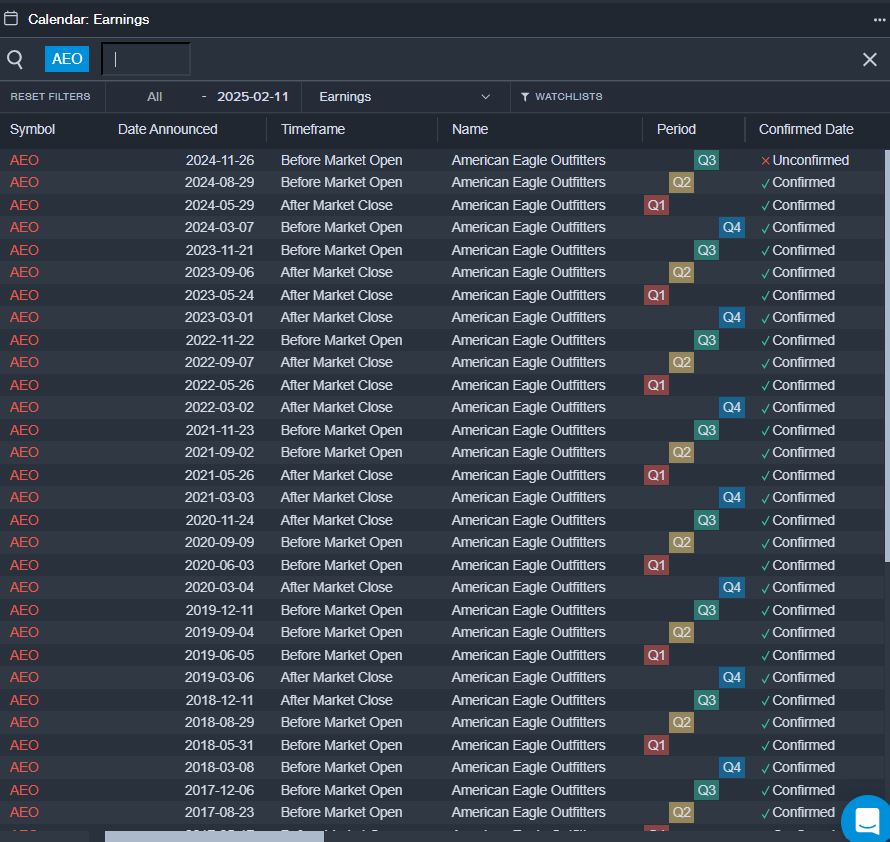

American Eagle Outfitters Inc (NYSE:AEO)

美鷹服飾公司 (紐交所:AEO)

- On Nov. 12, Jefferies analyst Corey Tarlowe maintained American Eagle with a Hold and lowered the price target from $22 to $19. The company's shares lost around 13% over the past month. The company's 52-week low is $73.04.

- RSI Value: 15.92

- AEO Price Action: Shares of American Eagle fell 1.5% to close at $17.94 on Tuesday.

- Benzinga Pro's earnings calendar was used to track upcoming AEO earnings reports.

- 11月12日,傑富瑞分析師科裏·塔爾洛維維持對美鷹服飾的持有評級,並將目標價從22美元下調至19美元。該公司的股票在過去一個月下跌了約13%。該公司的52周低點爲73.04美元。

- RSI值:15.92

- AEO Price Action: Shares of American Eagle fell 1.5% to close at $17.94 on Tuesday.

- Benzinga Pro's earnings calendar was used to track upcoming AEO earnings reports.

Read More:

閱讀更多:

- Top 3 Tech And Telecom Stocks Which Could Rescue Your Portfolio In Q4

- 第四季度可能拯救您投資組合的前三科技和電信股票