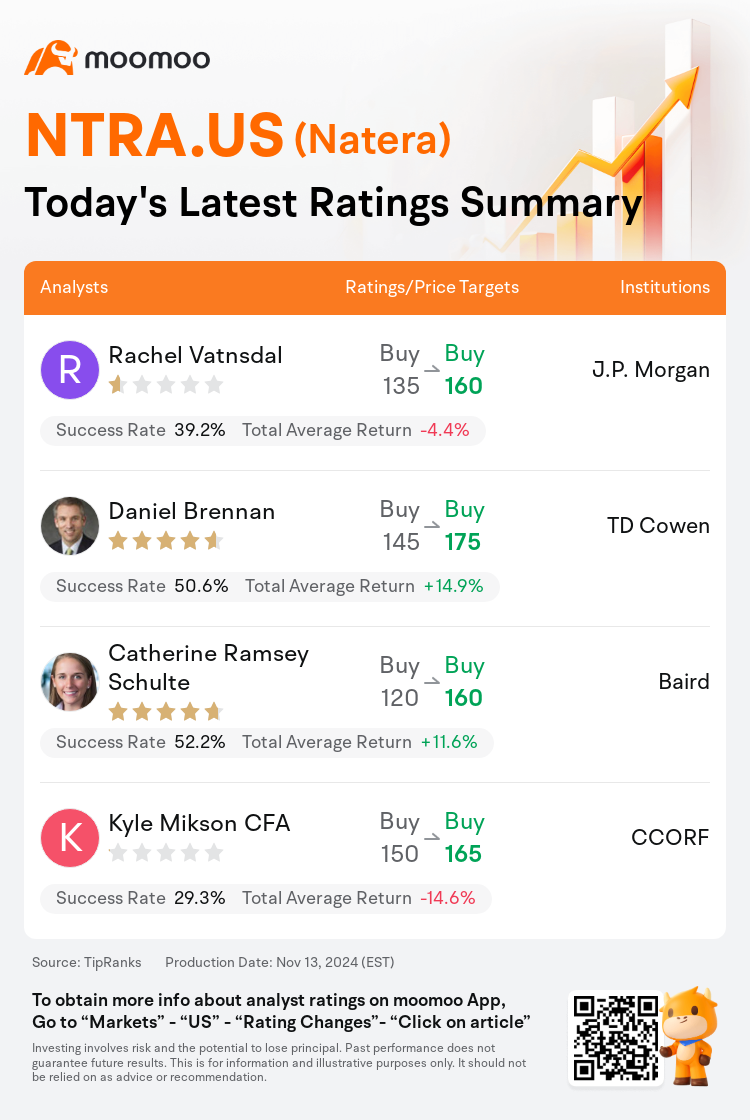

On Nov 13, major Wall Street analysts update their ratings for $Natera (NTRA.US)$, with price targets ranging from $160 to $175.

J.P. Morgan analyst Rachel Vatnsdal maintains with a buy rating, and adjusts the target price from $135 to $160.

TD Cowen analyst Daniel Brennan maintains with a buy rating, and adjusts the target price from $145 to $175.

Baird analyst Catherine Ramsey Schulte maintains with a buy rating, and adjusts the target price from $120 to $160.

Baird analyst Catherine Ramsey Schulte maintains with a buy rating, and adjusts the target price from $120 to $160.

CCORF analyst Kyle Mikson CFA maintains with a buy rating, and adjusts the target price from $150 to $165.

Furthermore, according to the comprehensive report, the opinions of $Natera (NTRA.US)$'s main analysts recently are as follows:

Natera has delivered another robust quarter, according to an analyst. With a strong performance across volume, selling price, margin, and cash management, the company is perceived as operating effectively, with potential for further enhancement leading into 2025. The consensus is that Natera stands out as one of the most distinguished entities in the diagnostics sector.

Natera's Q3 results significantly exceeded expectations, continuing to enhance its core fundamentals. The company is strategically reinvesting its operating cash flow back into the business, which is strengthening its position in sales, marketing, medical affairs, and legal aspects.

The company recorded another robust quarter with its sales, margins, and cash flow all surpassing expectations.

Natera's third quarter revenue and gross margins exceeded estimates, showing robust performance. The company's progress is widespread, highlighted by a 60% annual increase in Signatera clinical volume growth and significant gains within women's health accounts.

Here are the latest investment ratings and price targets for $Natera (NTRA.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

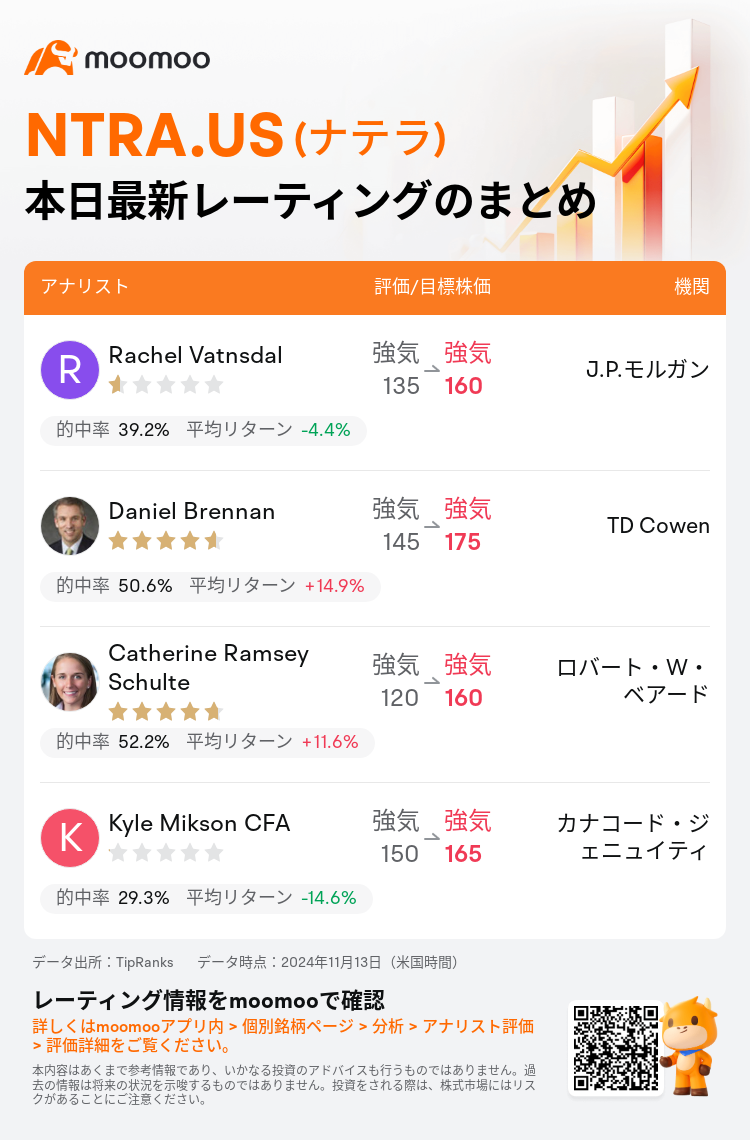

11月13日(米国時間)、ウォール街主要機関のアナリストが$ナテラ (NTRA.US)$のレーティングを更新し、目標株価は160ドルから175ドル。

J.P.モルガンのアナリストRachel Vatnsdalはレーティングを強気に据え置き、目標株価を135ドルから160ドルに引き上げた。

TD CowenのアナリストDaniel Brennanはレーティングを強気に据え置き、目標株価を145ドルから175ドルに引き上げた。

ロバート・W・ベアードのアナリストCatherine Ramsey Schulteはレーティングを強気に据え置き、目標株価を120ドルから160ドルに引き上げた。

ロバート・W・ベアードのアナリストCatherine Ramsey Schulteはレーティングを強気に据え置き、目標株価を120ドルから160ドルに引き上げた。

カナコード・ジェニュイティのアナリストKyle Mikson CFAはレーティングを強気に据え置き、目標株価を150ドルから165ドルに引き上げた。

また、$ナテラ (NTRA.US)$の最近の主なアナリストの観点は以下の通りである:

アナリストによると、ナテラはさらに堅調な四半期を遂行した。出来高、販売価格、利益率、現金管理など全セクターで強力なパフォーマンスを示し、2025年に向けて更なる向上の可能性があるとみなされている。コンセンサスでは、ナテラは診断セクターで最も卓越したエンティティの1つとして浮き彫りになっています。

ナテラの第3四半期の業績は予想を大幅に上回り、主要な基本を強化し続けています。同社は営業キャッシュフローを事業に再投資し、営業、マーケティング、医療関連、法務の各分野で強化し、ポジションを強化しています。

同社は売上、利益率、現金流れに関して予想を上回る強固な四半期を記録しました。

ナテラの第三四半期の売上高と粗利益率は予想を上回り、堅調なパフォーマンスを見せました。同社の進捗状況は広範囲にわたり、Signatera臨床出来高の年間増加率が60%増加し、女性の健康問題においても大幅な利益を上げました。

以下の表は今日4名アナリストの$ナテラ (NTRA.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

ロバート・W・ベアードのアナリストCatherine Ramsey Schulteはレーティングを強気に据え置き、目標株価を120ドルから160ドルに引き上げた。

ロバート・W・ベアードのアナリストCatherine Ramsey Schulteはレーティングを強気に据え置き、目標株価を120ドルから160ドルに引き上げた。

Baird analyst Catherine Ramsey Schulte maintains with a buy rating, and adjusts the target price from $120 to $160.

Baird analyst Catherine Ramsey Schulte maintains with a buy rating, and adjusts the target price from $120 to $160.