Palantir Technologies Unusual Options Activity

Palantir Technologies Unusual Options Activity

Deep-pocketed investors have adopted a bullish approach towards Palantir Technologies (NYSE:PLTR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PLTR usually suggests something big is about to happen.

資金雄厚的投資者對雅運股份(紐交所:PLTR)採取了看好的態度,這是市場參與者不容忽視的。我們在Benzinga的公開期權記錄跟蹤中發現了這一重要舉措。這些投資者的身份仍然未知,但這種PLTR的重大變動通常意味着即將發生的重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 73 extraordinary options activities for Palantir Technologies. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這些信息,當時Benzinga的期權掃描儀突出了palantir技術公司的73個異常期權活動。這種活躍度是不尋常的。

The general mood among these heavyweight investors is divided, with 47% leaning bullish and 46% bearish. Among these notable options, 8 are puts, totaling $498,691, and 65 are calls, amounting to $5,899,463.

這些大牌投資者的總體情緒不一,47%看好,46%看淡。在這些顯著的期權中,有8個是看跌期權,總計$498,691,65個是看漲期權,總額爲$5,899,463。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $90.0 for Palantir Technologies over the last 3 months.

考慮到這些合約的成交量和未平倉合約,可以看出鯨魚們在過去3個月內針對palantir技術公司的價格區間從$15.0到$90.0。

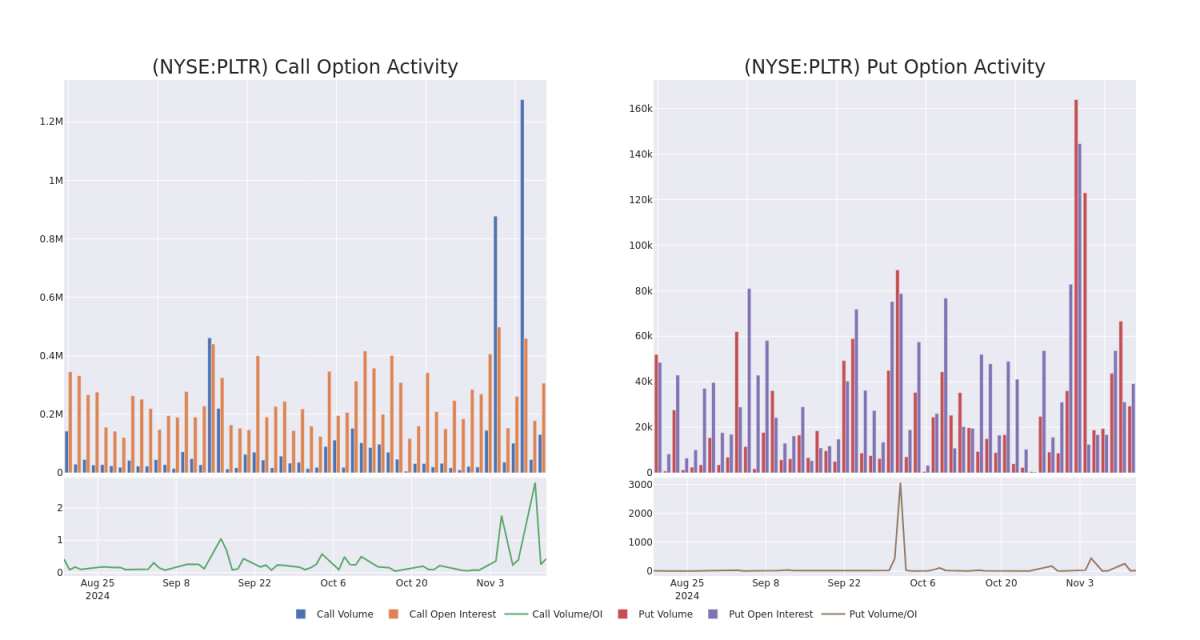

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palantir Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palantir Technologies's significant trades, within a strike price range of $15.0 to $90.0, over the past month.

檢查成交量和未平倉合約提供了股票研究的重要見解。這些信息在評估palantir技術公司的期權在某些行使價格的流動性和興趣水平方面至關重要。以下是過去一個月內palantir技術公司在$15.0到$90.0的顯著交易中看漲和看跌期權的成交量和未平倉合約趨勢的快照。

Palantir Technologies 30-Day Option Volume & Interest Snapshot

Palantir Technologies 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | CALL | SWEEP | BULLISH | 11/15/24 | $7.9 | $7.85 | $7.85 | $55.00 | $628.7K | 12.7K | 1.2K |

| PLTR | CALL | SWEEP | BULLISH | 11/15/24 | $6.6 | $6.55 | $6.55 | $55.00 | $471.6K | 12.7K | 3.5K |

| PLTR | CALL | TRADE | BEARISH | 01/17/25 | $31.35 | $31.15 | $31.2 | $32.00 | $312.0K | 13.0K | 219 |

| PLTR | CALL | TRADE | BULLISH | 12/20/24 | $21.35 | $21.35 | $21.35 | $41.00 | $213.5K | 1.9K | 102 |

| PLTR | CALL | SWEEP | BEARISH | 09/19/25 | $13.7 | $13.65 | $13.65 | $65.00 | $202.0K | 6.2K | 616 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| palantir | 看漲 | SWEEP | 看好 | 11/15/24 | $7.9 | $7.85 | $7.85 | $55.00 | $628.7K | 12.7K | 1.2K |

| palantir | 看漲 | 掃單 | 看好 | 11/15/24 | $6.6 | $6.55 | $6.55 | $55.00 | 471.6K美元 | 12.7K | 3.5K |

| palantir | 看漲 | 交易 | 看淡 | 01/17/25 | $31.35 | $31.15 | $31.2 | $32.00 | $312.0千美元 | 13.0千 | 219 |

| palantir | 看漲 | 交易 | 看好 | 12/20/24 | $21.35 | $21.35 | $21.35 | $41.00 | $213.5K | 1.9K | 102 |

| palantir | 看漲 | 掃單 | 看淡 | 09/19/25 | $13.7 | $13.65 | $13.65 | $65.00 | $202.0K | 6.2K | 616 |

About Palantir Technologies

關於Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Palantir是一家專注於利用數據創造客戶組織效率的分析軟件公司,該公司通過其Foundry和Gotham平台爲商業和政府客戶提供服務。總部位於丹佛的該公司成立於2003年,並於2020年上市。

In light of the recent options history for Palantir Technologies, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到Palantir Technologies的最近期權歷史,現在應該關注該公司本身。我們旨在探索其當前表現。

Where Is Palantir Technologies Standing Right Now?

Palantir Technologies目前處於什麼位置?

- Trading volume stands at 77,709,727, with PLTR's price up by 1.75%, positioned at $60.9.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 82 days.

- 交易成交量爲77,709,727,palantir的價格上漲了1.75%,當前價格爲$60.9。

- RSI指示股票可能已超買。

- 預計在82天內發佈業績。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的專業期權交易員揭示了他的單線圖技巧,可以顯示何時買入和賣出。複製他的交易,每20天平均盈利27%。點擊這裏獲取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $90.0 for Palantir Technologies over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $90.0 for Palantir Technologies over the last 3 months.