On Wednesday, Tesla, which ranked No. 1 in US stock turnover, closed 0.53% higher and traded 41.359 billion US dollars. US President-elect Trump announced on Wednesday that Musk will cooperate with American entrepreneur Vivek Ramaswamy to lead the proposed government efficiency department (DOGE for short). The government efficiency department will pave the way for dismantling government bureaucracy, cut excessive supervision, cut wasteful spending, and restructure federal institutions. There are also reports that Musk will attend Trump's House Republican meeting.

Furthermore, the US National Highway Traffic Safety Administration (NHTSA) revealed on November 13 that Tesla will recall some 2024 Cybertruck cars, totaling 2,431 vehicles, due to drive inverter failure that may cause the wheels to lose driving power. The recall covers some 2024 Cybertruck vehicles produced between November 6, 2023 and July 30, 2024.

The second-place Nvidia closed down 1.36% and traded $26.476 billion. Nvidia will join forces with SoftBank Group to build Japan's most powerful supercomputer and promote a new telecom network capable of simultaneously running AI tasks and providing 5G services. On November 13, at the Japan AI Summit hosted by Nvidia, Nvidia announced that it will launch a series of collaborations with telecom business subsidiaries under the SoftBank Group to accelerate Japan's sovereign AI development plans. The two companies will use Nvidia's latest Blackwell chip to jointly build Japan's most powerful AI supercomputer.

SoftBank will be the first company to receive Nvidia's DGX B200 AI server to build a supercomputer called the DGX SuperPod. Additionally, SoftBank is planning to build another supercomputer designed on Nvidia's Grace Blackwell platform.

SoftBank will be the first company to receive Nvidia's DGX B200 AI server to build a supercomputer called the DGX SuperPod. Additionally, SoftBank is planning to build another supercomputer designed on Nvidia's Grace Blackwell platform.

Citibank raised Nvidia's price target from $150 to $170 on Wednesday.

MicroStrategy, the third-largest Bitcoin concept stock, closed down 7.91% to $16.076 billion. Bitcoin fluctuated greatly on Wednesday, breaking through a record high of 930 million dollars during the day, but then gradually declined. As of 4 p.m. EST on Wednesday, Bitcoin fell below the 0.088 million dollar mark, falling more than 5,000 US dollars from the daily high. The daily increase was basically evened out.

As Bitcoin fluctuates, the total amount of cryptocurrency holdings across the network reached $63.02 million in one hour from 3:30 p.m. to 4:30 p.m. EST on Wednesday. Within 24 hours, a total of 252,857 people were liquidated, and the total amount of liquidated positions was 0.875 billion US dollars.

Apple, the fourth place, closed 0.40% higher at $10.729 billion. According to reports, Apple plans to launch a smart home device based on artificial intelligence (AI) in March 2025, marking the company's further layout in the smart home field. This new product is expected to be integrated with other Apple hardware products via wireless connectivity.

Apple CEO Cook believes that this product can make Apple a force in the smart home field. By integrating advanced AI technology and the advantages of the existing ecosystem, Apple hopes to attract and retain more users, thereby enhancing its competitiveness in the smart home market.

Furthermore, Apple reported on Wednesday that in the first nine months of this year, Apple's revenue was 1.63 billion euros and operating profit was 0.189 billion euros. The profit margin is expected to increase to around 11.5%, and the forecast is to achieve medium to high single-digit organic revenue growth in 2024.

Amazon, which ranked 5th, closed 2.48% higher and traded $9.784 billion. On Wednesday, Amazon announced the details of its online shopping deals during the “Black Friday” and “Cyber Monday” online shopping carnival in Western countries. Amazon expects these large-scale online shopping deals to be carried out during the busy extended holiday online shopping campaign from November 21 to December 2. During the Black Friday to Cyber Monday online shopping spree last year, the number of online purchases made by global consumers reached the largest scale so far on the Amazon e-commerce platform.

Amazon has also launched a new platform featuring clothing, home goods, electronics, and other items under $20 to counter growing competition from discounted up-and-coming Temu and Hiyin. The platform is called “Amazon Haul” and is accessible through the company's mobile app. Amazon promises to offer a large number of products at “insanely low prices” on this platform.

In 6th place, Microsoft closed 0.51% higher at $8.861 billion. Microsoft's video game director Phil Spencer detailed Microsoft's future plans in the gaming field in an interview a few days ago. Spencer said that Microsoft is still considering more acquisitions and is committed to competing and cooperating in the handheld gaming device and mobile store markets while increasing “geographical diversity” in Asia and other regions. He said the acquisition of another mobile company would add new content to the game Microsoft acquired last year by spending $69 billion to acquire Activision Blizzard.

Coinbase Global, the 7th largest cryptocurrency trading platform, closed down 10.78% and traded $8.406 billion.

Eighth-place Meta Platforms closed down 0.82% to $6.038 billion. Meta Platforms announced on Tuesday that it will reduce EU users' Facebook and Instagram ad-free subscription fees by 40% while providing a “less personalized ad” option in order to comply with EU regulatory requirements. The company issued a notice on its official website stating that it will drastically reduce the price of ad-free subscriptions. This price adjustment applies to the European Union, the European Economic Area, and Switzerland.

9th place Spotify closed 11.44% higher, reaching a record high of $5.518 billion. According to Spotify's results for the third quarter of fiscal year 2024, the company's revenue was 3.988 billion euros, compared to 3.357 billion euros in the same period last year, an increase of about 19% over the previous year. Net profit was 0.3 billion euros, compared to 65 million euros in the same period last year, up about 362% year over year. Diluted net earnings per share were €1.45, compared to €0.33 in the same period last year, up about 339% year over year. The gross margin was 31.1%, compared to 26.4% in the same period last year. The number of monthly active users was 0.64 billion, compared to 0.574 billion in the same period last year, an increase of about 11% over the previous year. Among them, the number of premium users was 0.252 billion, compared to 0.226 billion in the same period last year, an increase of about 12% over the same period last year.

In terms of fourth-quarter results guidance, the company expects revenue to be 4.1 billion euros, up about 12% year on year; operating profit is expected to be 0.481 billion euros, up about 741% year on year; gross margin is expected to be 31.8%, up about 5.1% year on year; and the number of monthly active users is expected to be 0.665 billion, up about 10% year on year.

J.P. Morgan raised Spotify's price target from $425 to $530.

Bank of America Global raised Spotify's target price from $430 to $515.

Crown Bank raised Spotify's target price from $100 to $130.

Barclays raised Spotify's price target from $70 to $93.

The 11th place AMD closed down 3.01% and traded $4.747 billion. AMD said on Wednesday it will cut 4% of its total global workforce to gain a stronger market position in the field of artificial intelligence chips, which is currently dominated by Nvidia. It is still unclear which sectors are affected.

As of the end of last year, AMD had 0.026 million employees, according to US Securities and Exchange Commission (SEC) documents. 4% is equivalent to about 1,000 people.

An AMD representative said in a statement, “To align our resources with maximum development opportunities, we are taking a series of targeted measures that will reduce the number of employees worldwide by approximately 4%. We are committed to treating affected employees with respect and helping them through this transition.”

The 12th Google Class A shares closed down 1.51% and traded $4.044 billion. According to people familiar with the matter, like OpenAI, Anthropic, which is supported by Google and Amazon, also said that the performance of its large-scale language models has come to a standstill. Three people familiar with the matter said that the upcoming Gemini version failed to meet internal expectations. Additionally, Anthropic has delayed the next version of its Claude model, the 3.5 Opus. One of the problems these companies face is a lack of artificial data to train models.

14th place Boeing closed down 3.58% and traded $2.94 billion. Boeing said more than 0.032 million mechanics on strike have been asked to return to the factory by Tuesday at the latest, but it will still take weeks to get the factory back into operation. The company said yesterday that it delivered 14 jets in October, the lowest delivery volume since the worst of the epidemic in November 2020 and the final phase of the global grounding of Boeing 737 Max flights after two fatal accidents.

The 19th Rocket Lab closed 28.44% higher, and its stock price reached a record high of 2.449 billion dollars. The company's third-quarter financial results were better than expected. The company's revenue was $0.105 billion, up 55% year over year; net loss was $51.939 million, better than expected. The company expects Q4 revenue to be between $0.125 billion and $-0.135 billion, and analysts expect $0.122 billion. In addition, the company Neutron Rocket signed a multi-launch service agreement with a commercial satellite constellation operator and obtained a federal military stock contract with a total value of up to 8 million US dollars.

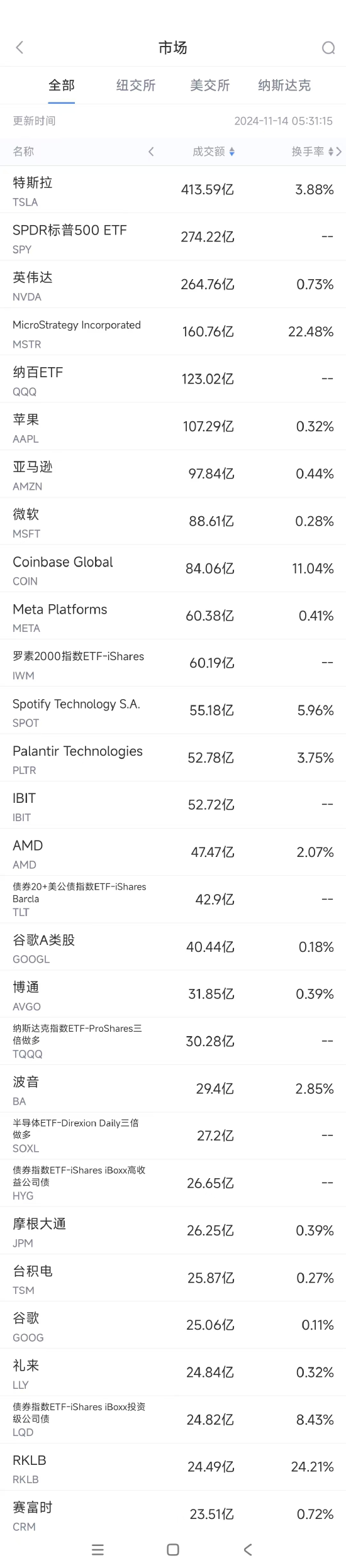

(Screenshot from the Sina Finance App Market - US Stocks - Market section, swipe left for more data) Download the Sina Finance App

软银将成为收到英伟达AI服务器DGX B200的第一家企业,用以搭建名为DGX SuperPOD的超级计算机。此外,软银正在计划搭建另一台基于英伟达Grace Blackwell平台设计的超级计算机。

软银将成为收到英伟达AI服务器DGX B200的第一家企业,用以搭建名为DGX SuperPOD的超级计算机。此外,软银正在计划搭建另一台基于英伟达Grace Blackwell平台设计的超级计算机。