On November 14, Aurora Mobile (NASDAQ: JG), a leading provider of customer interaction and marketing technology services in China, announced its unaudited financial report for the third quarter ending September 30, 2024.

Overall, Aurora Mobile's overseas business performance remained strong this quarter, indicating an increase in its participation and competitiveness in the global market. At the same time, Aurora Mobile's ballast business subscription service achieved a historic breakthrough, achieving profitability for five consecutive quarters, with steadily improving development quality, releasing positive expectations.

Behind this, AI empowerment and exploration of overseas markets have brought new opportunities to the saas industry, while macroeconomic pressures combined with capital retreat have accelerated the saas industry's entry into a market elimination phase, with saas vendors shifting from blindly pursuing scale to pursuing operational efficiency and profitability. Aurora Mobile has aligned with the mainline of the industry early, gaining sufficient development momentum.

At this time, there are more reasons to be bullish about Aurora Mobile's development potential and value recovery.

At this time, there are more reasons to be bullish about Aurora Mobile's development potential and value recovery.

Aurora Mobile's founder and CEO, Luo Weidong, stated: "In the third quarter of 2024, our financial performance was outstanding, achieving breakthrough results, as follows:"

l First, we set a historical record again; the Adjusted EBITDA indicators achieved profitability in this quarter for five consecutive quarters;

l Second, revenue from developer subscription services increased by 7% month-on-month and 11% year-on-year; more importantly, this revenue reached a historic high this quarter, breaking through 50 million yuan for the first time;

l Third, net operating cash inflow reached 12.3 million yuan, setting the highest level in the past 16 quarters;

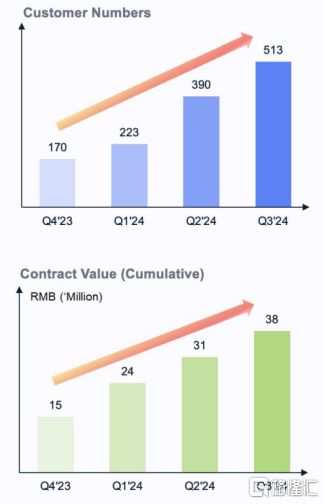

Fourth, EngageLab's business maintains strong growth, with the number of customers increasing by 32% quarter-on-quarter and cumulative signed amounts growing by 23% quarter-on-quarter.

In this quarter, our subscription service revenue reached 51.7 million yuan, a strong year-on-year growth of 11% and a quarter-on-quarter growth of 7%. The year-on-year and quarter-on-quarter growth is mainly attributed to the increase in average revenue per user and the robust performance of our EngageLab business. This quarter, EngageLab's revenue grew strongly, nearly doubling year-on-year.

1. EngageLab and GPTBots.ai continue to drive the group's revenue growth, with breakthroughs in multiple business areas.

1. EngageLab highlights its status as a revenue "engine", shining in overseas markets.

In the third quarter, under the banner of Aurora Mobile, the global products and solutions EngageLab and GPTBots.ai continued to make positive progress, gaining favorable reviews from global customers, thereby providing incremental revenue for the group.

Among them, EngageLab's role as a revenue engine has become more prominent, renowned internationally for its more refined outreach strategy, lower message sending costs, higher message delivery rates, and better user conversion rates, consistently ranking among the top in market share. According to the latest data, the number of overseas markets that EngageLab has developed has further increased, with customers spanning 31 countries and regions worldwide.

(EngageLab overseas customer distribution map; source: Aurora official website)

At the same time, the number of customers for EngageLab expanded to 513 in the third quarter, with a month-on-month growth of approximately 32%, achieving over 202% growth compared to the fourth quarter of 2023; the cumulative contract amount reached 38 million yuan, showing a month-on-month growth of about 23%, and an increase of over 153% compared to the fourth quarter of 2023, clearly indicating that its business landscape is continuously expanding at a rapid pace.

(EngageLab's phased achievements in going overseas; source: Aurora official website)

Behind this, EngageLab has also attracted the favor of many leading enterprises, such as TaoCollect. EngageLab enhances global customer interaction efficiency for TaoCollect with excellent performance, achieving omni-channel coverage for message pushes and millisecond-level precision in reach, as well as providing global smart support, allowing TaoCollect to create detailed user profiles based on push data information, enhancing its global competitiveness.

The favor of leading enterprises often easily forms a demonstration effect, driving more companies to join the collaborative team, which, to some extent, lays a solid foundation for EngageLab's continued growth and subsequent development.

According to GPTBots.ai, leveraging its technology accumulation and broad applications in the AI field promotes global layout, with registered users spread across more than 160 countries and regions worldwide. Moreover, in the third quarter, more breakthroughs were achieved in potential markets such as the Middle East and across different sectors.

For example, in September, GPTBots.ai announced a partnership with the startup sKora Tech, incubated by the Qatar Science and Technology Park, to integrate AI solutions into its platform, enhancing the athlete experience and facilitating career development, achieving breakthroughs in the Middle Eastern sports service sector.

It is also worth mentioning that GPTBots.ai was selected for the "Foundation Building Program" by the China Academy of Information and Communications Technology, receiving authoritative recognition. This is also the second product from Aurora Mobile to be selected for this program after the 2023 Aurora Unified Messaging (UMS).

As a result, GPTBots also possesses ample growth momentum and is expected to continue delivering performance from aspects such as global business layout, diversified scenario applications, and enhanced brand influence in the future.

2. Subscription service revenue achieved a historic breakthrough, crossing 51 million yuan in one go!

In the third quarter, Aurora's total revenue reached 79.1 million yuan, a year-on-year increase of 7%, maintaining a stable operation trend, with revenue scale at a high level over the last five quarters, second only to the previous quarter.

(Group total revenue chart; data source: Aurora official website)

Breaking down Aurora's revenue composition, the overall revenue from the Aurora developer service business reached 57.5 million yuan, accounting for over 72% of total revenue, among which subscription service revenue achieved a historic breakthrough, reaching 51.7 million yuan, growing by 11% and 7% year-on-year and quarter-on-quarter respectively, driving continuous growth in total revenue; value-added service revenue was 5.8 million yuan, a year-on-year increase of nearly 20%.

(Group developer services business revenue chart; data source: Aurora Mobile official website)

The certainty of Aurora's subscription business growth comes from two levels. Firstly, the essence of subscriptions is to establish and maintain relationships with customers, focusing on retaining customers through high-quality products and services, regular updates, etc. Aurora's products are innovative and have excellent performance, helping customers achieve significant results, thus possessing strong customer loyalty; secondly, Aurora's expansion into overseas markets has driven a leap in the customer base, enabling continuous acquisition of new and existing customers.

In terms of value-added services, its connection with the advertising industry is quite close, and the revenue growth rate aligns with the growth rate of the internet plus-related advertising market in the third quarter, even slightly exceeding it.

3. Revenue from industry applications remains stable, providing strong support for enterprise development.

In the third quarter, Aurora's revenue from industry application business was 21.6 million yuan. Although there was a decline, it remained relatively stable and did not significantly impact the overall revenue growth. Among them, the financial risk control business performed particularly well, achieving a remarkable 29% year-on-year growth.

This business is also influenced by the macro environment, and Aurora's ability to achieve such performance demonstrates a certain resilience.

(Aurora industry application revenue chart; data source: Aurora official website)

At the same time, from a business perspective, Aurora continues to consolidate its competitive advantages in the industry application field, and this business still provides strong support for overall development. For example, in this quarter, Weihu Data was invited to participate in the BRICS countries' digital industry cooperation seminar, where it shared and interpreted the current trends of going overseas and the current state of going overseas in the market, thereby showcasing its professional business strength and enhancing brand influence.

It is also worth noting that in September, Month Fox Data officially launched the global version of iAPP, which will cover over 170 countries and regions, nearly 4 million apps, including over 3,000 block orders going overseas, helping enterprises and institutions explore blue ocean markets with a global perspective, fully understand regional market resources, deeply analyze growth drivers, and optimize investment decisions, with its development potential yet to be realized.

Second, gross profit showed a double increase month-on-month and year-on-year, and the group's profitability steadily strengthened.

In the third quarter, Aurora Mobile's gross margin was 67.3%, relatively maintaining a high level, increasing by nearly 1 percentage point quarter-on-quarter.

According to comprehensive market data, the gross margin of internationally representative saas companies usually exceeds 70%, while the average gross margin level of domestic saas companies remains low, with Aurora's gross margin closer to the international level. According to the "2023 China Enterprise-level saas Industry Development Research Report" released by 36kr holdings, the average gross margin of China’s saas companies in 2023 is 57%, and Aurora's gross margin performance in all quarters this year has far exceeded this.

In terms of profit scale, Aurora's total gross profit reached 53.2 million yuan, achieving double increases year-on-year and month-on-month, also reaching the highest level this year, with profitability steadily strengthening.

(Aurora gross profit chart; data source: Aurora official website)

Third, adjusted EBITDA has been profitable for five consecutive quarters, further confirming high-quality operational capabilities.

In this quarter, benefiting from aurora mobile's continued expansion of its business and revenue scale, along with active control of cost expenditures, overall profitability remains stable. Its adjusted earnings before interest, taxes, depreciation, and amortization (Adjusted EBITDA) is approximately 0.58 million yuan, marking five consecutive quarters of profit.

(Aurora Mobile Adjusted EBITDA chart; source: Aurora Mobile official website)

Additionally, the net income indicators also reflect the trend of enhanced profitability for aurora mobile. In this quarter, aurora mobile reported a net loss of 2.16 million yuan, significantly narrowing year-on-year, and all quarterly data for this year have remained at historically low levels, making complete profitability not far away.

(Aurora Net Income Chart; Source: Aurora Official Website)

1. Operating expenses remain at a low level, decreasing by 5% year-on-year, achieving efficient operation.

In the third quarter, aurora mobile's total operating expenses were 57.1 million yuan, a year-on-year decrease of 5%, with a slight increase on a quarter-on-quarter basis.

In terms of specific expenses, aurora mobile's research and development expenses account for the largest share of total operating expenses, reaching 42%, with a slight month-on-month increase; sales expenses experienced a relatively large increase month-on-month, but their impact on overall performance is limited; management expenses saw a month-on-month decline, which well reflects aurora mobile's effective control of operating expenses, maintaining them at a low level.

At the same time, considering aurora mobile's breakthroughs in revenue and profitability, this further demonstrates its ability to drive business development at a relatively low cost level, showcasing efficient operational efficiency.

(Aurora Total Operating Expenses Chart; Source: Aurora Official Website)

2. The inflow of cash from operating activities reached 12.3 million yuan, and the new journey health technology group highlights improvements in operational efficiency and profitability.

In the third quarter, aurora mobile's net inflow of cash from operating activities set a new record again, reaching a peak of 12.3 million since Q4 2020. This means aurora mobile has achieved "profit with cash flow," with high operational efficiency and financial quality, while abundant cash flow provides strong guarantees for its stable operation, including continued market expansion.

(aurora mobile Balance Sheet & Financials chart; Source: aurora mobile official website)

3. Deferred income has exceeded 100 million for 18 consecutive quarters, with stable group clients and continuous growth momentum.

In the third quarter, the deferred income representing customer prepayments for aurora mobile was 0.135 billion yuan, basically flat compared to the previous quarter. This is also the 18th consecutive quarter that aurora's deferred income has exceeded 0.1 billion yuan.

(Aurora Mobile deferred revenue chart; source: Aurora Mobile official website)

Deferred income, as an important indicator, further reveals aurora's long-term development potential, making its future financial statements more 'transparent' and clearly demonstrating its positive future revenue expectations. For example, this indicates that aurora's customer base is stable, willing to collaborate with the company long-term, and loyal to the company's products and services, continuously contributing stable revenue and cash flow.

IV. Conclusion

Overall, aurora's development certainty and growth potential continue to stand out, with sustained growth in overseas business and subscription service revenue, along with robust profitability forming its new growth landscape.

Similarly, stable operation can showcase long-term investment value in the saas industry. As aurora continues to validate its performance, it will eventually embark on a path of value recovery and leapfrogging.

此时,也有了更多理由看好极光的发展后劲与价值回归。

此时,也有了更多理由看好极光的发展后劲与价值回归。