明天,終於又有主板新股申購了!

格隆匯獲悉,11月15日,滬主板新股紅四方(603395)申購,本次上市發行5000萬股,佔發行後總股本的25%,發行價格7.98元/股,發行市盈率爲10.62倍,明顯低於22.23倍的行業市盈率。

由於紅四方屬於10元以內的低價股,總市值和流通市值也都較低,而且滬深兩市的新股在上市後的前5個交易日不設價格漲跌幅限制,新股上市首日容易成爲資金炒作的對象。加上今年A股打新氛圍較好,預計紅四方在上市首日大概率收漲,建議積極申購。

同時,今年A股的上市新股數量較往年大幅減少,中籤率較低,大家且打且珍惜吧。

同時,今年A股的上市新股數量較往年大幅減少,中籤率較低,大家且打且珍惜吧。

今年A股的打新賺錢效應着實亮眼,據格隆匯統計,截止11月14日,今年在A股上市的83家企業中僅1家在上市首日破發,1家收平,其餘的81家首日全部收漲,上市首日平均漲幅超225%。

所以,大A 的新股申購中籤後,在上市首日賣出,賺錢的概率很大,但長揸還是得看公司的基本面情況及估值水平。接下來介紹一下紅四方的具體情況。

1

爲中鹽集團控股的化肥企業,毛利率低於同行均值

紅四方全稱爲「中鹽安徽紅四方肥業股份有限公司」,2012年由紅四方控股和弘邦投資2名發起人發起在安徽合肥設立。目前紅四方的控股股東爲紅四方控股,而紅四方控股背後是央企中鹽集團。

經過多年發展,紅四方已在安徽合肥、湖南醴陵、湖北隨州、吉林扶余建設有生產基地,產品品種可以滿足全國主要種植區不同環境、不同土壤條件下不同作物的施肥需求。同時公司還建立起覆蓋主要種植區域的穩定經銷商網絡。

作爲一家化肥生產企業,紅四方的主打產品爲複合肥和氮肥,主要通過經銷商渠道賣給終端農業種植客戶。2021年至2024年上半年,複合肥產品爲公司貢獻了80%以上的營收。

公司複合肥產品主要包括常規復合肥、作物配方肥、新型特種肥料三大類別,而氮肥是可提供植物氮元素營養的單質肥料,其氮肥產品主要包括尿素、脲銨氮肥等。

公司常規復合肥產品,圖片來源:招股書

業績方面,2021年、2022年、2023年、2024年上半年(簡稱「報告期」),紅四方的營業收入分別約30.54億元、41.7億元、38.99億元、19.75億元,對應的淨利潤分別約1.11億元、1.23億元、1.6億元、0.86億元。

儘管近幾年公司的淨利潤呈增長趨勢,但今年前三季度業績已出現下滑。

招股書顯示,經審閱,2024年1-9月紅四方的營業收入約26.66億元,同比下降11.41%;對應的淨利潤約1.14億元,同比下降14.44%,主要系2024年三季度以來受宏觀經濟影響,化肥市場產品價格呈下跌趨勢,下游化肥經銷商持觀望態度,備貨較爲謹慎,同時氣候異常種植季節推遲導致主要產品銷量下降導致。

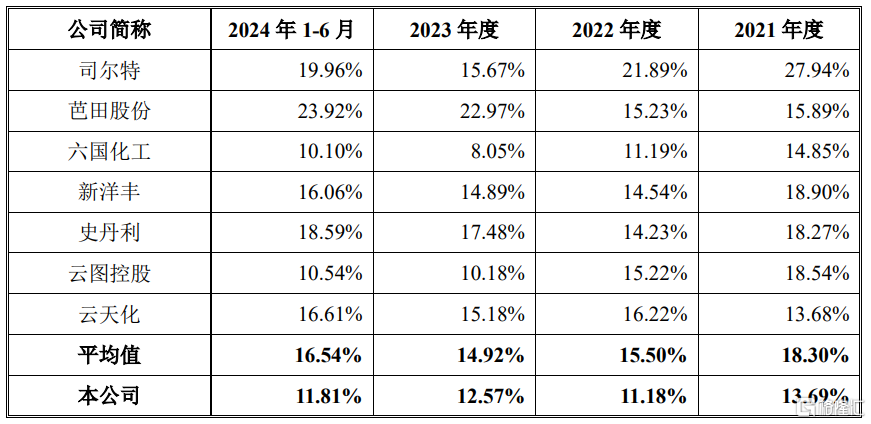

報告期內,紅四方的綜合毛利率分別爲13.69%、11.18%、12.57%、11.81%,低於同行業可比上市公司平均水平。其中公司毛利率與同行業差異主要系2021年開始,磷肥價格上漲,導致司爾特等擁有磷礦資源的企業毛利率增長所致。

公司與同行業可比公司的綜合毛利率對比情況,圖片來源:招股書

2

2023年公司複合肥產銷量排名第十,市佔率爲2.45%

化肥又稱無機肥料,指利用化學或物理方法制成的含有一種或多種農作物生長所需營養元素的肥料。化肥具有養分含量高,施用量少的特點,同時肥效快,大多數易溶於水,能很快被農作物吸收利用。化肥是重要的農業基本生產資料,對農作物增產有重大作用。

目前我國已成爲全球最大的複合肥生產國和消費國,但隨着我國農業生產的發展,單一肥料施用不合理問題日益突出,生產具有配比科學、使用便捷的複合肥成爲我國肥料產業的發展方向。

作爲化肥生產企業,紅四方面臨着市場需求波動風險。

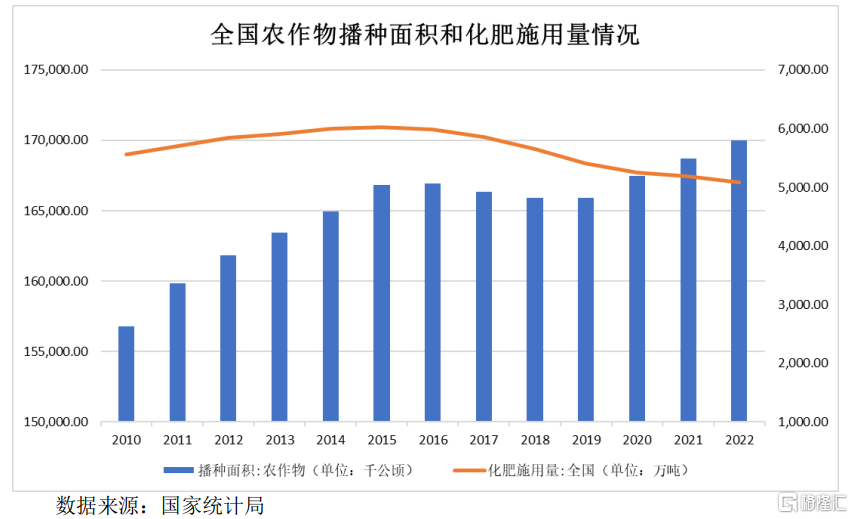

自2015年開始,農業部組織實施到2020年化肥使用零增長行動,推動農作物化肥用量持續下降、利用效率不斷提高。2022年農業農村部制定了《到2025年化肥減量化行動方案》,提出進一步減少農用化肥施用總量。

圖片來源:招股書

受政策影響化肥市場整體增量受到抑制,產品結構需求從普通複合肥爲主向高效化、專業化、功能化、精準化的增效肥料延伸,尤其是聚焦土壤改良、減量增效、全面營養、環保友好方面的功能性肥料,認可度和使用量逐年增加。如果公司不能加強技術創新和新產品研發,調整產品結構,可能會影響公司的經營業績。

紅四方所處的複合肥行業企業數量衆多,集中度較低。據中國磷複肥工業協會統計,目前全國持有生產許可證的複合肥企業多達3000餘家,其中前200餘家企業產能佔總產能的70%,多數企業規模較小,產品同質化嚴重,市場競爭激烈,複合肥行業集中整合的空間仍然較大。

目前,複合肥行業上市公司主要包括司爾特、芭田股份、六國化工、新洋豐、史丹利、雲圖控股、雲天化。2023年紅四方的複合肥產銷量行業排名第10位,市場佔有率約爲2.45%。

隨着化肥減量增效政策的持續推進,安全環保監管的日益嚴格,行業已經演變爲技術和產品創新、產品質量、營銷網絡和服務、產業鏈完整程度等全方位的競爭。公司需要加強技術創新、新產品開發,不然可能影響產品競爭力和市場份額。

按照本次發行價格計算,紅四方預計募集資金總額3.99億元,低於約4.96億元的使用募集資金額,扣除發行費用後的淨額,將按輕重緩急順序投資於擴建20萬噸/年新型增效專用肥料項目、擴建5萬噸/年經濟作物用專用優質鉀肥及配套工程項目、償還銀行貸款及補充流動資金。

募資使用情況,圖片來源:招股書

同时,今年A股的上市新股数量较往年大幅减少,中签率较低,大家且打且珍惜吧。

同时,今年A股的上市新股数量较往年大幅减少,中签率较低,大家且打且珍惜吧。