Veru Inc. (NASDAQ:VERU) shares have had a horrible month, losing 34% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

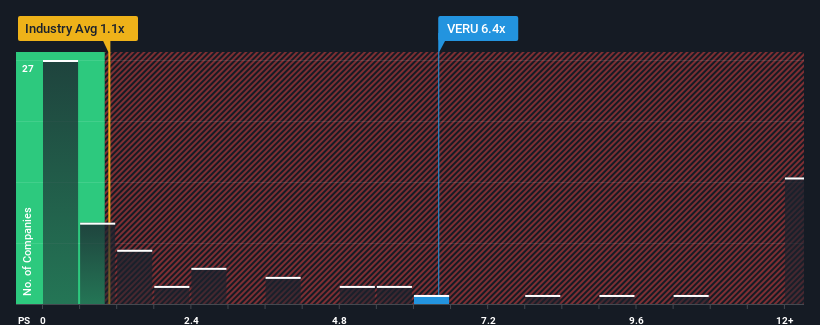

In spite of the heavy fall in price, when almost half of the companies in the United States' Personal Products industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Veru as a stock not worth researching with its 6.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Veru Performed Recently?

While the industry has experienced revenue growth lately, Veru's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Veru will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Veru?

Veru's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Veru's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.2%. The last three years don't look nice either as the company has shrunk revenue by 75% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 8.0% each year over the next three years. Meanwhile, the broader industry is forecast to expand by 4.1% per year, which paints a poor picture.

With this in mind, we find it intriguing that Veru's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From Veru's P/S?

Even after such a strong price drop, Veru's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Veru's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 4 warning signs for Veru (2 are a bit concerning!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.