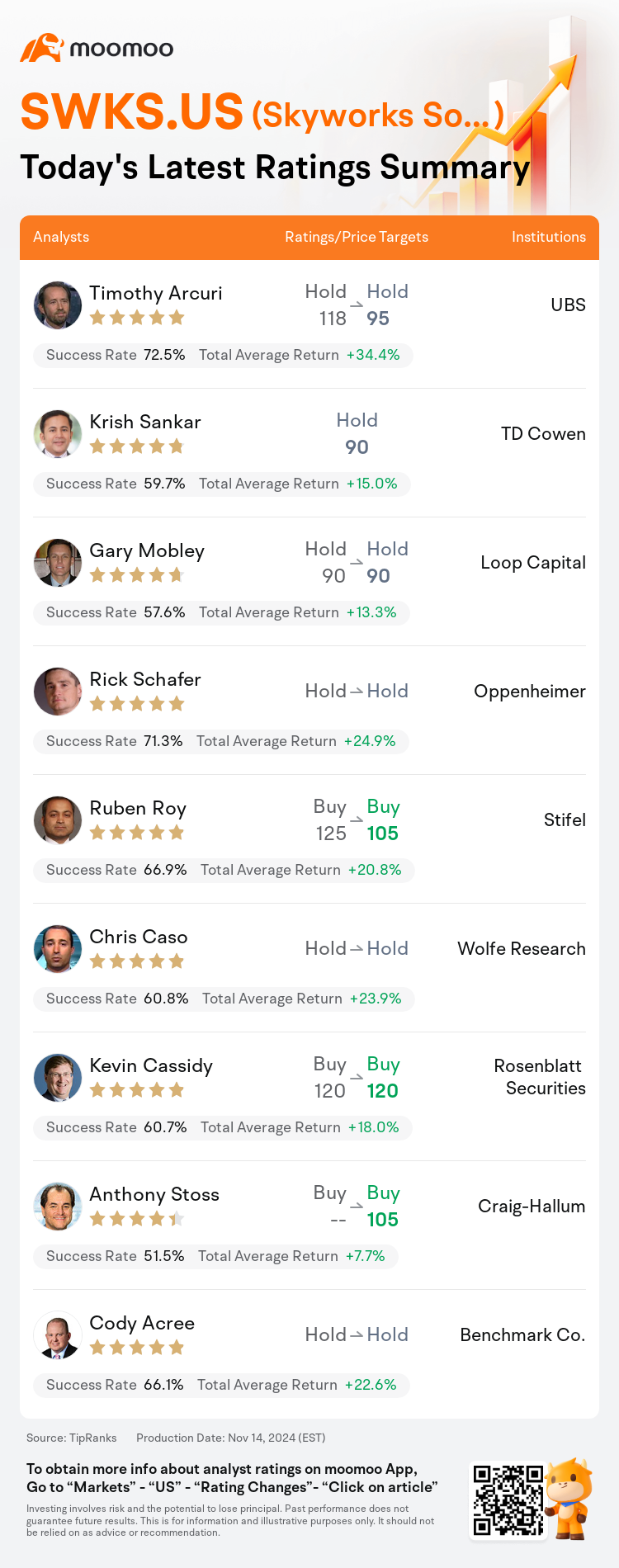

On Nov 14, major Wall Street analysts update their ratings for $Skyworks Solutions (SWKS.US)$, with price targets ranging from $90 to $120.

UBS analyst Timothy Arcuri maintains with a hold rating, and adjusts the target price from $118 to $95.

TD Cowen analyst Krish Sankar initiates coverage with a hold rating, and sets the target price at $90.

Loop Capital analyst Gary Mobley maintains with a hold rating, and maintains the target price at $90.

Loop Capital analyst Gary Mobley maintains with a hold rating, and maintains the target price at $90.

Oppenheimer analyst Rick Schafer maintains with a hold rating.

Stifel analyst Ruben Roy maintains with a buy rating, and adjusts the target price from $125 to $105.

Furthermore, according to the comprehensive report, the opinions of $Skyworks Solutions (SWKS.US)$'s main analysts recently are as follows:

The expectation for reduced growth in Broad Markets by 2025 is due to elevated inventory levels in the automotive/industrial and wireless infrastructure sectors. In addition, it is anticipated that increased operating expenses may impact earnings for 2025. The recent performance in terms of content from a major tech company has not met expectations; however, there is hope for a turnaround in the following year. The potential for value recovery hinges on the successful regaining of content from this key client, though this outcome is currently uncertain.

Skyworks' reported a marginally superior September quarter performance, followed by a guidance for December quarter revenue which suggests a 4% sequential increase, marginally missing the consensus forecasts. Despite this, the performance is considered more robust than anticipated, bolstered by sustained vigor from its primary customer, Apple.

The company's guidance for the December quarter was set below market expectations, primarily due to a slower-than-anticipated recovery across the broader market sectors. Consequently, projections for earnings in 2024 and 2025 have been revised downwards in light of subdued market conditions, reduced gross margins, and an increase in operating expenses.

Skyworks is reportedly going through an extended transition for its core Mobile business and Broad Markets, which may result in a return to topline growth potentially only materializing in FY26. The projections have been significantly recalibrated, with the estimated pro-forma EPS for FY25 and FY26 being revised downwards substantially.

Here are the latest investment ratings and price targets for $Skyworks Solutions (SWKS.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月14日,多家华尔街大行更新了$思佳讯 (SWKS.US)$的评级,目标价介于90美元至120美元。

瑞士银行分析师Timothy Arcuri维持持有评级,并将目标价从118美元下调至95美元。

TD Cowen分析师Krish Sankar首予持有评级,目标价90美元。

Loop Capital分析师Gary Mobley维持持有评级,维持目标价90美元。

Loop Capital分析师Gary Mobley维持持有评级,维持目标价90美元。

奥本海默控股分析师Rick Schafer维持持有评级。

斯迪富分析师Ruben Roy维持买入评级,并将目标价从125美元下调至105美元。

此外,综合报道,$思佳讯 (SWKS.US)$近期主要分析师观点如下:

到2025年,广泛市场增长预期下调,是因为汽车/工业和无线基础设施领域库存水平升高。此外,预计2025年增加的营业费用可能会影响收益。近期一家主要科技公司的内容表现未达预期;然而,对于接下来的一年有希望出现好转。价值恢复的潜力取决于成功从这家关键客户那里重新获得内容,尽管目前结果不确定。

Skyworks报告了一个略优于九月季度表现的报告,随后发布了12月季度营收预期,暗示了4%的顺序增长,略低于共识预测。尽管如此,该表现被认为比预期更为强劲,得到了其主要客户苹果持续活力的支持。

公司对12月季度的指引低于市场预期,主要是因为更广泛市场部门的复苏速度低于预期。因此,鉴于市场疲软、毛利降低和营业费用增加,已经下调了2024年和2025年的收益预期。

据报道,Skyworks正经历旗下核心移动业务和广泛市场的延长转型,这可能导致在FY26年后才有望出现的总体增长。预测已经进行了重大调整,预计FY25和FY26的预估的规模EPS大幅下调。

以下为今日9位分析师对$思佳讯 (SWKS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Loop Capital分析师Gary Mobley维持持有评级,维持目标价90美元。

Loop Capital分析师Gary Mobley维持持有评级,维持目标价90美元。

Loop Capital analyst Gary Mobley maintains with a hold rating, and maintains the target price at $90.

Loop Capital analyst Gary Mobley maintains with a hold rating, and maintains the target price at $90.