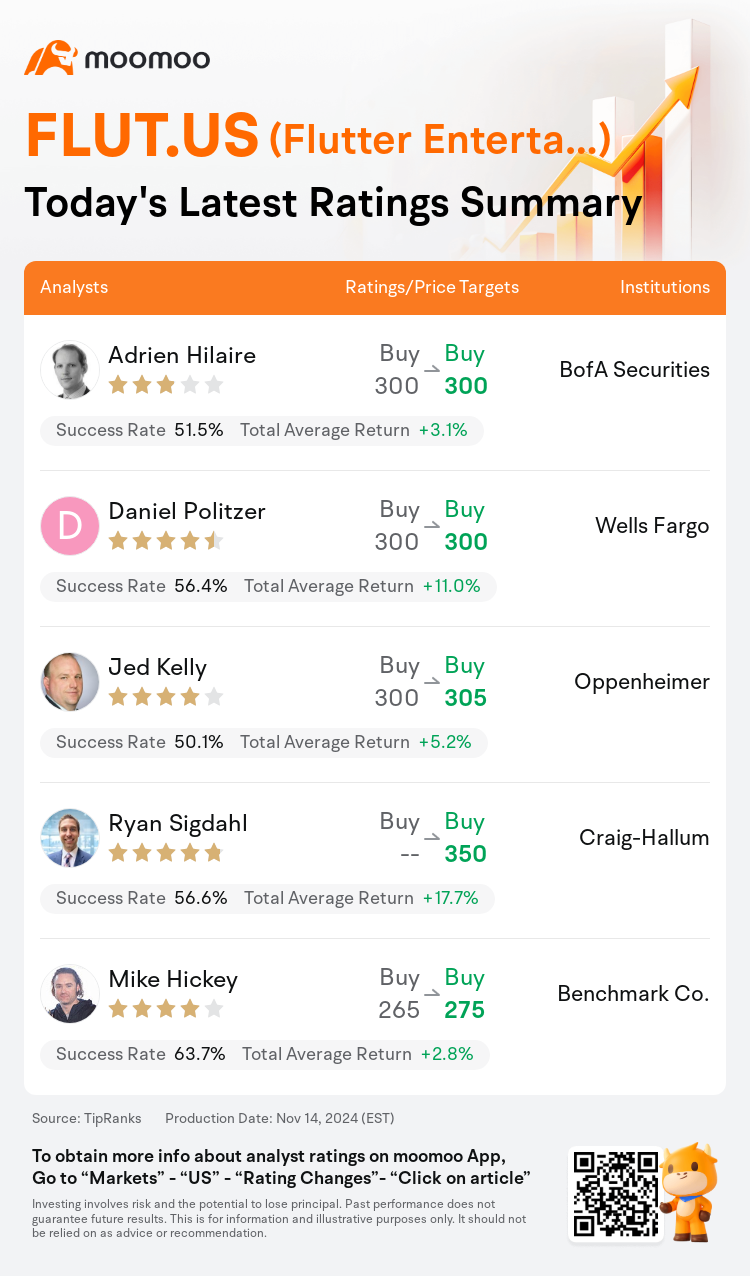

On Nov 14, major Wall Street analysts update their ratings for $Flutter Entertainment (FLUT.US)$, with price targets ranging from $275 to $350.

BofA Securities analyst Adrien Hilaire maintains with a buy rating, and maintains the target price at $300.

Wells Fargo analyst Daniel Politzer maintains with a buy rating, and maintains the target price at $300.

Oppenheimer analyst Jed Kelly maintains with a buy rating, and adjusts the target price from $300 to $305.

Oppenheimer analyst Jed Kelly maintains with a buy rating, and adjusts the target price from $300 to $305.

Craig-Hallum analyst Ryan Sigdahl maintains with a buy rating, and sets the target price at $350.

Benchmark Co. analyst Mike Hickey maintains with a buy rating, and adjusts the target price from $265 to $275.

Furthermore, according to the comprehensive report, the opinions of $Flutter Entertainment (FLUT.US)$'s main analysts recently are as follows:

Following Flutter Entertainment's third-quarter report, there is an increase in the projected EBITDA for the outer year, specifically a 3% rise for 2026, which is 11% higher than the general consensus. However, the outlook for 2024 and 2025 remains mostly unaltered. Even though Flutter has reiterated its revenue growth forecast of 20%-25% for FanDuel, this projection is deemed to be on the conservative side.

Flutter Entertainment's third quarter was characterized as strong across the board, demonstrating its continued dominance in the U.S. market, in addition to the advantages of having a diversified business model.

Flutter Entertainment's Q3 earnings surpassed expectations, with their U.S. performance being more robust than anticipated. Management credits this to their superior risk and trading capabilities. The company is capitalizing on this strength by introducing their new Your Way product.

Flutter Entertainment exhibited robust results for the third quarter, effectively balancing out less favorable outcomes in October's NFL events. The analyst also emphasized the company's reaffirmed outlook for the U.S. market by 2025, alongside predictions of a modest increment in revenue growth, approximately +25% year-over-year, coupled with a 520 basis point expansion in margins.

Flutter Entertainment's Q3 results and forecast exceeded consensus expectations, fueled by a more robust performance in the U.S. and U.K. markets alongside more restrained headwinds in Q4. The company is highlighted for its strong fundamental structure and the potential for significant catalysts.

Here are the latest investment ratings and price targets for $Flutter Entertainment (FLUT.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

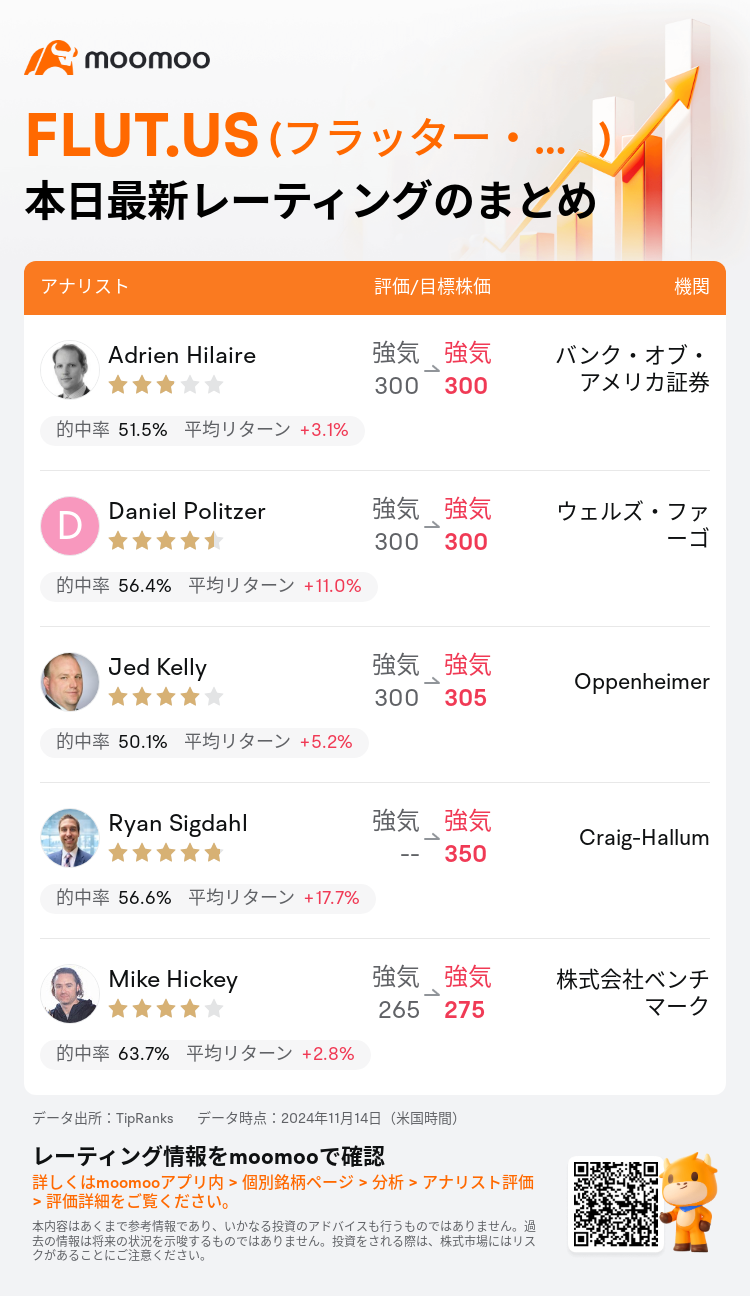

11月14日(米国時間)、ウォール街主要機関のアナリストが$フラッター・エンターテインメント (FLUT.US)$のレーティングを更新し、目標株価は275ドルから350ドル。

バンク・オブ・アメリカ証券のアナリストAdrien Hilaireはレーティングを強気に据え置き、目標株価を300ドルに据え置いた。

ウェルズ・ファーゴのアナリストDaniel Politzerはレーティングを強気に据え置き、目標株価を300ドルに据え置いた。

OppenheimerのアナリストJed Kellyはレーティングを強気に据え置き、目標株価を300ドルから305ドルに引き上げた。

OppenheimerのアナリストJed Kellyはレーティングを強気に据え置き、目標株価を300ドルから305ドルに引き上げた。

Craig-HallumのアナリストRyan Sigdahlはレーティングを強気に据え置き、目標株価を350ドルにした。

株式会社ベンチマークのアナリストMike Hickeyはレーティングを強気に据え置き、目標株価を265ドルから275ドルに引き上げた。

また、$フラッター・エンターテインメント (FLUT.US)$の最近の主なアナリストの観点は以下の通りである:

Flutterエンターテイメントの第3四半期の報告に続き、外部年のEBITDAの予測が増加し、特に2026年には3%の上昇が見込まれ、一般的なコンセンサスよりも11%高いです。しかし、2024年および2025年の展望はほぼ変更されていません。FlutterはFanDuelの売上高成長の予測を20%-25%と繰り返しましたが、この予測は保守的であると見なされています。

Flutterエンターテイメントの第3四半期は、全体的に強いと特徴付けられ、米国市場での継続的な優位性を示しています。さらに、多様なビジネスモデルを持つ利点も示されています。

FlutterエンターテイメントのQ3の収益は期待を上回り、米国でのパフォーマンスは予想よりも堅調でした。経営陣は、これを彼らの優れたリスクと取引能力に起因したと認めています。会社はこの強みを活かして新しいYour Way製品を導入しています。

Flutterエンターテイメントは第3四半期の強力な結果を示し、10月のNFLイベントでのあまり好ましくない結果をうまくバランスさせました。アナリストはまた、2025年までの米国市場に対する同社の確認された見通しについて強調し、年間約+25%の売上高成長の緩やかな増加と、520ベーシスポイントのマージン拡大を予測しています。

FlutterエンターテイメントのQ3の結果と予測は、合意された期待を上回り、米国および英国市場でのより強力なパフォーマンスと、Q4のより抑制された逆風に後押しされました。この会社は、その強固な基盤と重要な触媒の可能性において際立っています。

以下の表は今日5名アナリストの$フラッター・エンターテインメント (FLUT.US)$に対する最新レーティングと目標価格である。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

OppenheimerのアナリストJed Kellyはレーティングを強気に据え置き、目標株価を300ドルから305ドルに引き上げた。

OppenheimerのアナリストJed Kellyはレーティングを強気に据え置き、目標株価を300ドルから305ドルに引き上げた。

Oppenheimer analyst Jed Kelly maintains with a buy rating, and adjusts the target price from $300 to $305.

Oppenheimer analyst Jed Kelly maintains with a buy rating, and adjusts the target price from $300 to $305.