On Nov 14, major Wall Street analysts update their ratings for $Spotify Technology (SPOT.US)$, with price targets ranging from $435 to $540.

Morgan Stanley analyst Benjamin Swinburne maintains with a buy rating, and adjusts the target price from $430 to $460.

Goldman Sachs analyst Eric Sheridan maintains with a buy rating, and adjusts the target price from $430 to $490.

BofA Securities analyst Jessica Reif Ehrlich maintains with a buy rating, and adjusts the target price from $430 to $515.

BofA Securities analyst Jessica Reif Ehrlich maintains with a buy rating, and adjusts the target price from $430 to $515.

Deutsche Bank analyst Benjamin Black CFA maintains with a buy rating, and adjusts the target price from $440 to $500.

Wells Fargo analyst Steven Cahall maintains with a buy rating, and maintains the target price at $520.

Furthermore, according to the comprehensive report, the opinions of $Spotify Technology (SPOT.US)$'s main analysts recently are as follows:

Analysts note that Spotify delivered a 'very strong' Q3, with its gross margin, operating income, and free cash flow surpassing expectations. After the company disclosed Q3 results and Q4 projections, forecasts for the 2024 operating income were raised, anticipating an 'extraordinary year on margins'.

The recent Q3 outcomes and Q4 forecasts for Spotify demonstrate a continuation of the year's positive trends, with ARPU growth, gross margins, and EBIT/FCF surpassing expectations. Following several quarters of lackluster MAU net additions, there was a noticeable uptick in growth during Q3, with the Q4 outlook also exceeding forecasts. It is anticipated that Spotify will surpass 700M MAUs by 2025.

Following the Q3 report, the sentiment towards Spotify has become increasingly positive, anticipating a boost in the shares with the company's anticipated addition to the MSCI World Index on November 25. The opinion reflects that Spotify continues to be a top pick.

Post-earnings, Spotify's trajectory for margin expansion is observed to have several driving factors that could influence its growth leading into 2025.

The company delivered a robust quarter, slightly surpassing subscriber expectations, while its profit and notably free cash flow, were significantly above the anticipated figures and consensus estimates. Spotify has achieved the lower spectrum of its 30%-35% gross margin goal and is projected to reach GAAP profitability within this year.

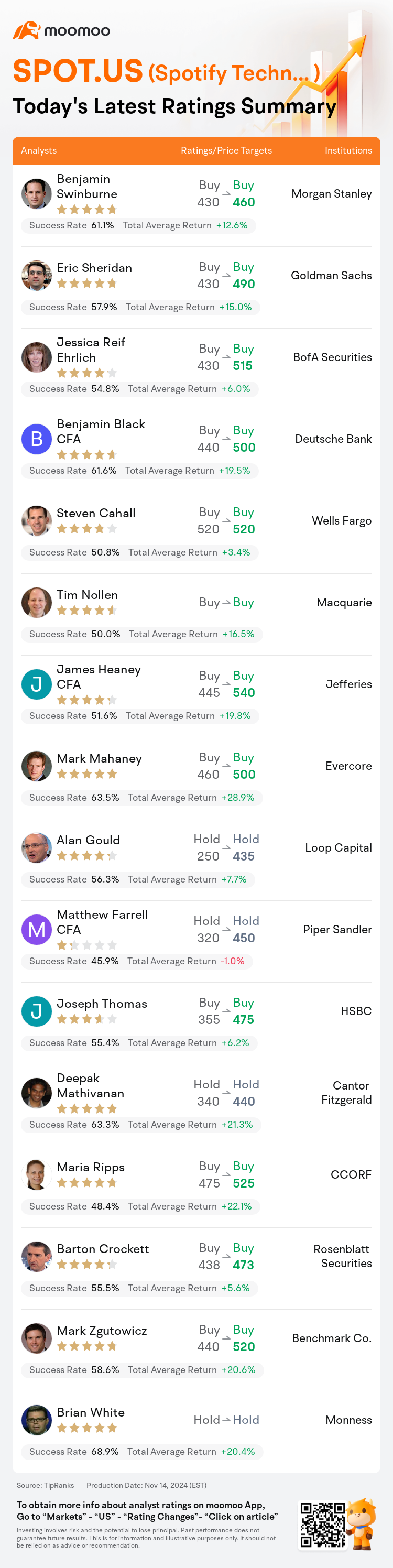

Here are the latest investment ratings and price targets for $Spotify Technology (SPOT.US)$ from 16 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间11月14日,多家华尔街大行更新了$Spotify Technology (SPOT.US)$的评级,目标价介于435美元至540美元。

摩根士丹利分析师Benjamin Swinburne维持买入评级,并将目标价从430美元上调至460美元。

高盛集团分析师Eric Sheridan维持买入评级,并将目标价从430美元上调至490美元。

美银证券分析师Jessica Reif Ehrlich维持买入评级,并将目标价从430美元上调至515美元。

美银证券分析师Jessica Reif Ehrlich维持买入评级,并将目标价从430美元上调至515美元。

德意志银行分析师Benjamin Black CFA维持买入评级,并将目标价从440美元上调至500美元。

富国集团分析师Steven Cahall维持买入评级,维持目标价520美元。

此外,综合报道,$Spotify Technology (SPOT.US)$近期主要分析师观点如下:

分析师指出,Spotify在第三季度表现'非常强劲',其毛利率、营业收入和自由现金流超过预期。在公司披露第三季度业绩和第四季度预期后,2024年营业收入的预测被上调,预计将迎来'在毛利率方面的非凡一年'。

Spotify最近的第三季度业绩和第四季度预测显示出年度积极趋势的持续,平均每用户收入增长、毛利率以及EBIT/FCF都超出预期。在经历了几个季度的MAU净新增乏力后,第三季度的增长明显回升,第四季度的前景也超出预期。预计Spotify到2025年将超过70000万活跃用户。

在第三季度报告后,市场对Spotify的情绪变得越来越积极,预计随着公司预计在11月25日加入MSCI世界指数,股价将得到提升。这一观点反映出Spotify依然是首选之一。

在财报发布后,观察到Spotify的毛利率扩张趋势有多个推动因素可能会影响其在2025年的增长。

公司交出了一份强劲的季度业绩,略微超出用户预期,而其利润和特别是自由现金流则显著高于预期数字和共识估计。Spotify已实现其30%-35%毛利率目标的下限,预计将在今年内实现GAAP盈利。

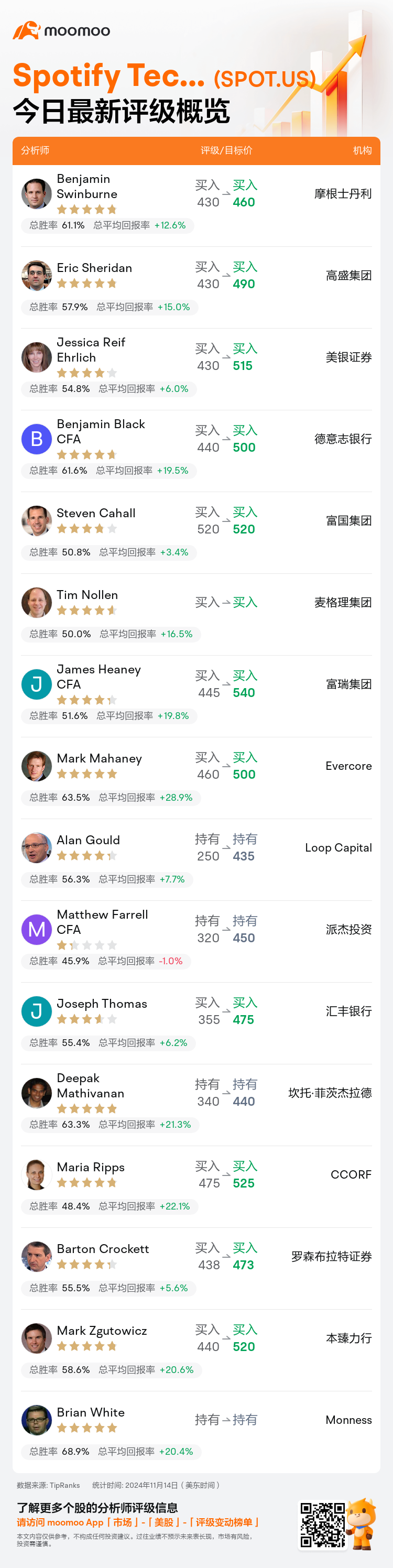

以下为今日16位分析师对$Spotify Technology (SPOT.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

美银证券分析师Jessica Reif Ehrlich维持买入评级,并将目标价从430美元上调至515美元。

美银证券分析师Jessica Reif Ehrlich维持买入评级,并将目标价从430美元上调至515美元。

BofA Securities analyst Jessica Reif Ehrlich maintains with a buy rating, and adjusts the target price from $430 to $515.

BofA Securities analyst Jessica Reif Ehrlich maintains with a buy rating, and adjusts the target price from $430 to $515.