Decoding Block's Options Activity: What's the Big Picture?

Decoding Block's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Block. Our analysis of options history for Block (NYSE:SQ) revealed 15 unusual trades.

金融巨头在Block上进行了明显的看淡举动。我们对Block(纽交所:SQ)的期权历史进行分析,发现了15笔飞凡交易。

Delving into the details, we found 40% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $92,180, and 12 were calls, valued at $1,227,460.

深入细节后,我们发现40%的交易者看好,而46%显示出看淡倾向。在我们发现的所有交易中,有3笔看跌交易,价值为92180美元,而有12笔看涨交易,总价值为1227460美元。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $125.0 for Block over the last 3 months.

考虑到这些合约的成交量和未平仓合约量,似乎鲸鱼们已经在过去3个月中针对Block的价格区间从70.0美元到125.0美元展开了行动。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

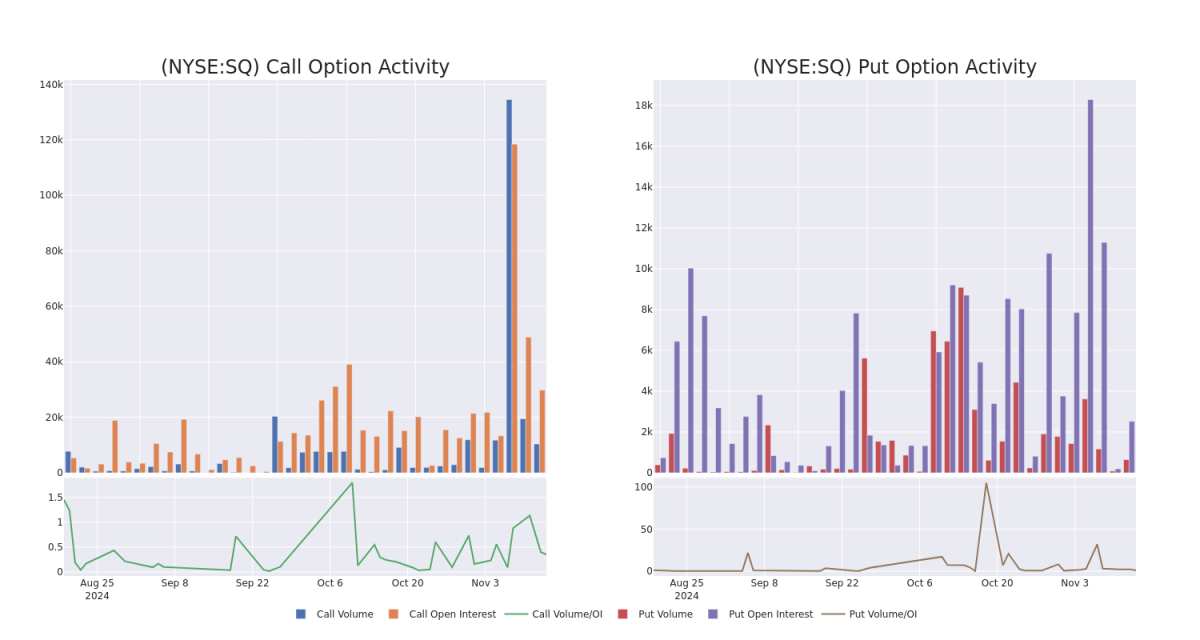

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $70.0 to $125.0 over the preceding 30 days.

评估成交量和未平仓合约量是期权交易中的一个战略步骤。这些指标揭示了Block在特定行权价上的期权流动性和投资者兴趣。即将出现的数据将展示过去30天内与Block重大交易挂钩的看涌和未平仓合约量的波动,该波动范围涵盖了从70.0美元到125.0美元的行权价区间。

Block Option Activity Analysis: Last 30 Days

Block期权活动分析:最近30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | TRADE | BEARISH | 01/17/25 | $13.65 | $13.45 | $13.45 | $72.50 | $402.1K | 2.3K | 306 |

| SQ | CALL | SWEEP | BEARISH | 12/20/24 | $2.36 | $2.25 | $2.36 | $90.00 | $202.4K | 3.7K | 1.1K |

| SQ | CALL | TRADE | NEUTRAL | 11/22/24 | $0.27 | $0.23 | $0.25 | $93.00 | $160.6K | 7.3K | 6.7K |

| SQ | CALL | SWEEP | BULLISH | 01/15/27 | $13.55 | $13.45 | $13.55 | $125.00 | $135.5K | 341 | 111 |

| SQ | CALL | SWEEP | BEARISH | 12/20/24 | $15.5 | $15.25 | $15.35 | $70.00 | $75.1K | 2.7K | 51 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | 看涨 | 交易 | 看淡 | 01/17/25 | $13.65 | $13.45 | $13.45 | $72.50 | $402.1K | 2.3K | 306 |

| SQ | 看涨 | 扫单 | 看淡 | 12/20/24 | $2.36 | $2.25 | $2.36 | $90.00 | $202.4K | 3.7千 | 1.1K |

| SQ | 看涨 | 交易 | 中立 | 11/22/24 | $0.27 | $0.23 | $0.25 | $93.00 | 160.6千美元 | 7.3千 | 6.7千 |

| SQ | 看涨 | 扫单 | 看好 | 01/15/27 | $13.55 | $13.45 | $13.55 | $125.00 | $135.5K | 341 | 111 |

| SQ | 看涨 | 扫单 | 看淡 | 12/20/24 | $15.5 | $15.25 | $15.35 | $70.00 | $75.1K | 2.7K | 51 |

About Block

关于Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

成立于2009年,Block为商家提供支付服务及相关服务。该公司还推出了Cash App,一个人对人的支付网络。2023年,Square的支付量略超过2亿美元。

In light of the recent options history for Block, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Block的最新期权历史,现在应将焦点集中在公司本身。我们的目标是探索其当前表现。

Block's Current Market Status

区块的当前市场状况

- Currently trading with a volume of 5,295,109, the SQ's price is down by -2.13%, now at $83.99.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 98 days.

- 目前交易量为5,295,109,SQ的价格下跌了-2.13%,目前为$83.99。

- RSI读数表明该股目前可能接近超买水平。

- 预期的收益发布将在98天后。

Professional Analyst Ratings for Block

行业板块的专业分析师评级

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $92.2.

过去一个月,5位行业分析师分享了对这只股票的见解,提出了平均目标价92.2美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Block with a target price of $90. * An analyst from RBC Capital downgraded its action to Outperform with a price target of $88. * Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Block, targeting a price of $120. * In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $83. * An analyst from Keefe, Bruyette & Woods has decided to maintain their Market Perform rating on Block, which currently sits at a price target of $80.

Benzinga Edge的期权异动板块提前发现潜在的市场推动因素。查看大型资金在您喜爱的股票上的仓位。点击这里进行访问。* Needham的分析师在评估中保持一致,对Block给予买入评级,并设定目标价为90美元。* RBC Capital的分析师将其评级下调为表现优异,价格目标为88美元。* Canaccord Genuity的分析师继续保持对Block的买入评级,并设定目标价为120美元。* Piper Sandler的分析师以谨慎的态度,将其评级下调为增持,并设定目标价为83美元。* Keefe,Bruyette & Woods的分析师决定维持对Block的市场表现评级,目前目标价为80美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Block with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供更高利润的潜力。精明的交易员通过持续学习、策略性的交易调整、利用各种因子和保持对市场动态的敏锐感来减轻这些风险。通过Benzinga Pro实时警报,及时了解Block的最新期权交易。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $70.0 to $125.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $70.0 to $125.0 over the preceding 30 days.