Despite an already strong run, Wuxi Best Precision Machinery Co., Ltd. (SZSE:300580) shares have been powering on, with a gain of 30% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

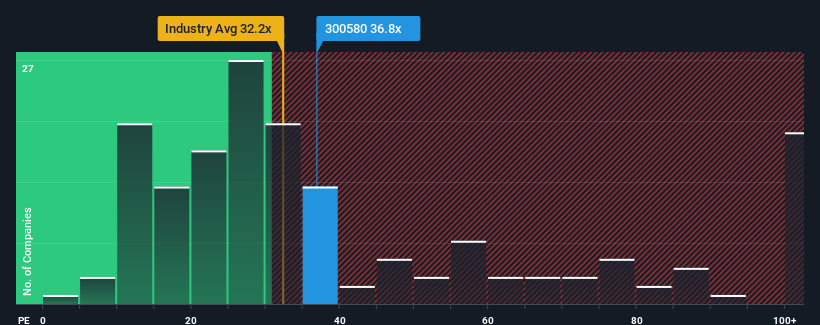

Although its price has surged higher, there still wouldn't be many who think Wuxi Best Precision Machinery's price-to-earnings (or "P/E") ratio of 36.8x is worth a mention when the median P/E in China is similar at about 37x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Wuxi Best Precision Machinery as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Is There Some Growth For Wuxi Best Precision Machinery?

There's an inherent assumption that a company should be matching the market for P/E ratios like Wuxi Best Precision Machinery's to be considered reasonable.

There's an inherent assumption that a company should be matching the market for P/E ratios like Wuxi Best Precision Machinery's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 6.1%. Regardless, EPS has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 40% as estimated by the eight analysts watching the company. That's shaping up to be similar to the 40% growth forecast for the broader market.

With this information, we can see why Wuxi Best Precision Machinery is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Wuxi Best Precision Machinery's P/E?

Wuxi Best Precision Machinery appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Wuxi Best Precision Machinery's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Wuxi Best Precision Machinery that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.