BlueFocus Intelligent Communications Group Co., Ltd. (SZSE:300058) shares have continued their recent momentum with a 38% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

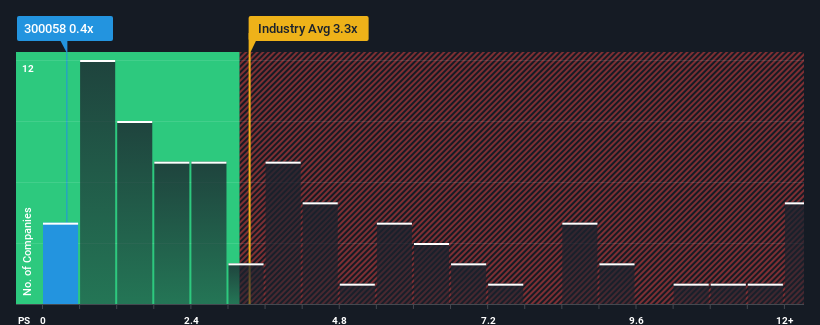

Although its price has surged higher, BlueFocus Intelligent Communications Group's price-to-sales (or "P/S") ratio of 0.4x might still make it look like a strong buy right now compared to the wider Media industry in China, where around half of the companies have P/S ratios above 3.3x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

How BlueFocus Intelligent Communications Group Has Been Performing

BlueFocus Intelligent Communications Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think BlueFocus Intelligent Communications Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is BlueFocus Intelligent Communications Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as BlueFocus Intelligent Communications Group's is when the company's growth is on track to lag the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as depressed as BlueFocus Intelligent Communications Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. The latest three year period has also seen an excellent 43% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the five analysts watching the company. That's shaping up to be similar to the 15% growth forecast for the broader industry.

With this information, we find it odd that BlueFocus Intelligent Communications Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Shares in BlueFocus Intelligent Communications Group have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of BlueFocus Intelligent Communications Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Before you settle on your opinion, we've discovered 1 warning sign for BlueFocus Intelligent Communications Group that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.