Yongxing Special Materials Technology Co.,Ltd (SZSE:002756) shares have continued their recent momentum with a 32% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

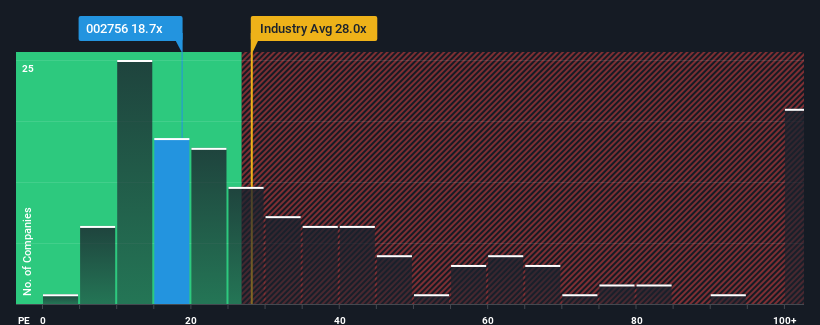

Even after such a large jump in price, Yongxing Special Materials TechnologyLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.7x, since almost half of all companies in China have P/E ratios greater than 37x and even P/E's higher than 74x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Yongxing Special Materials TechnologyLtd has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

Yongxing Special Materials TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Yongxing Special Materials TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 74%. Still, the latest three year period has seen an excellent 129% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 9.5% as estimated by the seven analysts watching the company. With the market predicted to deliver 40% growth , that's a disappointing outcome.

With this information, we are not surprised that Yongxing Special Materials TechnologyLtd is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Yongxing Special Materials TechnologyLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Yongxing Special Materials TechnologyLtd maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Yongxing Special Materials TechnologyLtd (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.