Despite an already strong run, Dlg Exhibitions & Events Corporation Limited (SHSE:600826) shares have been powering on, with a gain of 31% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 36% in the last year.

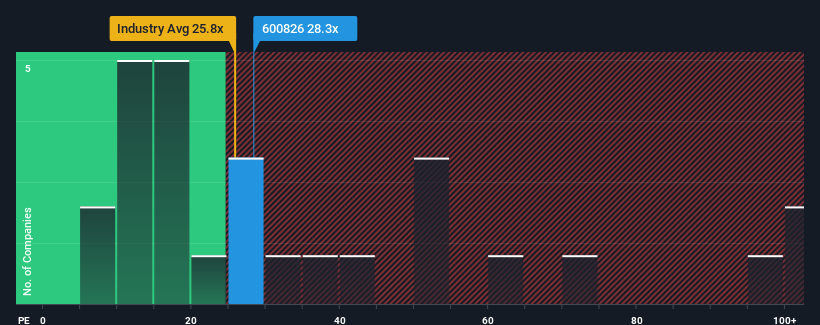

Even after such a large jump in price, Dlg Exhibitions & Events' price-to-earnings (or "P/E") ratio of 28.3x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 74x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Dlg Exhibitions & Events has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

How Is Dlg Exhibitions & Events' Growth Trending?

Dlg Exhibitions & Events' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Dlg Exhibitions & Events' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. Even so, admirably EPS has lifted 53% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 47% during the coming year according to the one analyst following the company. With the market only predicted to deliver 40%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Dlg Exhibitions & Events is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Dlg Exhibitions & Events' P/E?

The latest share price surge wasn't enough to lift Dlg Exhibitions & Events' P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Dlg Exhibitions & Events currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Dlg Exhibitions & Events, and understanding should be part of your investment process.

If you're unsure about the strength of Dlg Exhibitions & Events' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.