Significant increase in holdings of Ali, JD, and Baidu

Overseas capital is betting heavily on Chinese assets.

Previously, Michael Burry, a well-known Wall Street fund manager who went short during the 2008 US subprime mortgage crisis and became famous in World War I, and the prototype of the movie “The Big Short” recently increased his investment in China.

On November 14, EST, the hedge fund Scion (Scion Asset Management) led by Michael Burry announced the 13F position report.

On November 14, EST, the hedge fund Scion (Scion Asset Management) led by Michael Burry announced the 13F position report.

In the third quarter, the fund significantly increased its holdings of Chinese stocks such as Alibaba, JD, and Baidu, but it also hedged bets.

Increase the bet on Chinese securities

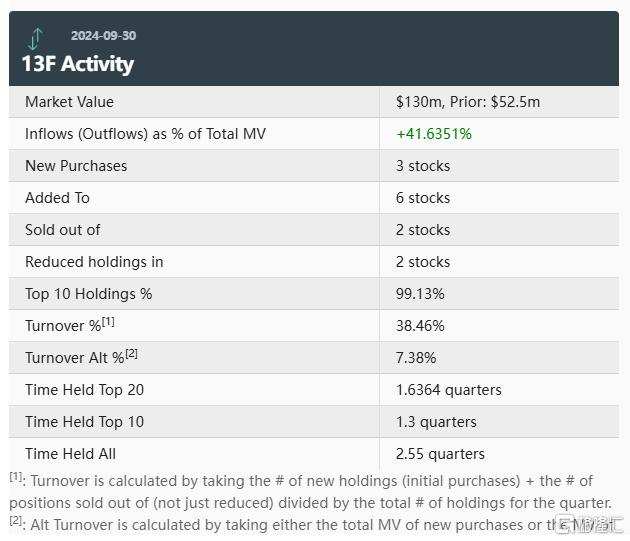

According to the 13F document, in the third quarter of this year, the total market value of Scion Fund holdings was about 0.13 billion US dollars, accounting for 99.13% of the top ten holdings.

In Q3 holdings, a total of 6 stocks were increased, 2 stocks were reduced, 3 new stocks were added, and 2 stocks were liquidated.

In the third quarter, Scion continued to significantly increase the holdings of Ali, Baidu, and JD, but also allocated corresponding put options.

Among them, the biggest increase was JD, which increased its holdings by 100%, increasing its holdings by 0.25 million shares, and its total holdings reached 0.5 million shares; at the same time, it held put options corresponding to 0.5 million shares.

The second largest increase was Baidu, which increased its holdings by 66.67% and increased its holdings by 0.05 million shares. The total number of shares reached 0.125 million shares, with a total value of 13.16125 million US dollars; at the same time, it also held put options corresponding to 0.0833 million shares.

It increased its holdings of Alibaba by 29% to 0.2 million shares, worth about 21 million US dollars; at the same time, it also held put options on nearly 0.169 million shares of Ali, worth about 18 million US dollars.

As of the end of September, the value of these three shares held by Scion was 54 million US dollars, accounting for about 65% of the fund's total stock holdings.

Currently, the fund holds the most shares in the following order: Alibaba 16.36%, JD 15.41%, Shift4 Payments Inc 10.24%, Baidu 10.14%, and Molina Healthcare Inc 7.97%.

The main industries where shareholding is concentrated are: consumer cyclical, technology, communication services, healthcare, and financial services.

Additionally, 151,892 shares of American Coastal Insurance Corp and 500,000 shares of The RealReal Inc were reduced; Hudson Pacific Properties Inc and BioAtla Inc were liquidated.

Enthusiasm for foreign investment is high

Since September 24, a series of incremental policies have been intensively introduced, China's economic growth momentum has improved, and capital market vitality has continued to be unleashed.

According to the latest Chinese economic data released today, economic growth momentum strengthened in October.

Total retail sales of consumer goods in October were 4539.6 billion yuan, up 4.8% year on year;

The value added of industries above the national scale increased by 5.3% year-on-year in October;

From January to October, the country's fixed asset investment (excluding rural households) was 4,2322.2 billion yuan, an increase of 3.4% over the previous year;

In October, the total import and export volume of goods was 3,700.7 billion yuan, up 4.6% year on year.

Recently, a number of foreign-funded institutions are optimistic about China's economic growth, and have expressed optimism about China's asset prospects and raised the Chinese stock rating.

Nomura recently raised its forecast for China's fourth-quarter GDP and full-year GDP growth. Previously, UBS and J.P. Morgan had raised their forecasts for China's economic growth this year.

According to the monthly survey of global fund managers released by Bank of America, “optimistic about China” ranked in the top 3 most popular transactions in the October survey, with a ratio of 14%. Furthermore, the proportion of global fund managers who expect China's economy to strengthen in the next 12 months will reach 48%.

“After the policy shift, growth expectations for China have revived. “(Survey) Participants thought this time was different, so they gave up looking for opportunities elsewhere and turned their sights to China.”

Morgan Asset Management released an overview of the global market for the fourth quarter, pointing out that A-shares have now rebounded from emotional recovery to a fundamental-driven market stage.

The future recovery of corporate profits may be a core variable for the continuation of the market. Investors are advised to pay attention to the “core assets” of A-shares and leading companies with “new quality productivity” in various industries.

美东时间11月14日,

美东时间11月14日,