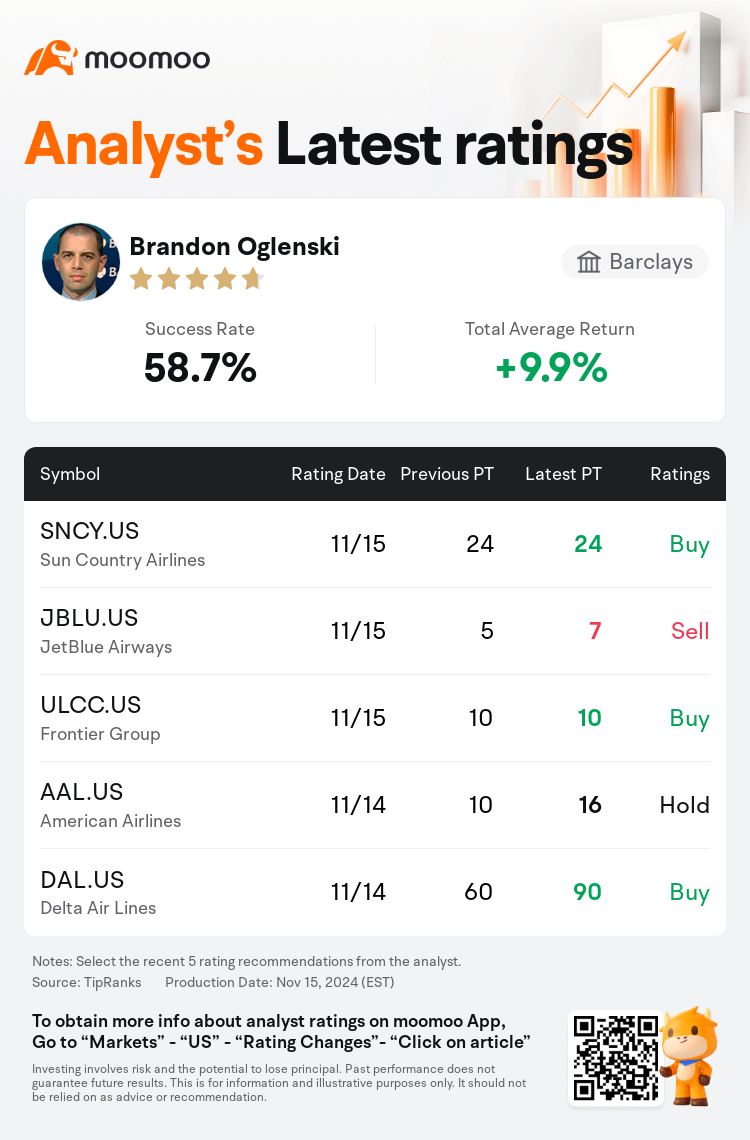

Barclays analyst Brandon Oglenski maintains $JetBlue Airways (JBLU.US)$ with a sell rating, and adjusts the target price from $5 to $7.

According to TipRanks data, the analyst has a success rate of 58.7% and a total average return of 9.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $JetBlue Airways (JBLU.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $JetBlue Airways (JBLU.US)$'s main analysts recently are as follows:

JetBlue, with its offerings well-suited to capture the growing premium demand, continues to experience capacity restrictions influenced by factors beyond the management's direct influence. The airline's challenges with profitability are notably due to engine-related and regional capacity limitations, along with a leverage ratio that surpasses industry averages.

The firm anticipates a positive shift in airline fundamentals by 2025, which is expected to enhance market perception significantly, potentially leading to substantial appreciation in the share prices of industry leaders. The merging of advancing airline fundamentals with investor sentiment is projected to catalyze a robust surge in airline stocks as we look into the next year. It is expected that those who are currently leading will continue to dominate. The airline sector presents considerable growth opportunities as capacity expansion slows, competition among low-cost carriers undergoes a transformation, and the leading companies further solidify their market positions.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

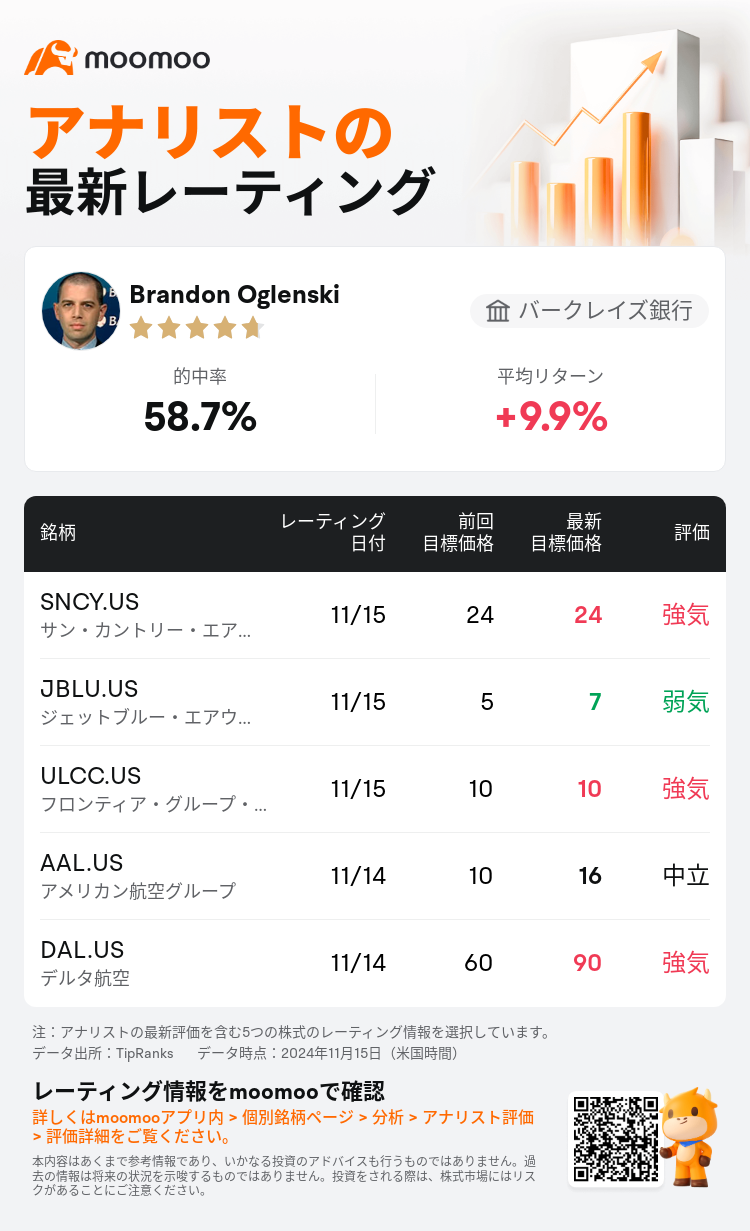

バークレイズ銀行のアナリストBrandon Oglenskiは$ジェットブルー・エアウェイズ (JBLU.US)$のレーティングを弱気に据え置き、目標株価を5ドルから7ドルに引き上げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は58.7%、平均リターンは9.9%である。

また、$ジェットブルー・エアウェイズ (JBLU.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ジェットブルー・エアウェイズ (JBLU.US)$の最近の主なアナリストの観点は以下の通りである:

ジェットブルーは、急成長するプレミアム需要をキャプチャするのに適した提供を持ち続けており、経営陣の直接的な影響を受ける要因によって引き続き運航能力に制約を受けています。航空会社の収益性に関する課題は、エンジンに関連した問題や地域の運行能力の制約、産業平均を上回るてことが特に目立っています。

同社は2025年までに航空業の基本的な変化が期待され、市場の認識を大幅に向上させ、産業リーダーのシェア価格に大幅な評価をもたらすことが予想されます。進化する航空業の基本と投資家の感情の融合が、来年を見据えるなかで航空株の急激な上昇を促すことが予測されています。現在リードしている企業が引き続き支配を続けることが予想されます。航空セクターは、運航拡大が鈍化し、低コストキャリアの間の競争が変革を遂げ、主要企業が市場ポジションをさらに堅固にしているなかで、かなりの成長機会を提供しています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ジェットブルー・エアウェイズ (JBLU.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ジェットブルー・エアウェイズ (JBLU.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of