Track the latest developments in Southbound Funding

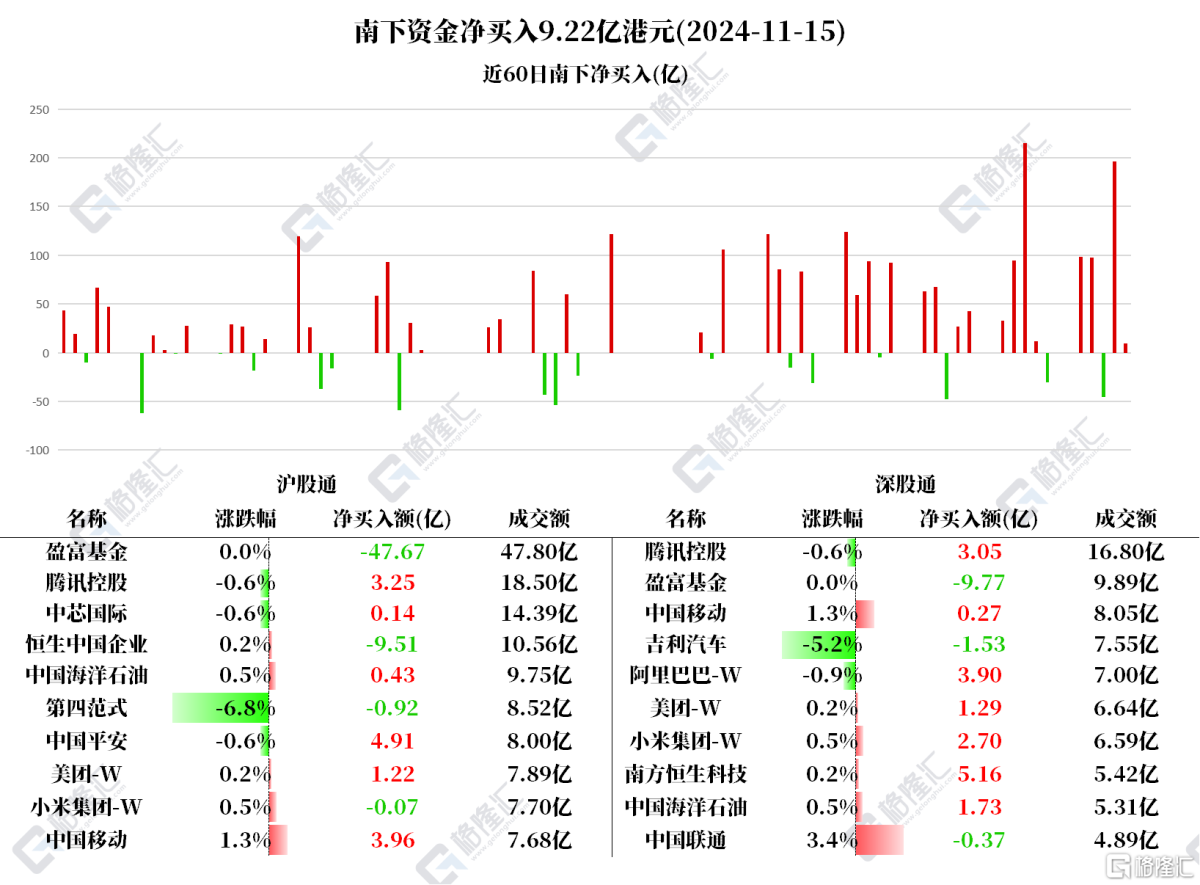

On November 15, Southbound made a net purchase of HK$0.922 billion in Hong Kong stocks.

Among them, Hong Kong Stock Connect (Shanghai) had a net sale of HK$1.516 billion, and Hong Kong Stock Connect (Shenzhen) had a net purchase of HK$2.438 billion.

Net purchases of Tencent 0.629 billion, Southern Hang Seng Technology 0.516 billion, China Ping An 0.491 billion, China Mobile 0.422 billion, Alibaba 0.39 billion, Meituan 0.251 billion, Xiaomi 0.262 billion, and CNOOC 0.215 billion;

Net purchases of Tencent 0.629 billion, Southern Hang Seng Technology 0.516 billion, China Ping An 0.491 billion, China Mobile 0.422 billion, Alibaba 0.39 billion, Meituan 0.251 billion, Xiaomi 0.262 billion, and CNOOC 0.215 billion;

Net sales of Yingfu Fund were 5.744 billion, Hang Seng China was 0.95 billion, and Geely was 0.153 billion.

According to statistics, Southbound has net purchases of Xiaomi for 5 consecutive days, totaling HK$3.11463 billion; net purchases of Tencent for 4 consecutive days, totaling HK$4.08,194 billion.

Furthermore, in the 40 trading days since it was included in the Hong Kong Stock Connect, Southwest Capital has accumulated a net purchase of HK$69.39,907 billion on Alibaba.

Beishui focuses on individual stocks

Tencent: According to the Citi Research Report, Tencent's third quarter performance was steady, with total revenue growing 8% year-on-year, while gross profit, operating profit, and net profit increased by 16%, 19%, and 33% respectively. This was mainly due to a renewed acceleration in game revenue and steady advertising promotion. Looking ahead to the fourth quarter of this year and 2025, game revenue is expected to maintain healthy double-digit growth in the fourth quarter and the first half of 2025 due to steady growth in total domestic and international game revenue.

According to the bank, although recent stimulus policies will take time to take effect, the company's management is optimistic about the long-term economic outlook and will continue to focus on handing over results within its control. The bank maintained a target price of HK$573 and a “buy” rating, and tied the stock as its preferred and core holding position.

Ping An China: According to news, Ping An China announced that in the first ten months of this year, its subsidiary Ping An Insurance's original insurance contract premium income was 265.7 billion yuan (same below), up 6.5% year over year; Ping An Life Insurance premium income was 447.44 billion yuan, up 9.4% year on year; Ping An Pension Insurance premium income reached 15.01 billion yuan, down 5.4% year on year; Ping An Health Insurance's premium income reached 15.01 billion yuan, up 14.2% year on year.

China Mobile: According to the news, Wang Zhiqin, head of the 6G promotion team and deputy director of the China Academy of Information and Communication Technology, said that 6G technical standards research will be initiated in June 2025, the technical research phase will be completed in 2025-2027, and the first version of the technical specification will be completed in March 2029. Currently, 3GPP standard partners in Europe, the United States, Japan, South Korea, and India, including China, are jointly developing the 6G standard. Guoyuan International previously pointed out that the three major operators are still continuously increasing their dividend payout ratio. According to current stock prices, the dividend rate is expected to rise further from the current level of 6%.

Alibaba: Alibaba will release its third quarter results today. According to the news, the hedge fund Scion (Scion Asset Management), led by Michael Burry, a well-known fund manager on Wall Street and the prototype of the movie “The Big Short,” announced the 13F position report. In the third quarter, the fund significantly increased its holdings of Chinese stocks such as Alibaba, JD, and Baidu.

Meituan: According to a report published by Morgan Stanley, Meituan is the company with the fastest compound annual growth in operating profit among the Chinese Internet stocks covered by the bank. It maintains an “gain” rating and target price of HK$215, and raised the target price for next year's best scenario to HK$300 (originally HK$290).

Xiaomi: According to the news, during the 2024 Guangzhou Auto Show, Xiaomi held a press conference. Chairman @雷军 said that the delivery of the Xiaomi SU7 surpassed 0.02 million units in October this year, and is expected to deliver 0.02 million+ in November.

CNOOC: According to news, CNOOC announced on the 14th that all 76 production wells in China's largest offshore intelligent oilfield group, the Enping 15-1 Oilfield Group, have been put into production, with a daily output of over 7,500 tons, a record high.

Geely Automobile: Macquarie released a research report stating that it will raise Geely's rating to “outperform the market” and increase the profit forecast per share by 8%, 16%, and 11%, respectively, from 2024 to 2026 to reflect the performance of the third quarter, and the target price will increase by 13% to HK$18. Geely's merger and acquisition plan is a major step in integrating diverse brands and will clarify the roadmap for the development of electric vehicles.