During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

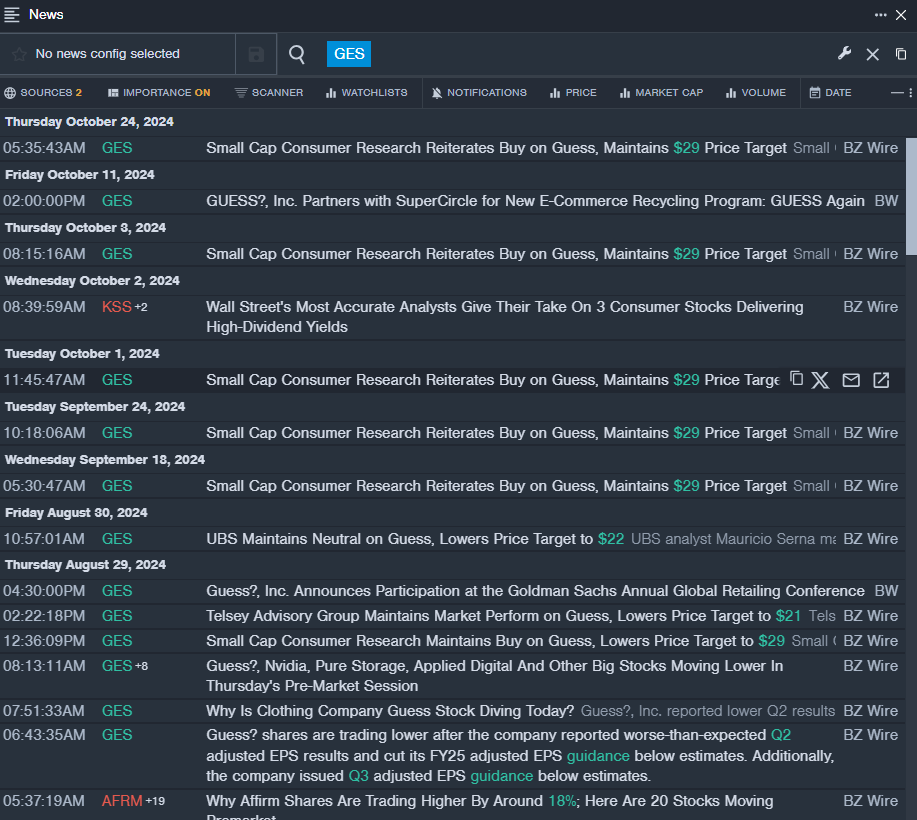

Guess?, Inc. (NYSE:GES)

- Dividend Yield: 7.08%

- Small Cap Consumer Research analyst Eric Beder reiterated a Buy rating with a price target of $29 on Oct. 24. This analyst has an accuracy rate of 60%.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and cut the price target from $26 to $21 on Aug. 29. This analyst has an accuracy rate of 62%.

- Recent News: On Aug. 28, Guess reported worse-than-expected second-quarter adjusted EPS results and cut its FY25 adjusted EPS guidance below estimates. Additionally, the company issued third-quarter adjusted EPS guidance below estimates.

- Benzinga Pro's real-time newsfeed alerted to latest GES news

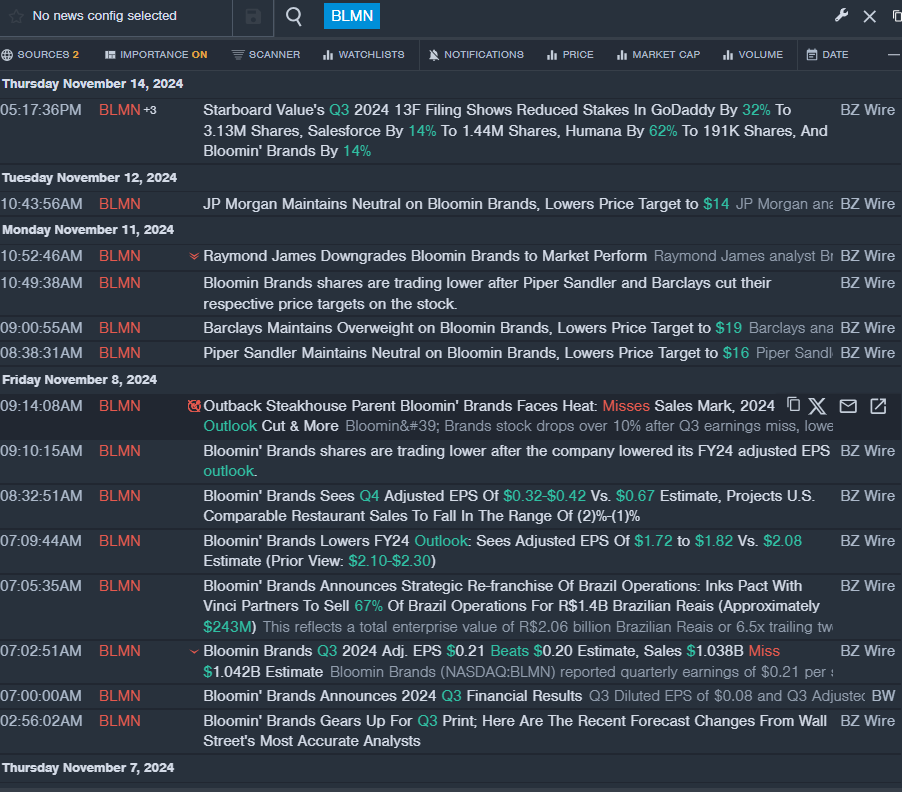

Bloomin' Brands, Inc. (NASDAQ:BLMN)

- Dividend Yield: 7.15%

- Raymond James analyst Brian Vaccaro downgraded the stock from Outperform to Market Perform on Nov. 11. This analyst has an accuracy rate of 82%.

- Piper Sandler analyst Brian Mullan maintained a Neutral rating and slashed the price target from $20 to $16 on Nov. 11. This analyst has an accuracy rate of 76%.

- Recent News: On Nov. 8, the company reported third-quarter adjusted earnings per share of 21 cents, beating the street view of 20 cents. Quarterly revenues of $1.038 billion (down 3.8%) missed the analyst consensus of $1.042 billion.

- Benzinga Pro's real-time newsfeed alerted to latest BLMN news

Kohl's Corporation (NYSE:KSS)

- Dividend Yield: 10.74%

- JP Morgan analyst Matthew Boss downgraded the stock from Neutral to Underweight with a price target of $19 on Aug. 29. This analyst has an accuracy rate of 66%.

- Baird analyst Mark Altschwager maintained an Outperform rating and cut the price target from $27 to $25 on Aug. 29. This analyst has an accuracy rate of 71%.

- Recent News: On Nov. 13, the company's board declared a regular quarterly dividend of 50 cents per share on its common stock.

- Benzinga Pro's charting tool helped identify the trend in KSS stock.

Read More:

Read More:

- Jim Cramer Recommends Microsoft, Praises American Water Works For Being 'Consistent'