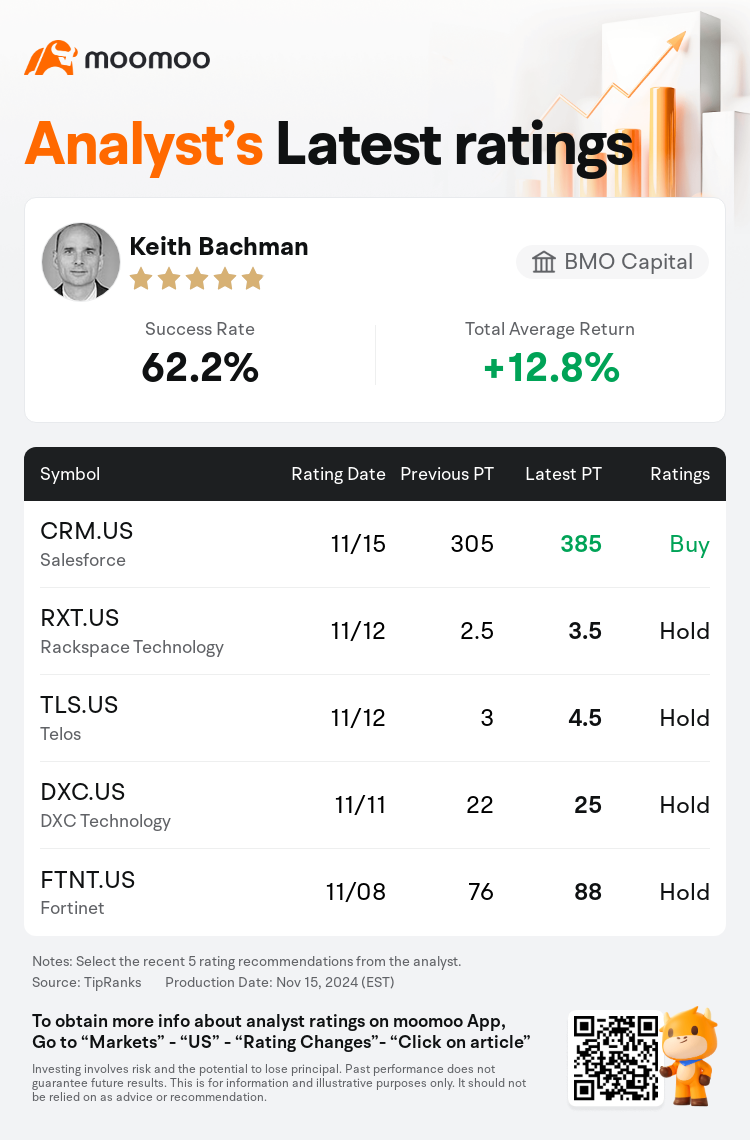

BMO Capital analyst Keith Bachman maintains $Salesforce (CRM.US)$ with a buy rating, and adjusts the target price from $305 to $385.

According to TipRanks data, the analyst has a success rate of 62.2% and a total average return of 12.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Salesforce (CRM.US)$'s main analysts recently are as follows:

The latest increase in software stocks complicates the forecast for this quarter's earnings. Although there is a slight improvement in the software sector, it remains questionable whether this will be sufficient to further elevate stock values following their recent rally.

A series of discussions with partners indicates that deal activity in Q3 was generally consistent with expectations, with an improved pipeline for Q4. Salesforce is expected to see increasing visibility for an acceleration in top-line growth in the coming year as future valuations are projected into calendar year 2026.

Initial channel feedback on Salesforce's new Agentforce solution has been significantly positive, more so than previous introductions of new solutions. It is suggested that Agentforce could positively influence modest revenue and growth in the latter half of FY26. In anticipation of earnings reports, it is anticipated that Salesforce may achieve modest growth exceeding their constant-currency CRPO growth guidance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

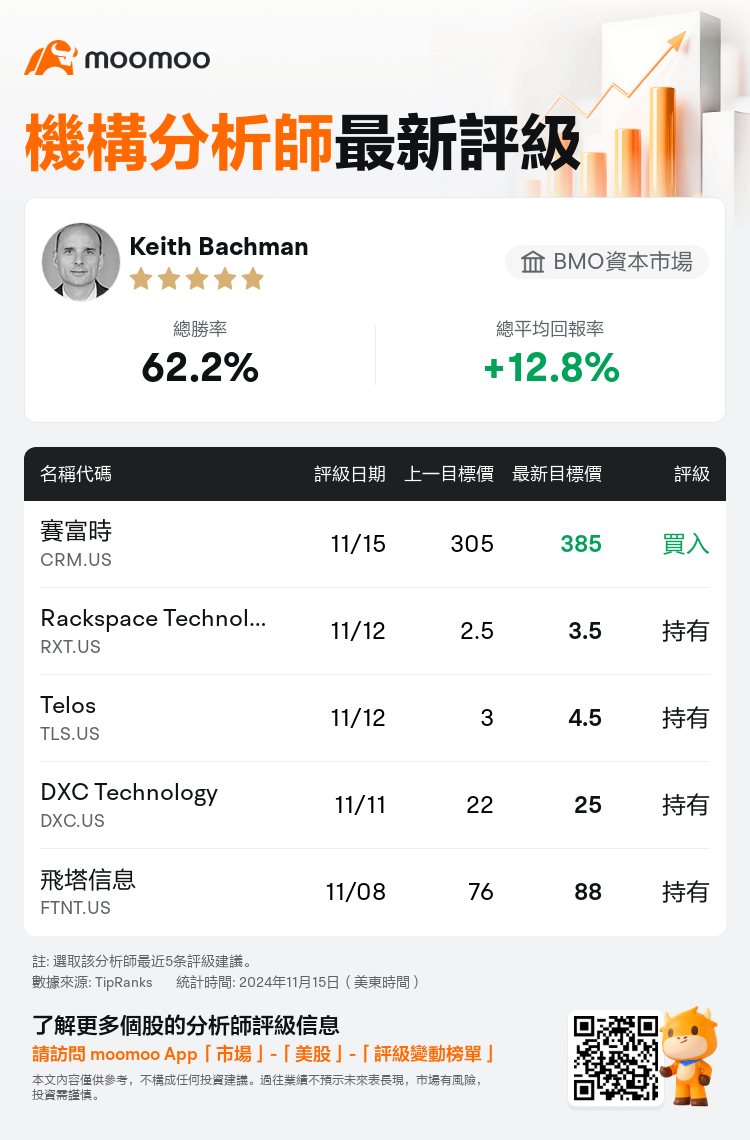

BMO資本市場分析師Keith Bachman維持$賽富時 (CRM.US)$買入評級,並將目標價從305美元上調至385美元。

根據TipRanks數據顯示,該分析師近一年總勝率為62.2%,總平均回報率為12.8%。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

最新一輪軟件股票漲幅使得本季度業績的預測變得複雜。雖然軟件板塊有輕微改善,但目前還不確定是否足以在最近股市上漲之後進一步提升股票價值。

與合作伙伴的一系列討論顯示,第三季度的交易活動總體上符合預期,並有望在第四季度擁有更好的業務儲備。賽富時預計,隨着未來估值被預測至2026年日曆年,其營收增長率可望加快。

關於賽富時新的Agentforce解決方案的初步渠道反饋明顯積極,較以往新解決方案的推出更爲樂觀。有跡象表明Agentforce可能對財年26下半年的營收和增長產生積極影響。在業績公佈前,有預期認爲賽富時可能實現超越其恒定貨幣下CRPO增長指導的適度增長。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

此外,綜合報道,$賽富時 (CRM.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of