① Futures on the three major US stock indices continued to decline; ② Bitcoin briefly returned above $0.09 million; ③ Alibaba's quarterly revenue increased 5% year over year; ④ Cruise, the autonomous driving division of GM, admitted submitting false reports.

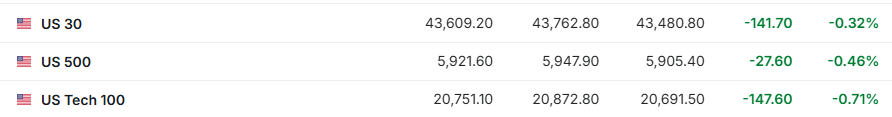

Financial Services, November 15 (Editor: Zhao Hao) Futures on the three major indices continued to decline before the US stock market on Friday (November 15). As of press release, Dow Jones futures were down 0.32%, S&P 500 futures were down 0.46%, and Nasdaq 100 futures were down 0.71%.

On the previous trading day, the three major US stock indices collectively closed down, as Federal Reserve Chairman Powell claimed that he was in no hurry to cut interest rates, which dampened investors' optimism. Powell said that the economy did not send any signal that the Federal Reserve needed to cut interest rates as soon as possible, giving the central bank the ability to make careful decisions.

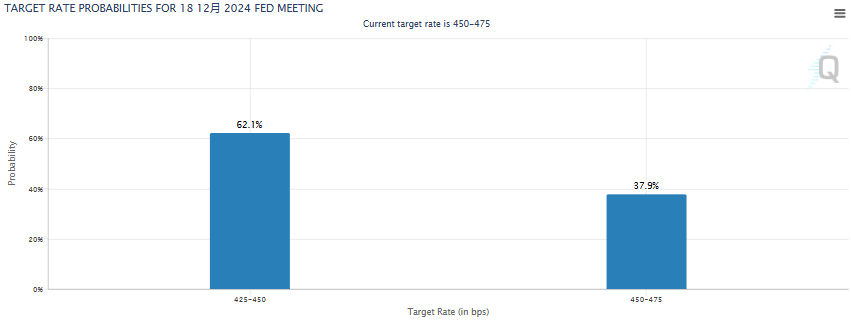

According to CME's “Federal Reserve Watch” tool, the market expects that the bank's probability of cutting interest rates by 25 basis points in December will be reduced to around 60%, and the probability of keeping interest rates unchanged will rise to nearly 40%, which is about 20 percentage points higher than the previous day.

According to CME's “Federal Reserve Watch” tool, the market expects that the bank's probability of cutting interest rates by 25 basis points in December will be reduced to around 60%, and the probability of keeping interest rates unchanged will rise to nearly 40%, which is about 20 percentage points higher than the previous day.

On the other hand, the “Trump deal,” which previously supported a series of new highs in US stocks, has clearly cooled down. Sam Stovall, chief investment strategist at CFRA Research, said investors are evaluating whether the previous wave of gains was worthwhile.

Stovall added: “We really don't see any signs of disrupting the stock market right now, but investors are always looking around for factors that could end this trend.” Tesla, one of Trump's concept stocks, has fallen more than 3% this week following a sharp drop yesterday.

Meanwhile, the “Trump deal”'s boost to cryptocurrencies doesn't seem to have faded away. Bitcoin briefly returned above $0.09 million shortly before the press release. As of press time, MicroStrategy is up more than 3% in the premarket, while Coinbase is up nearly 2%.

Among other individual stocks, Applied Materials fell 7.5%, and the company's revenue guidance fell below Wall Street's expectations, indicating weak market demand for chip manufacturing equipment; Domino's Pizza rose 5.7%, and the company's stock position was opened by Berkshire in the third quarter.

Pharmaceutical stocks such as Pfizer, AstraZeneca, GlaxoSmithKline, and Novo Nordisk were lower. The day before, Trump nominated Robert Francis Kennedy Jr., as Secretary of Health and Human Services. According to information, JFK Jr. has unorthodox views on medicine, including skepticism about vaccines.

Most European stock markets that are currently trading are lower. The German DAX30 index is now down 0.17%, the UK FTSE 100 index is down 0.12%, and the French CAC40 index is down 0.36%.

Company news

[FTC plans to investigate anti-competitive behavior in Microsoft's cloud computing business]

People familiar with the matter revealed that the US Federal Trade Commission (FTC) is preparing to investigate anti-competitive behavior in Microsoft's cloud computing business. Strategies under review include drastically increasing subscription fees for leaving users, charging high exit fees, and allegedly making their Office 365 products incompatible with competitors' clouds.

[Japan's first ASML EUV lithography machine will arrive in the middle of next month for trial production at the Rapidus fab]

The first ASML EUV lithography machine purchased by Japan's advanced semiconductor foundry Rapidus will arrive at Hokkaido's New Chitose Airport in mid-December 2024, which will also be the first EUV lithography device in Japan. According to previous statements from Rapidus executives, the lithography machine is an earlier 0.33 NA model, not the 0.55 NA (High NA) model, which currently has less than 10 units worldwide.

[News says SK Hynix is considering introducing ASML High NA EUV equipment]

SK Hynix Technical Director Seon-yong Cha said they are considering introducing ASML's $0.4 billion HIGH NA EUV lithography equipment to produce next-generation memory chips.

[Cruise, GM's autonomous driving division, admits filing a false report and was fined 0.5 million dollars]

Cruise, the autonomous vehicle subsidiary of GM, admitted on Thursday that it submitted a false report to influence the federal investigation and will pay a $0.5 million criminal fine as part of the deferred prosecution agreement, the US Department of Justice said.

[Alibaba's revenue for the second fiscal quarter of 2025 was 236.5 billion yuan, up 5% year-on-year]

Alibaba's revenue for the second fiscal quarter of 2025 (the quarter ended September 30, 2024) was 236.5 billion yuan, up 5% year on year, and estimated at 239.43 billion yuan; net profit was RMB 43.547 billion (US$6.205 billion), up 63% year on year; adjusted EBITA (a non-GAAP financial indicator) fell 5% year over year to RMB 40.561 billion (US$5.78 billion). Non-GAAP net profit for the quarter ended September 30, 2024 was RMB 36.518 billion (US$5.204 billion), down 9% from RMB 40.188 billion for the same period in 2023.

[Xiaopeng Motors He Xiaopeng: Xiaopeng MONA M03 targets a monthly production capacity of 0.02 million vehicles before the Spring Festival]

At the 2024 Guangzhou Auto Show held today, Xiaopeng Motor Chairman He Xiaopeng said that since the launch of the Xiaopeng MONA M03, sales volume exceeded 10,000 for two consecutive months, and production capacity increased by 40% in November; by the Spring Festival, the target monthly production capacity will reach 0.02 million vehicles.

[Avita and NIO Energy Reach Charging Network Cooperation]

Avita Technology and NIO Energy jointly announced today that the two sides have formally reached a charging network cooperation. From now on, Avita users can find and use NIO Energy charging stations nationwide through the Avita App to further enhance the charging experience and charging efficiency.

Notable events during the US stock market (Beijing time)

November 15th

22:15 Monthly rate of US industrial output in October

23:00 Monthly rate of US commercial inventory in September

22:00 Boston Federal Reserve Chairman Collins (2025 FOMC Voting Committee) delivered an opening speech at the bank's 68th economic conference

23:30 Boston Federal Reserve Chairman Collins was interviewed by the media

November 16

Total number of oil drills in the US for the week from 02:00 to November 15

02:15 New York Federal Reserve Chairman Williams (FOMC Permanent Voting Committee) delivered the opening address at an event.

04:30 CFTC releases weekly position report

芝商所的“美联储观察”工具显示,市场预计该行12月降息25个基点的概率缩减至60%附近,维持利率不变的概率升至近四成,较前一日高出了约20个百分点。

芝商所的“美联储观察”工具显示,市场预计该行12月降息25个基点的概率缩减至60%附近,维持利率不变的概率升至近四成,较前一日高出了约20个百分点。